- Uniswap may have a solid competitor which has the backing of Lido Finance

- Although UNI active addresses are around the same zone, development activity is at its peak

Uniswap’s [UNI] status as the top Automated Market Maker (AMM) could be at risk after a certain Maverick protocol announced a partnership with Lido Finance [LDO]. Like Uniswap. Maverick operates as a Decentralized Exchange (DEX) by bringing greater capital control to the liquidity market.

Realistic or not, here’s UNI’s market cap in ETH’s terms

Putting the Lido stealth to work against UNI

Maverick’s announcement on 8 March revealed Lido’s position as having the most deposits of staked Ether [stETH] would play a vital role in its charge. So, instead of using Ethereum [ETH] for rewards, users would get stETH.

Maverick includes liquidity pools using @LidoFinance liquid staking token wstETH as quote asset

🟣LP with wstETH instead of ETH to receive extra staking rewards.

🟣New opportunities for wstETH holders to put their liquid staking tokens to work.👉https://t.co/y0G4JW5eiy

2/8

— Maverick Protocol (@mavprotocol) March 8, 2023

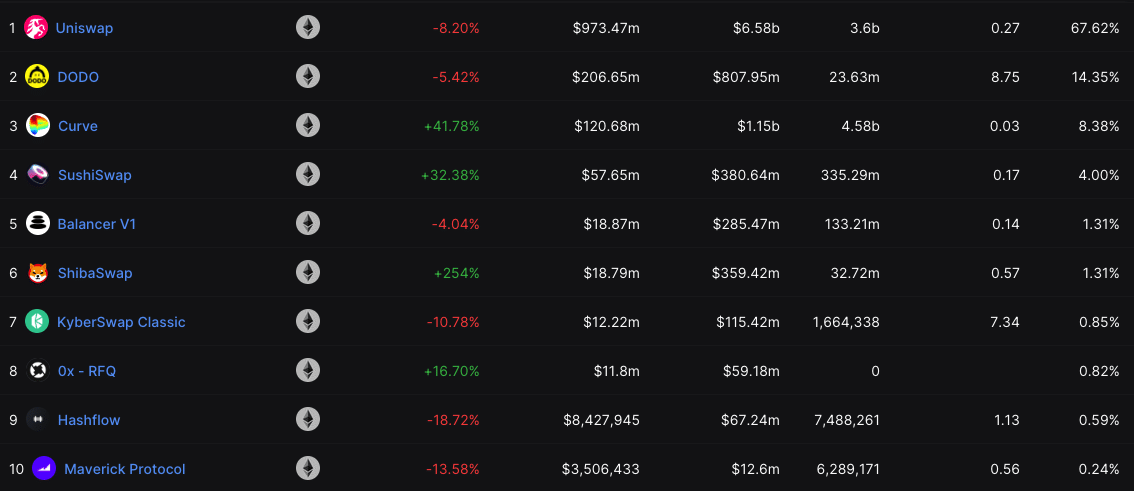

Up until now, Uniswap has occupied the top position as the most used DEX. While others like PancakeSwap [CAKE] and Curve Finance [CRV] have also registered incredible volumes, it has remained difficult to boot the Hayden Adams-led project off its peak.

In fact, the protocol was the go-to AMM for most investors during the FTX contagion as users scrambled for asset safety on DEXs. Nonetheless, Maverick’s collaboration with Lido Finance still poses a threat.

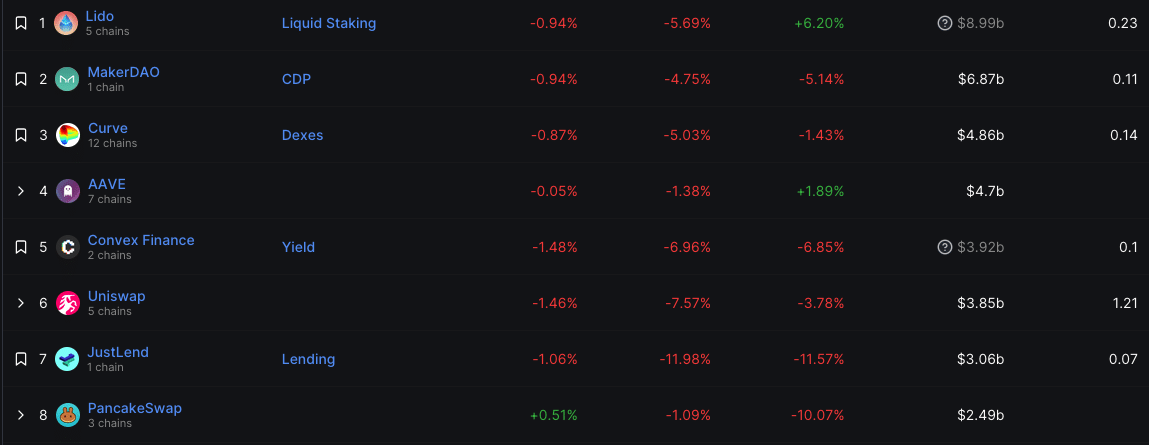

A notable part that could foster competition for Uniswap is Lido’s dominance of DeFi Total Value Locked (TVL). At press time, Lido’s five chains were helping it maintain the top spot. Here, the TVL generally indicates the aggregate amount of assets in a liquidity pool.

However, Uniswap is nowhere near Lido in this regard. While Lido’s 30-day TVL saw a 6.20% hike, Uniswap fell by 3.78%. And, with over $5 billion in difference, it could be difficult for the latter to catch up.

Source: DeFi Llama

A difficult race to play catch-up

Additionally, information from DeFi Llama showed that the yields of the collaboration may already be here. This, because Maverick protocol had jumped into the top-10 DEXs under the Ethereum blockchain. However, with a weekly change of -13.58%, it could still be a hassle to catch Uniswap with a $ 6.58 billion seven-day volume.

Source: DeFi Llama

Read Uniswap’s [UNI] Price Prediction 2023-2024

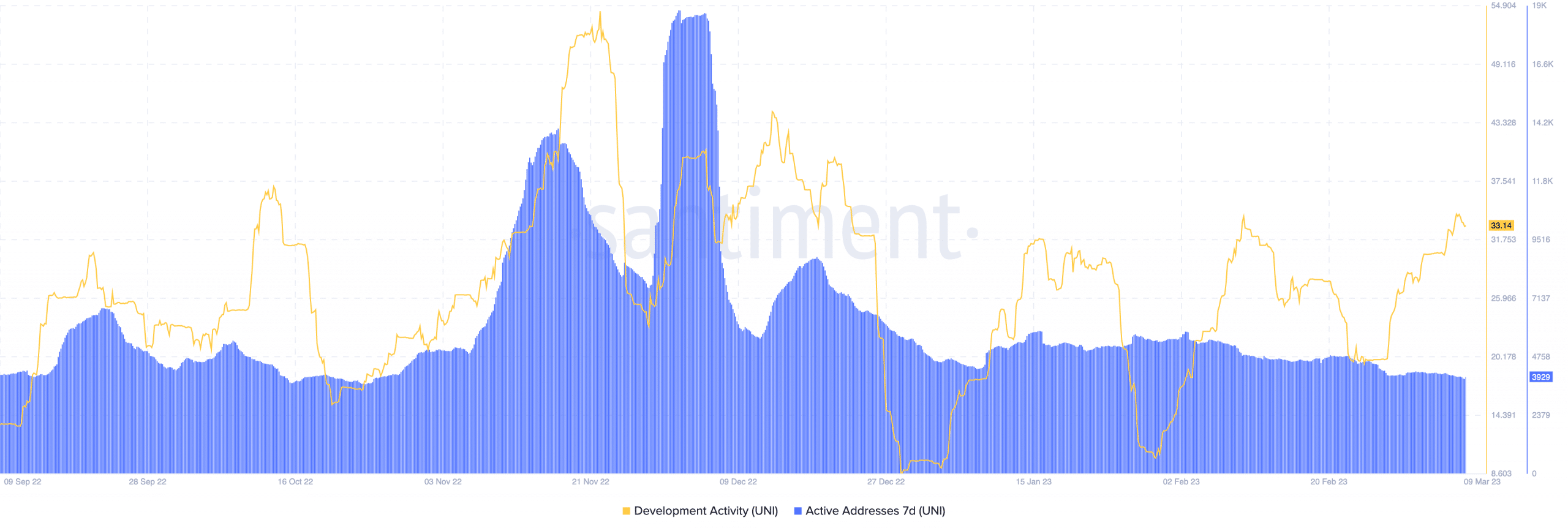

Furthermore, Uniswap does not seem to be resting on its oars based on its development activity trend. The metric measures the public GitHub repositories of a project, aimed at determining the commitment to upgrade the network.

At the time of writing, Unsiwap’s development activity was 33.14— One of the highest points since the new year began. However, active addresses on the network have not been exactly impressive.

The metric indicates the level of investor speculation and synergy concerning a token. Despite the stalemate with the metric, Maverick’s aim to directly compete with Uniswap could be a wild goose chase in the interim bar any unusual development.

Source: Santiment