On-chain data shows the Bitcoin Korea Premium Index has been displaying signs of selling pressure, something that could result in a pullback.

Bitcoin Korea Premium Index Has Turned Red In Recent Days

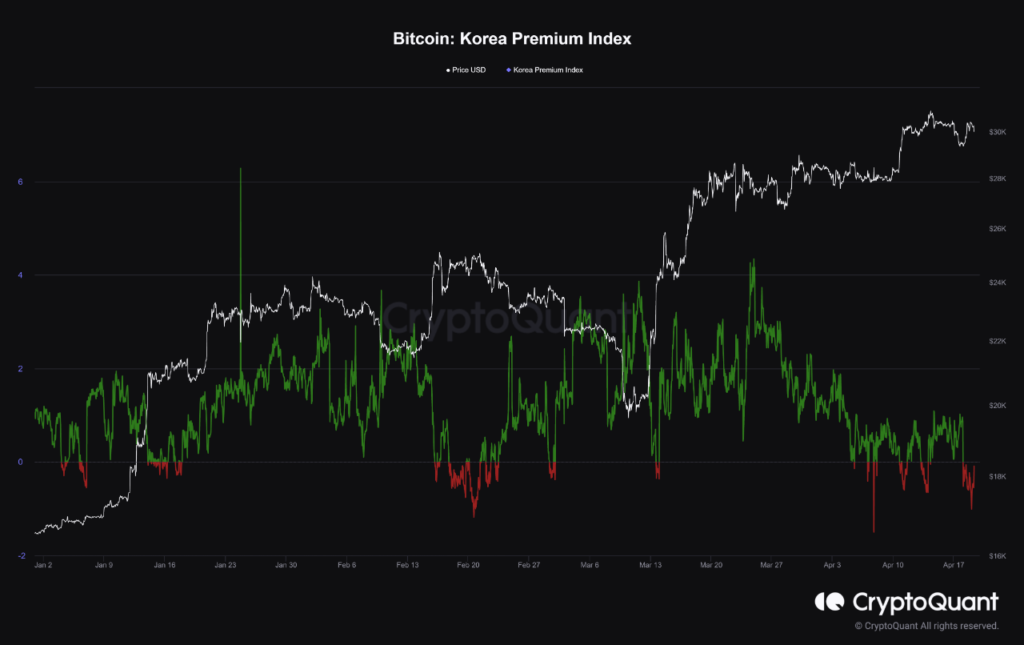

As pointed out by an analyst in a CryptoQuant post, the selling pressure has been rising in the sector recently. The “Korea Premium Index” is an indicator that measures the difference between the Bitcoin price listed on the South Korean exchanges and that listed on foreign platforms.

When the value of this metric is positive, it means the price of the cryptocurrency listed on the South Korean exchanges is currently greater than that on the global ones. Such a trend suggests that there is a heavier amount of buying taking place on the former platforms right now compared to the latter ones (or alternatively, the Korean exchanges are just observing a lower amount of selling pressure).

On the other hand, the indicator showing a negative value implies that South Korean investors may be selling more of the cryptocurrency compared to the rest of the world’s user base.

Now, here is a chart that shows the trend in the Bitcoin Korea Premium Index over the last few months:

The value of the metric seems to have been quite red in recent days | Source: CryptoQuant

As shown in the above graph, the Bitcoin Korea Premium Index has been very positive during most of the rallies in the last few months, suggesting that users of the South Korean exchanges have been heavily purchasing the cryptocurrency throughout the price surge.

This constant buying pressure from these holders may be one of the reasons why the asset has been able to sustain an upwards trajectory in these recent months.

There have also been a few instances, however, where the indicator’s value has turned negative and the global investors have outpaced this cohort in terms of the buying pressure.

The most notable recent instance of this trend was when Bitcoin broke above the $31,000 mark a few days back. The asset topped out above this level when the Korea Premium Index turned red, implying that it may be the selling from these holders that led to the coin’s decline.

Many of the other occurrences of the metric showing negative values this year have also similarly provided resistance to the asset. Recently, the indicator has again turned red, suggesting that these investors may have started to distribute once more.

The bearish impact from these red values didn’t immediately appear as the price in fact started climbing and went above the $30,000 mark shortly after. During the past day, however, this recovery has disappeared as the asset has sharply plunged below this level again.

It’s uncertain whether this dip was all that was to come because of the selling pressure from the Korean investors, or if the cryptocurrency would be facing more pullback in the near term.

BTC Price

At the time of writing, Bitcoin is trading around $29,100, down 3% in the last week.

Looks like BTC has plunged during the past day | Source: BTCUSD on TradingView

Featured image from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com