NFT

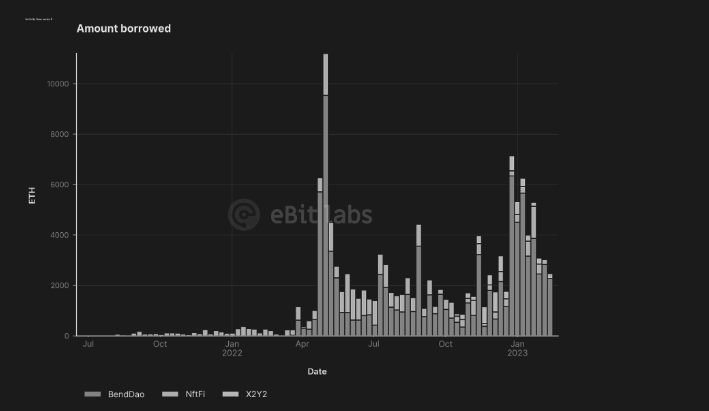

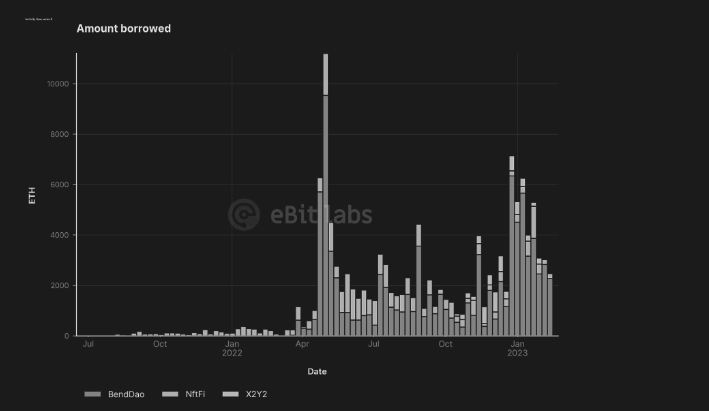

According to a new report by digital asset analytics firm eBit labs, NFT lending hit a record month in January, returning to numbers not seen since the sector’s previous all-time high in May 2022.

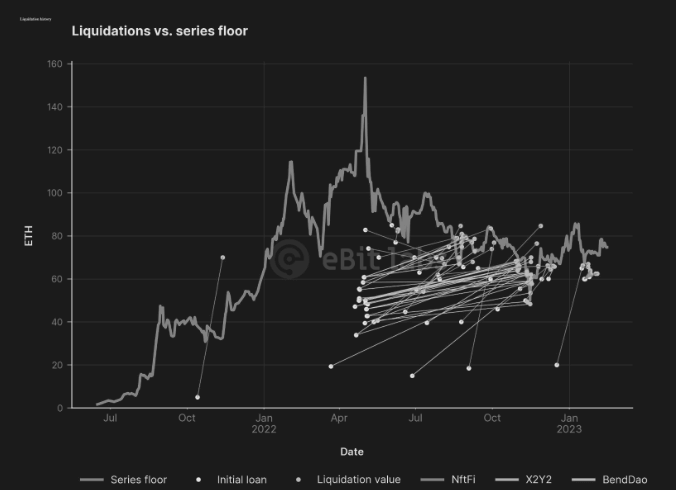

The report used on-chain data of loans backed by Bored Ape Yacht Club (BAYC) and examined BAYCs according to loan price, duration, liquidation value, and marketplace dominance.

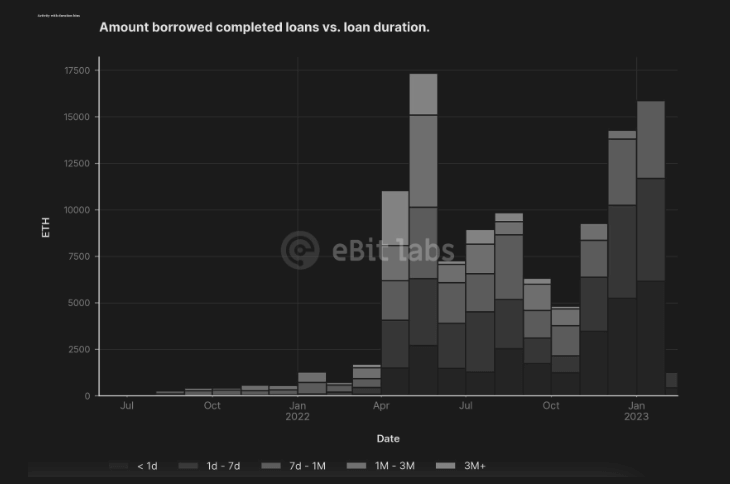

Furthermore, eBit labs discovered that the amount borrowed in Jan. 2023 had returned to peaks not seen since May 2022. For the first time in more than nine months, weekly loan volume totaled more than 6,000 ETH in the first week of Jan. Furthermore, the total borrowed throughout January reached more than 18,000 ETH – or $30,516,660 as of press time.

In the midst of 2022, the lending industry gained widespread attention as the declining floor price of BAYC sparked market pressure and heightened concerns about potential liquidation, ultimately leading to a liquidity crisis, the report also found.

Competition among platforms gets more intense

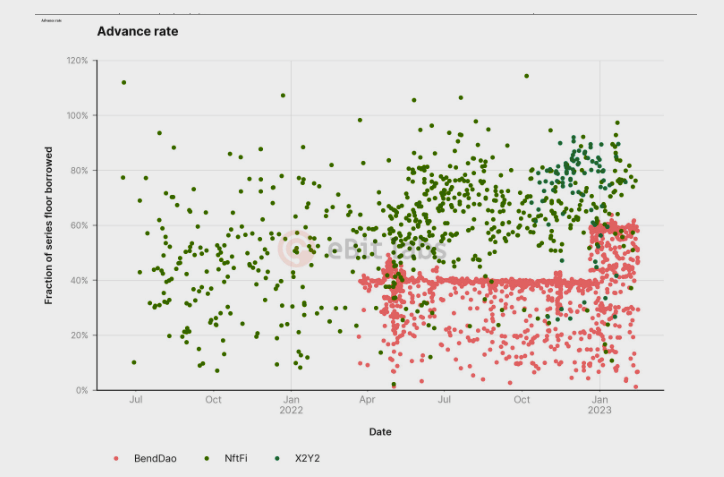

Since its launch, BendDao has maintained a consistent maximum advance rate of 40%, notably lower than the advanced rates of up to 80% offered by other peer-to-peer NFTfi platforms.

However, in September 2022, the entry of X2Y2 into the market disrupted this status quo by offering advance rates exceeding 100%. As a result, BendDao faced intense competition and user attrition, prompting it to raise its advance rates to 60% to remain competitive. This adjustment was made during the winter holiday season.

Janusry 2023 peaks

Several factors propelled January’s surge in NFT lending, the report says. One major factor was market exuberance and the Yuga Labs’ Dookey Dash News, which encouraged users to ramp up Yuga-related lending activity. According to research, the bulk of loans issued across the three primary lending platforms was against Bored Apes, with short-term loan balances for BAYC hitting record highs in January 2023.

Insights

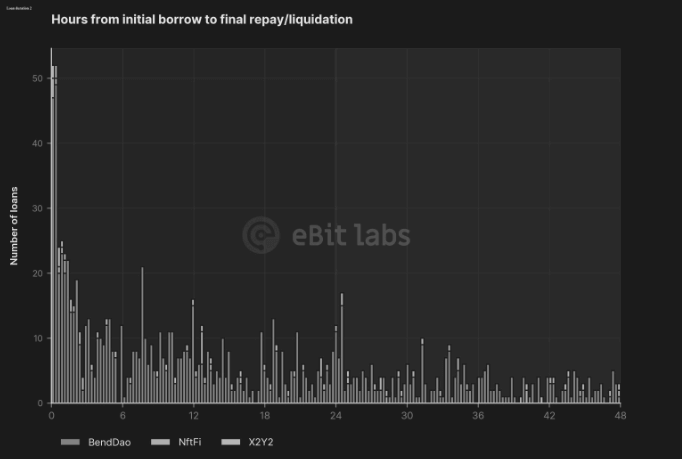

The data shows that the overwhelming majority of loans are either repaid or liquidated within a single day, with longer-term loans constituting a much smaller portion of the total. This trend suggests that potentially many borrowers are utilizing these loans to address immediate liquidity requirements rather than as a hedge against market-value fluctuations.

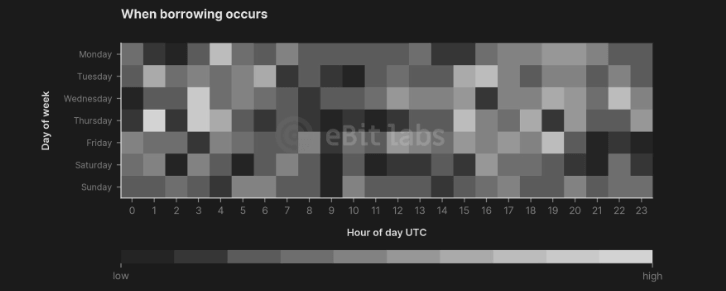

A lull in activity between the 6th and 14th hour (UTC) on weekdays – outside the general US waking hours – suggests that a substantial portion of the activity occurs within the United States.

Overall, the report concluded that:

“The availability of NFT lending meets a valuable market need and helps fuel the ongoing development and sophistication of the entire NFT ecosystem. Drivers for the borrowing are likely wide-ranging, however it’s clear that these loans can meet both short and longer-term liquidity needs and also provide valuable market-value hedges.”