- Bitcoin shorts increase as the bearish conditions intensify.

- Whales drive the current price action but a pivot may trigger shorts liquidations.

Bitcoin and the altcoin market are going through the most bearish week of 2023 so far. A situation that has resulted in the liquidation of long positions as prices crashed. Many derivatives traders have consequently shifted to short positions but there is an unforeseen risk.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin’s bearish performance so far this week has enticed many traders to execute short positions to take advantage of the falling prices.

But herein lies a potential risk of liquidations in case whales start buying up BTC, triggering a bullish pivot. Whales often take advantage of such situations because the liquidations extend the directional move, allowing them to benefit.

4/ Bearish:

– Jobs added >= 224k

– Unemployment rate <= 3.4%Bullish:

– Jobs added < 224k

– Unemployment rate > 3.4%Seems like the market is setup for a squeeze after yesterday’s action, traders are heavily short the crypto market. But, we’ll need a downside miss IMO! pic.twitter.com/qrxADT6IdG

— tedtalksmacro (@tedtalksmacro) March 10, 2023

Assessing the state of Bitcoin derivatives

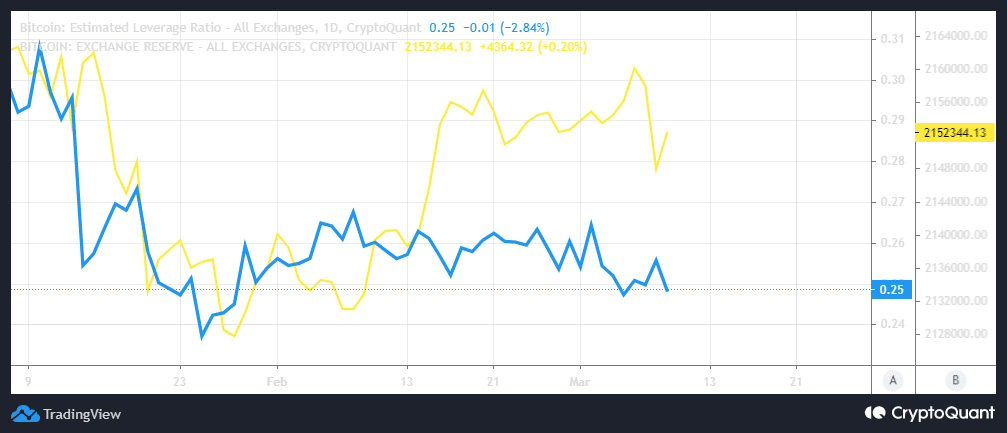

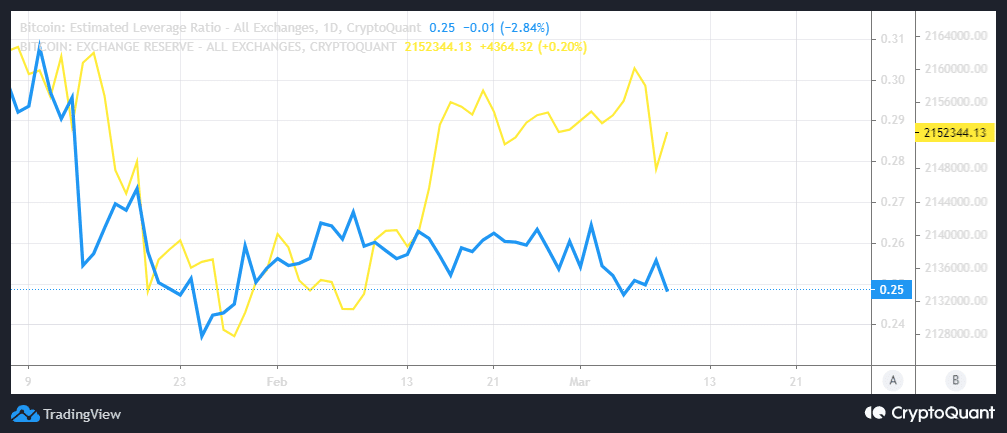

A surge in Bitcoin Funding rates suggests that there is currently a strong increase in shorts. This means there is an increased risk of shorts liquidations if whales suddenly start buying.

Such a scenario is more likely to take place when there is a high level of leverage in the market. The level of leverage is still low so far, hence the risk of liquidation may not be as pronounced.

Source: CryptoQuant

The BTC exchange reserve metric indicates a pivot after the latest sell pressure. Exchange reserves are on the rise, courtesy of the recent sell pressure.

On the other hand, the strong pullback observed this week has also offered a lower entry point that may entice many to start accumulating.

Read Bitcoin [BTC] Price Prediction 2023-24

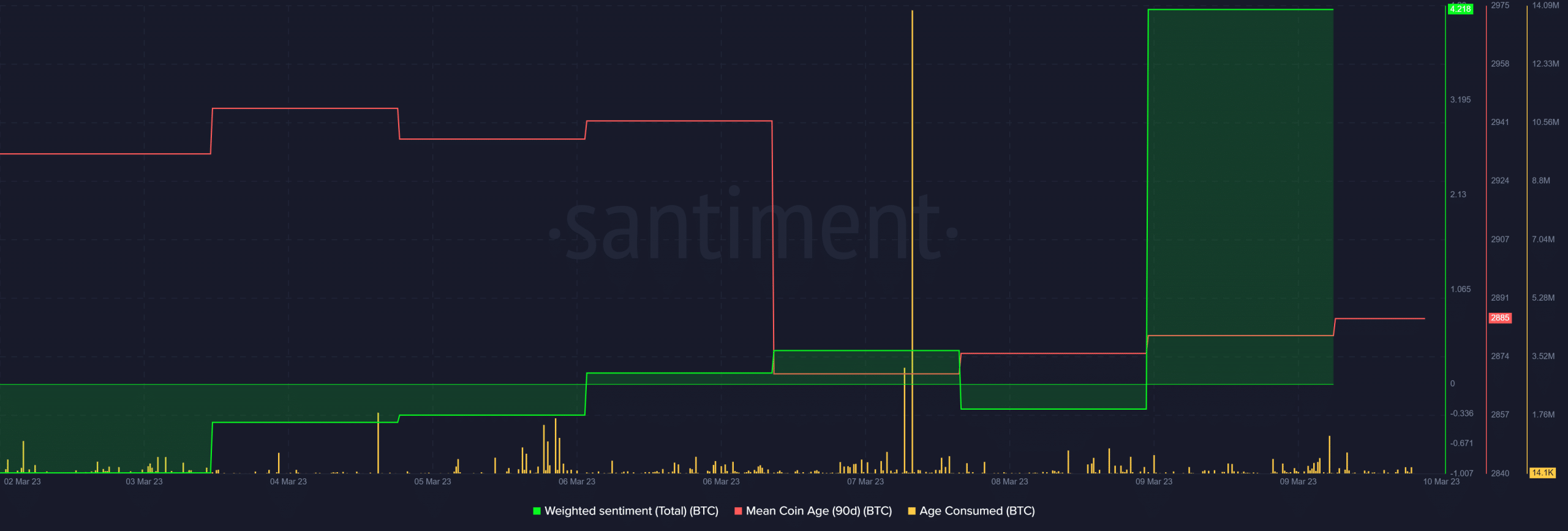

The weighted sentiment metric is now at its highest weekly level due to the expectations of a relief rally. Additionally, the mean coin age metric has been on the rise for the last three days, suggesting that there has been a significant accumulation.

Source: Santiment

One can also interpret it as a sign that many traders are HODLing amid the ongoing selling pressure. Looking at Bitcoin’s supply distribution reveals outflows from addresses holding between 10,000 and 100,000 BTC in the last seven days. On the other hand, addresses holding between 10 and 10,000 BTC have been accumulating especially in the last 24 hours.

Bitcoin investors should keep a close eye on whale activity. The recent price crash kicked into high gear after a large surge in the age-consumed metric, confirming a large number of sales.

The same metric may offer insights into the next move by BTC whales especially one related to accumulation.