- Solana’s price declined by more than 8% in the last 24 hours.

- Several metrics were negative, but revenue and fees remained unaffected.

The crypto market witnessed a major price correction over the last day, and Solana [SOL] followed suit. Along with most of the cryptos, SOL took a harder hit as its price declined by over 8% in the last 24 hours. As per CoinMarketCap, at press time, SOL was trading at $17.04 with a market capitalization of over $6.5 billion.

Read Solana’s [SOL] Price Prediction 2023-24

Bearish sentiments dominate

The ongoing bearish market played its role in changing the market sentiment, which caused several of SOL’s indicators to turn in the sellers’ favor.

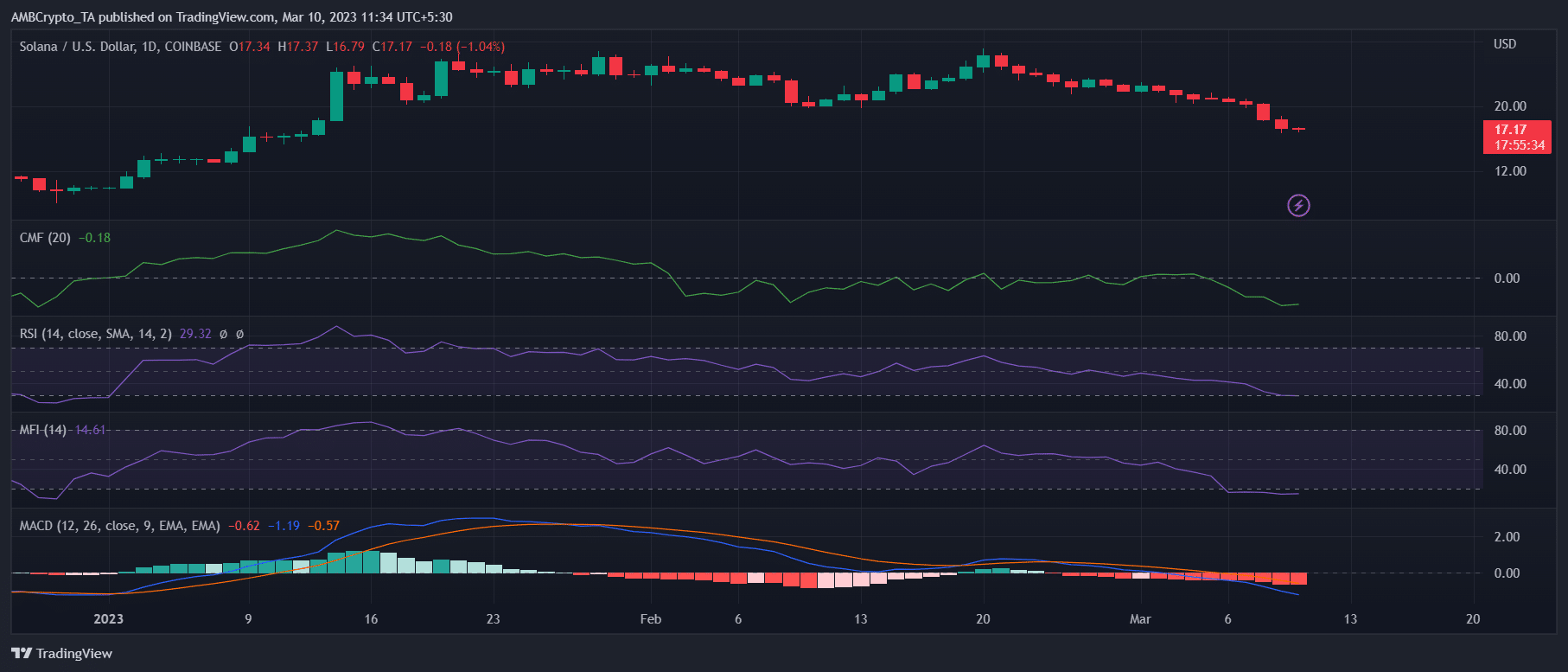

For instance, SOL’s Chaikin Money Flow (CMF) registered a decline, which was a bearish signal, indicating that SOL’s price may be subject to more corrections in the coming days.

The MACD’s readings also revealed a clear bearish advantage in the market. SOL’s Relative Strength Index (RSI) declined sharply and went into the oversold zone.

The Money Flow Index (RSI) also followed the same trend. And, considering the current market conditions, the graph might plummet further.

Source: TradingView

What the metrics have to say

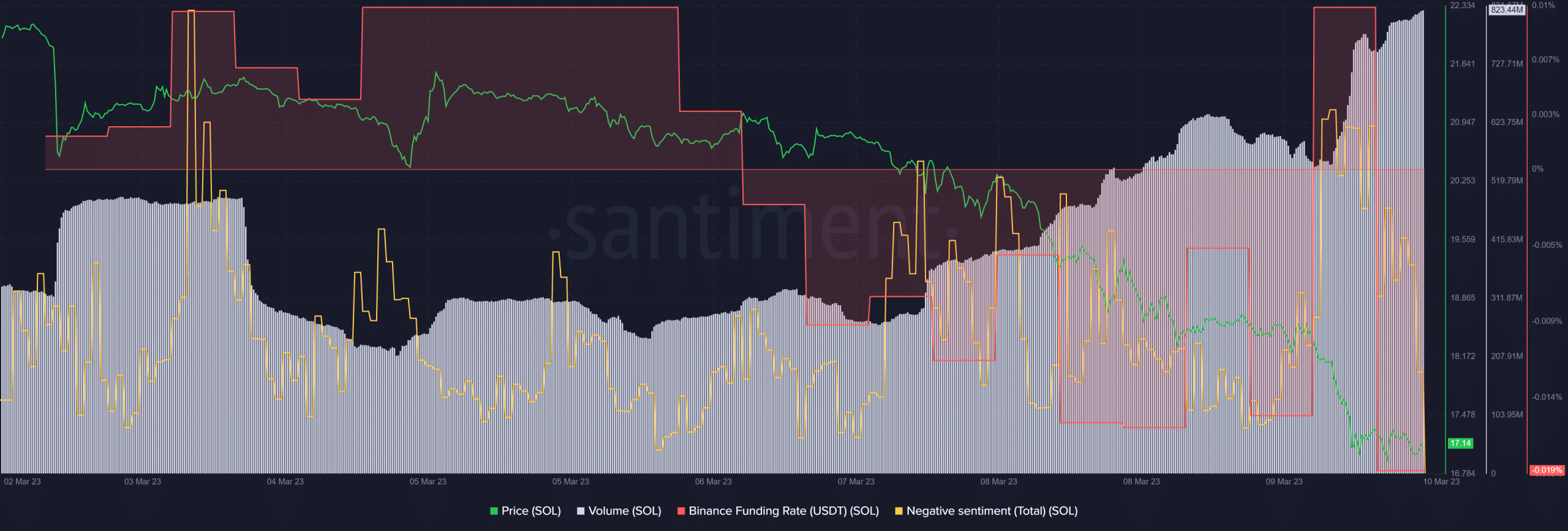

A major red flag for Solana was that its downtrend was accompanied by a rise in trading volume, indicating that the decline was legitimate.

Besides, the decline also affected SOL’s demand in the derivatives market, as SOL’s Binance funding rate went down considerably in the last 24 hours.

Moreover, negative sentiments around SOL have spiked lately, suggesting that investors are not confident in the token’s price movements.

Source: Santiment

Solana NFTs were also affected

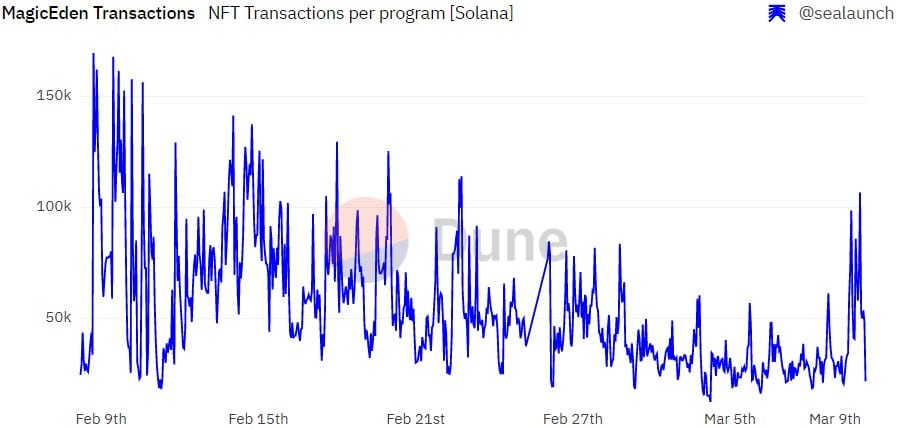

Solana’s NFT space was booming a few days earlier as its daily NFTs minted on the network jumped to a three-month high.

However, the NFT segment has registered a decline over the last few weeks in terms of user count.

Dune’s data further revealed that since February, Solana NFT marketplace’s daily active users have been on the decline. Not only that, but Magic Eden’s transaction count also followed a similar trend and went down.

Source: Dune

How much are 1,10,100 SOLs worth today?

Here is the relief

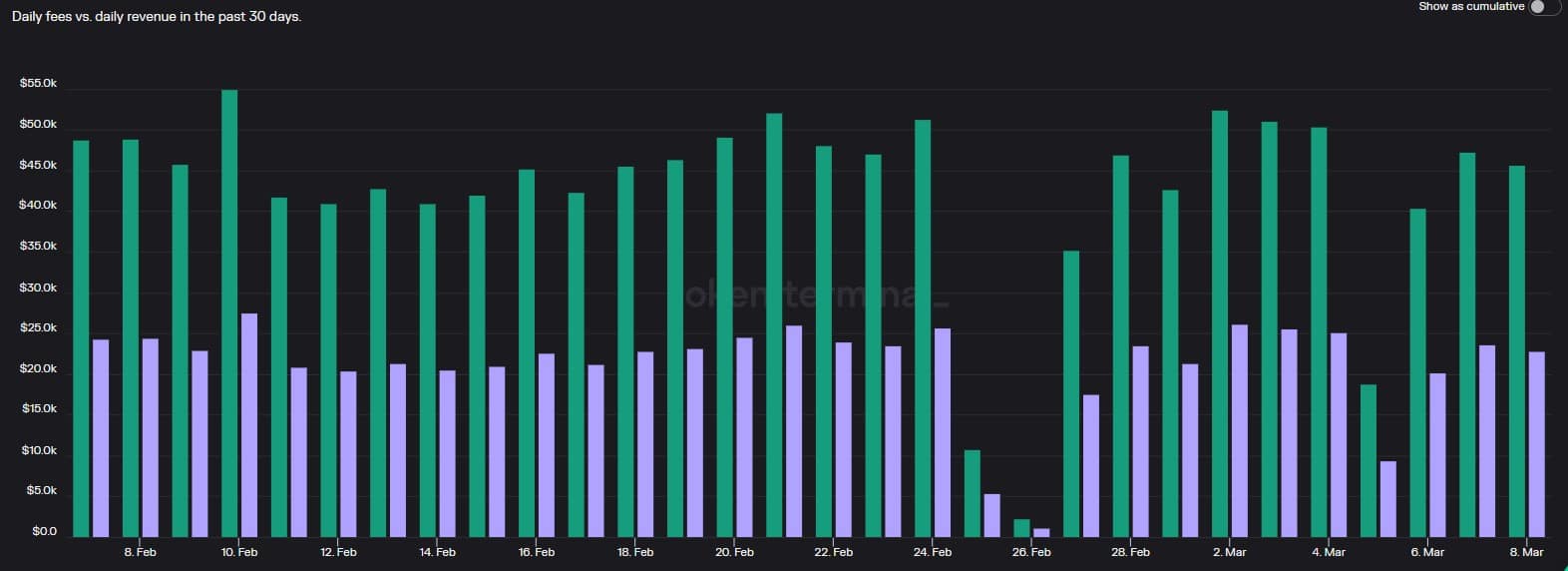

While the market continued to be on a declining trend, a few of the metrics suggested that SOL’s downturn might be a short-term episode.

Santiment’s chart revealed that SOL’s development activity increased considerably while its price declined. This was a positive update reflecting developers’ efforts in improving the network. In addition, SOL’s fees and revenue remained unaffected.

Source: Token Terminal