- The SEC vs Binance episode caused harm to the crypto market.

- BNB’s TVL also declined substantially last month, but a few market indicators were bullish.

Binance [BNB] has felt heat from all sides since the United States Securities and Exchange Commission (SEC) accused the exchange of several misconducts. The episode not only affected the exchange but also took a toll on the overall crypto market, as Bitcoin’s [BTC] price witnessed a decline.

Is your portfolio green? Check out the BNB Profit Calculator

While this happened, Binance also lost multiple of its top executives, further fueling the FUD around the exchange. With the FUD that seems to be developing around the largest exchange, how have key metrics fared? Also, has there been any impact on BNB?

Binance vs. SEC 101

For starters, the SEC has taken legal action against Binance and its CEO, Changpeng Zhao, accusing them of mishandling billions of dollars and jeopardizing investors’ assets.

The SEC also alleges that Zhao and Binance exercise control of the platforms’ customers’ assets, permitting them to commingle customer assets or divert customer assets as they please, including to an entity Zhao owned and controlled called Sigma Chain.

The aftermath of the lawsuit

Following the lawsuit, fear among investors spiked, which was legitimate considering the previous collapse of big exchanges like FTX, which caused a market crash. This time, though the market did not crash, it caused some harm.

The episode caused a correction in BTC’s price, which made investors anxious as they feared a further drop in its price. However, that was not the case, as the market was quick to recover. But a notable fact is that during that period, investors lost confidence in Binance as the exchange witnessed massive outflows.

FUD around Binance is nowhere near declining

Investors and the entire crypto community as a whole were still concerned about the Binance situation, as things were not cooling off. As per Santiment’s latest tweet, Binance’s social volume spiked substantially over the last few days.

This happened just prior to BTC dropping below the $30,000 mark. This was also fueled by the resignation of multiple top executives at Binance.

😱 On top of #Binance‘s regulatory pressure, the top #crypto exchange has lost its:

👉 General Counsel

👉Chief Strategy Officer

👉Senior Vice President for Compliance

👉Chief Global Investigations and Intelligence Officer#FUD is currently very high.https://t.co/h11unYOwD8 pic.twitter.com/009nde8A62— Santiment (@santimentfeed) July 7, 2023

As per the latest report, Binance’s top shots, including its General Counsel, Chief Strategy Officer, Senior Vice President of Compliance, and Chief Global Investigations and Intelligence Officer, exited the company.

This might have further increased fear among investors, causing a spike in its social volume as the community kept talking about the incident.

Is BNB affected by any means?

As this episode affected the entire crypto space, Binance’s native token, BNB, also took a blow – not only in terms of its price action but also in terms of its network value. Artemis’ data revealed that the blockchain’s TVL declined sharply over the last 30 days, which was a negative signal.

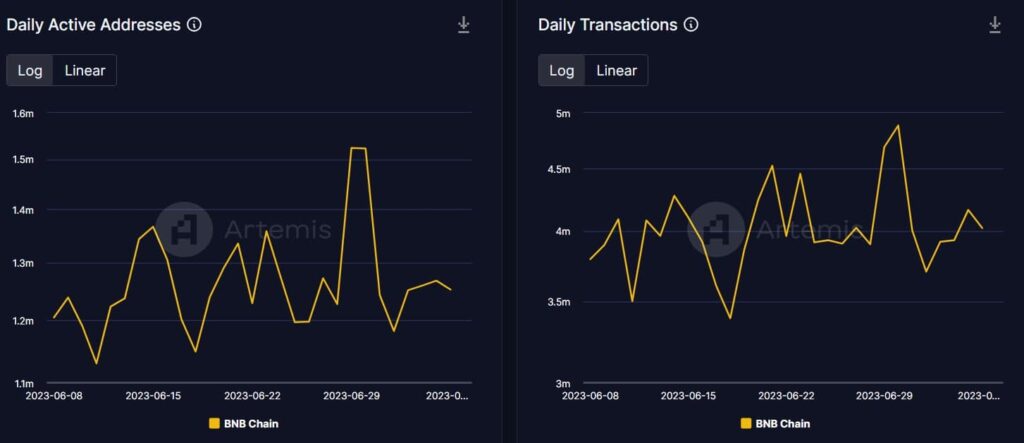

The same trend remained true for its DEX volume, reflecting a decline in its popularity. However, it was interesting to note that the update did not affect BNB Chain’s network activity. This was evident from the rise in its daily active addresses and transactions over the last 30 days.

Source: Artemis

What to expect from BNB?

Investors’ sentiment around BNB did not seem to improve, as its negative sentiment spiked considerably over the last seven days. On top of that, as per LunarCrush, bullish sentiment around BNB also declined 85% in the previous week.

The token’s Altrank also increased, which is a typical bearish signal.

Source: Santiment

As per CoinMarketCap, BNB’s price has declined by 2% in the last seven days. However, the situation seemed to be changing as its daily chart was painted green. At the time of writing, BNB was trading at $236.96 with a market capitalization of over $36.9 billion.

A look at BNB’s daily chart gave an idea of what can be expected from the token in the coming days.

Read Binance Coin’s [BNB] Price Prediction 2023-24

A few of the metrics were in the bulls’ favor, while the others suggested otherwise. For instance, the token’s Relative Strength Index (RSI) and Money Flow Index (MFI) registered upticks.

However, the Exponential Moving Average (EMA) Ribbon was supporting the bears, as the 20-day EMA was well below the 55-day EMA. The MACD also displayed the possibility of a bearish crossover, increasing the chances of a downtrend in the coming days.

Source: TradingView