- Avalanche partners with gaming company TSM to increase interest in the protocol

- Number of users have declined as the price of AVAX fell

Even though the FTX collapse was a massive hit to the crypto-market, Avalanche managed to benefit from this ordeal. TSM, a popular gaming firm, had plans to establish its own crypto-based gaming network with FTX. However, after the collapse, Avalanche managed to swoop in and announced a partnership with the firm.

Read Avalanche’s Price Prediction 2023-2024

TSM’s Blitz, which is the company’s competitive gaming platform, will use $AVAX for gas fees, burning a portion of $AVAX fees with every transaction that gamers make.

This deal could improve the current state of the Avalanche network, especially in the NFT department. Based on Dune Analytics’ data, it was Gaming NFTs make up only 27.1% of the overall NFT volume on the Avalanche network. Avalanche’s TSM partnership could increase the contribution of Gaming NFTs to Avalanche’s NFT volume.

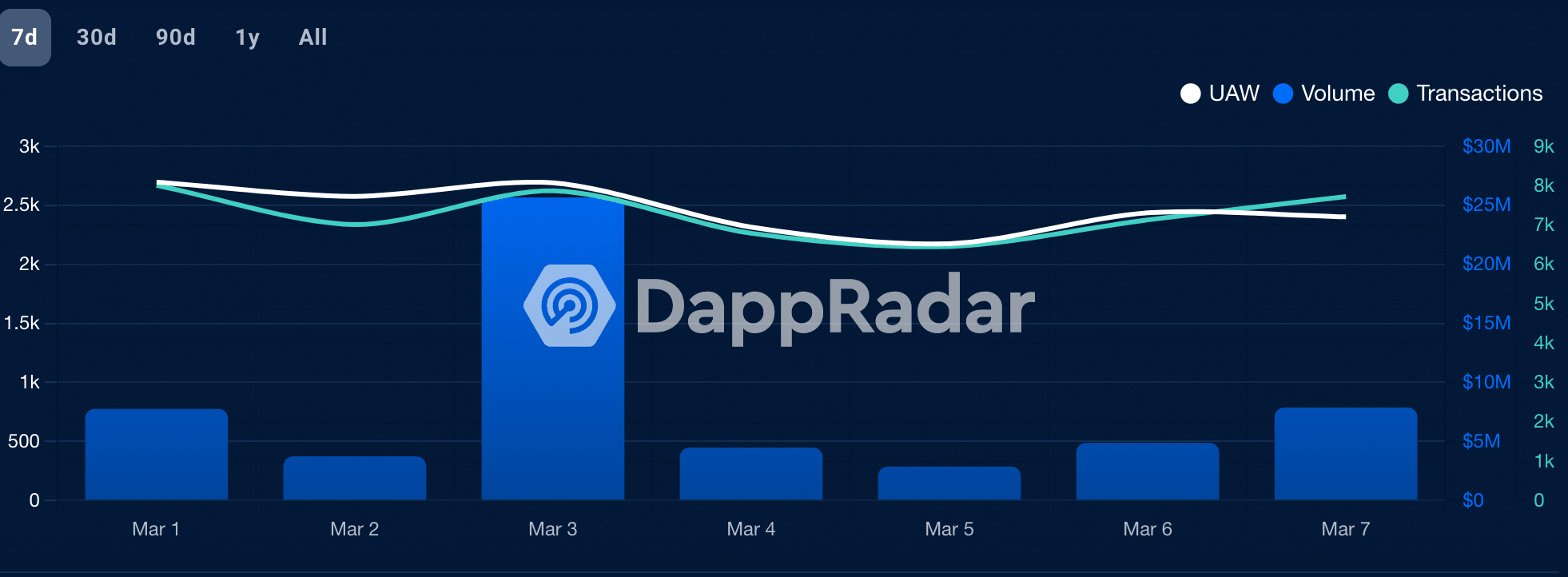

Besides the NFT sector, another area where Avalanche would need to see improvements would be the activity on its dApps. Popular dApps on the Avalanche network such as TraderJoe and GMX recorded a significant decline in overall activity. According to Dapp Radar’s data, the number of unique active wallets on TraderJoe and GMX fell by 56% and 18%, respectively.

Additionally, Trader Joe was impacted in other areas such as volume and number of transactions.

At press time, the volume on the TraderJoe dApp was $55.03M, after falling by 58.46%. Subsequently, the number of transactions on the network fell by -36.6% over the same period.

Source: Dapp Radar

Long road ahead…

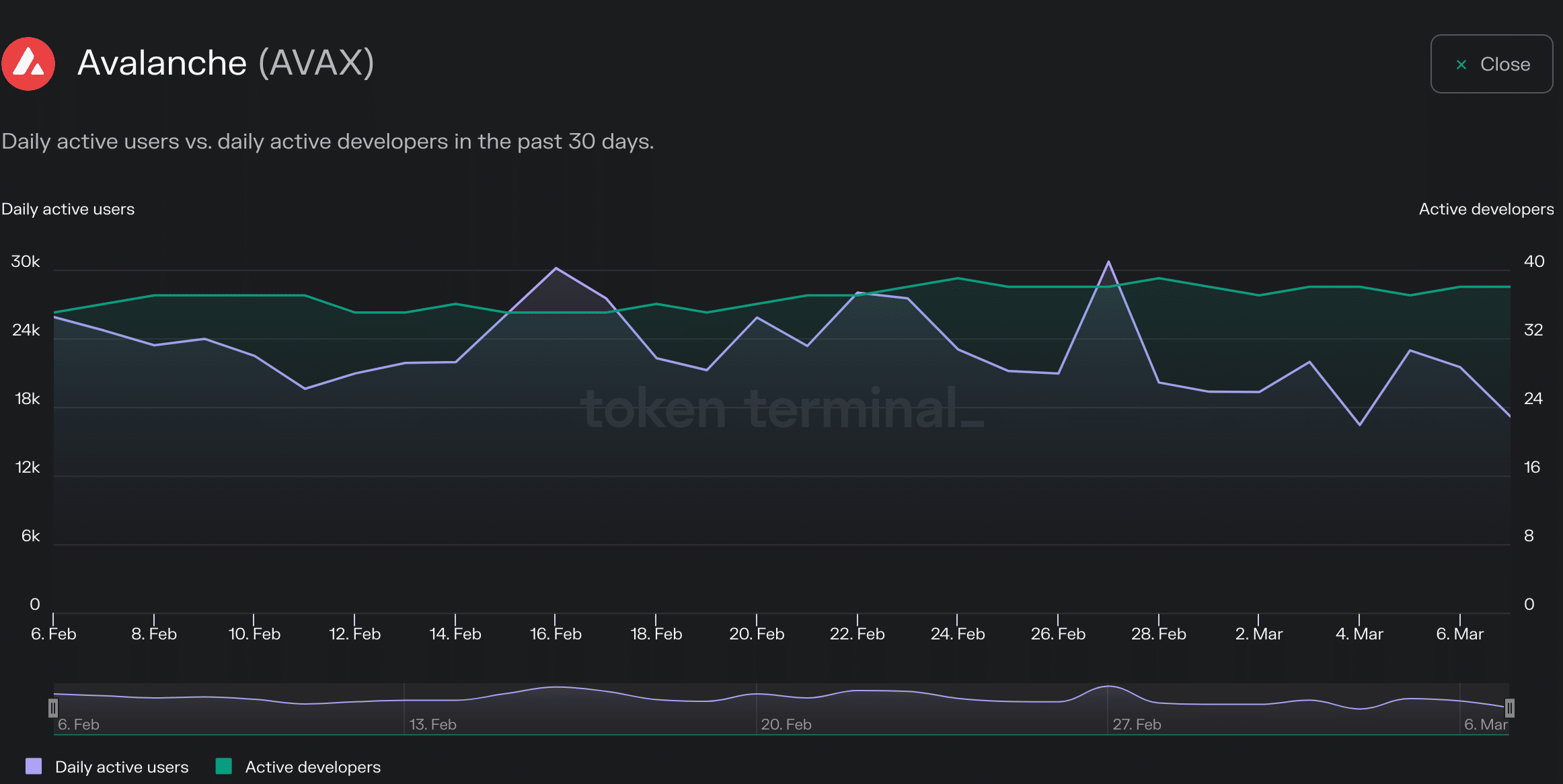

The decline in dApp activity ultimately affected the number of daily active users on the network. Token Terminal’s data showcased that the number of active users on the network fell by 14.1% over the past month. New developments on the network could increase interest from users and bring them back on to the network.

However, the number of active developers on the network fell too. This implies that the chances of new developments coming to the Avalanche network in the near future are very low.

Source: token terminal

Realistic or not, here’s AVAX market cap in BTC’s terms

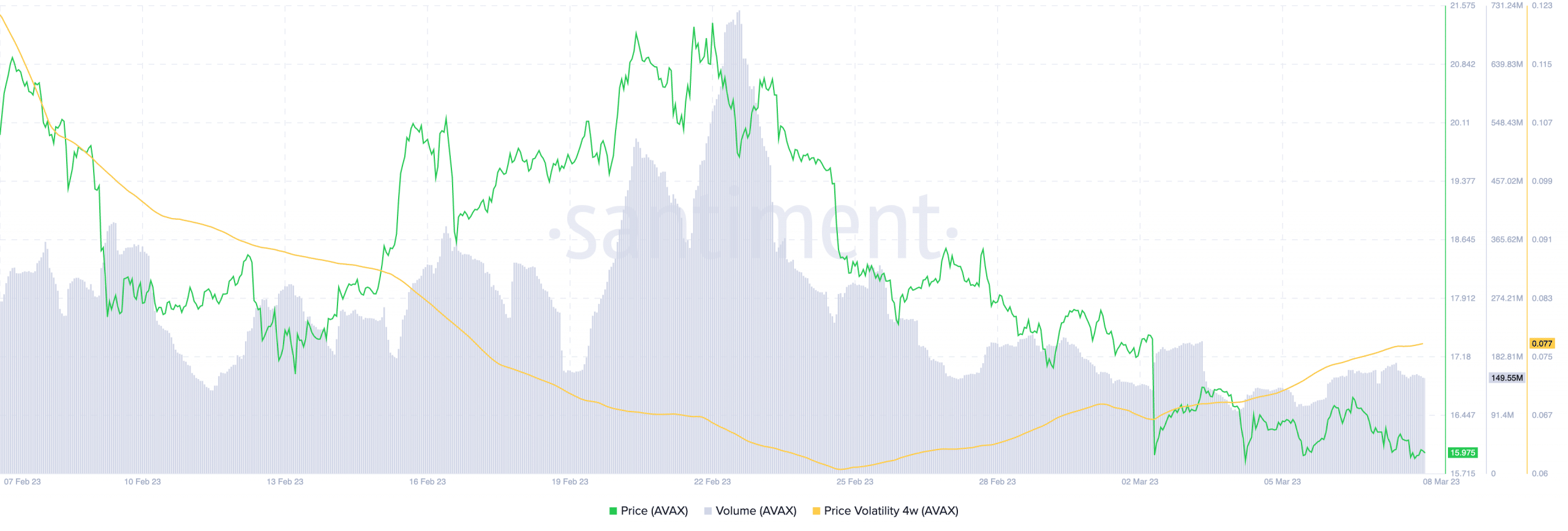

For its part, AVAX has suffered on the charts too. The price of AVAX started to decline on the 22nd of February, alongside AVAX’s volume. Since then, the volume of AVAX has fallen from 709.5 million to 149 million.

Over that period, the price volatility of AVAX has appreciated. This could make risk-averse investors shy away from buying AVAX.

Source: Santiment