The voluntary liquidation of Silvergate Bank has sparked many to share their thoughts about the source of its troubles and the broader impact of the crypto-friendly bank’s collapse on crypto.

From lawmakers to crypto analysts, crypto firm executives to commentators — nearly everyone’s had something to say regarding the recent announcement from Silvergate.

Some United States lawmakers have used the moment to make a comment about the state of the crypto industry, labeling it a “risky, volatile sector,” which “spreads risk across the financial system.”

Senator Elizabeth Warren called Silvergate’s failure “disappointing, but predictable,” calling for regulators to “step up against crypto risk.”

As the bank of choice for crypto, Silvergate Bank’s failure is disappointing, but predictable. I warned of Silvergate’s risky, if not illegal, activity—and identified severe due diligence failures. Now, customers must be made whole & regulators should step up against crypto risk.

— Elizabeth Warren (@SenWarren) March 8, 2023

Senator Sherrod Brown also chimed in, sharing his concern that banks that get involved with crypto are putting the financial system at risk and reaffirming his desire to “establish strong safeguards for our financial system from the risks of crypto.”

The senators’ remarks have sparked criticism from the community, some of whom argue it was not a crypto problem and that fractional-reserve banking was to blame — as Silvergate held far more in-demand deposits compared to cash on hand.

.@SenSherrodBrown, you’re wrong that #crypto triggered Silvergate’s issue. What did it was $13.3bn in demand deposits that depositors cld withdraw in minutes, but only $1.4bn of cash. Had $SI held $13.3bn of cash, the bank run wouldn’t have impaired its capital. Not a crypto… https://t.co/nGlfHwUcBN

— Caitlin Long ⚡️ (@CaitlinLong_) March 8, 2023

Several companies have instead used the recent announcement from Silvergate to reiterate their lack of or now-severed ties with the firm.

Binance CEO Changpeng Zhao assured customers on Twitter that the crypto exchange does not have assets stored with Silvergate, while peer exchange Coinbase has also assured its followers that no customer funds were held by the bank.

Update: We’re sorry to see Silvergate make the tough decision to wind down their operations. They were a partner & contributors to the growth of the cryptoeconomy. Coinbase has no client or corporate cash at Silvergate. Client funds continue to be safe, accessible & available. https://t.co/78oMrLQ6VH

— Coinbase (@coinbase) March 9, 2023

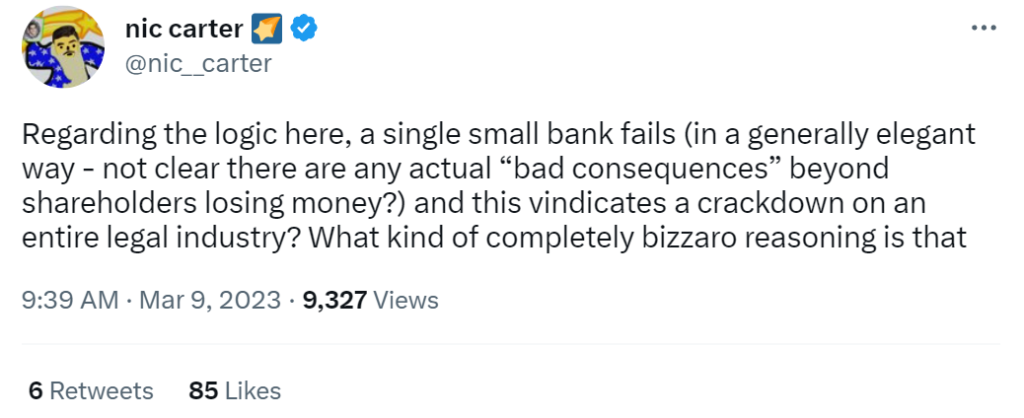

Meanwhile, Nic Carter, co-founder of venture firm Castle Island and crypto intelligence firm Coin Metrics, suggested that it was the government that “hastened the collapse” of Silvergate by launching investigations and legal attacks on it.

“They’re the arsonist and the firefighter in one,” he wrote.

The CEO of financial services firm Lumida — Ram Ahluwalia — had a similar take, arguing in a tweet that Silvergate faced a bank run after a senator’s letter had undermined public trust in the firm. He saidthat “Silvergate was denied due process.”

Related: Marathon Digital terminates credit facilities with Silvergate Bank

In an earlier blog post, Carter referred to “Operation Choke Point 2.0” as being underway, claiming that the U.S. government is using the banking sector to organize “a sophisticated, widespread crackdown against the crypto industry.”

Others believe the collapse of Silvergate won’t necessarily hurt the crypto industry, but along with proposed changes to tax laws, would exacerbate the exodus of crypto firms from the U.S.

– Silvergate winding down operations in light of “regulatory developments”

– Proposed changes to capital gains

– Proposed elimination of tax loss harvestingnone of these are bad for crypto…

they’re just reasons for passionate builders to operate outside the US

— Tom ️ (@thomasjeans) March 9, 2023

With Silvergate winding down, some have also asked where crypto firms will turn to now.

Coinbase, which previously accepted payments via Silvergate, announced on March 3 that it would facilitate institutional client cash transactions for its prime customers with its other banking partner, Signature Bank.

Signature Bank, however, announced in December that it intended to reduce its exposure to the crypto sector by reducing deposits from clients holding digital assets.

To further reduce its crypto exposure, on Jan. 21 Signature imposed a minimum transaction limit of $100,000 on transactions it would process through the SWIFT payment system on behalf of crypto exchange Binance.