- BTC continued to push to break back into the $24,000 price region.

- BTC price trended above DRM as more miners joined the network.

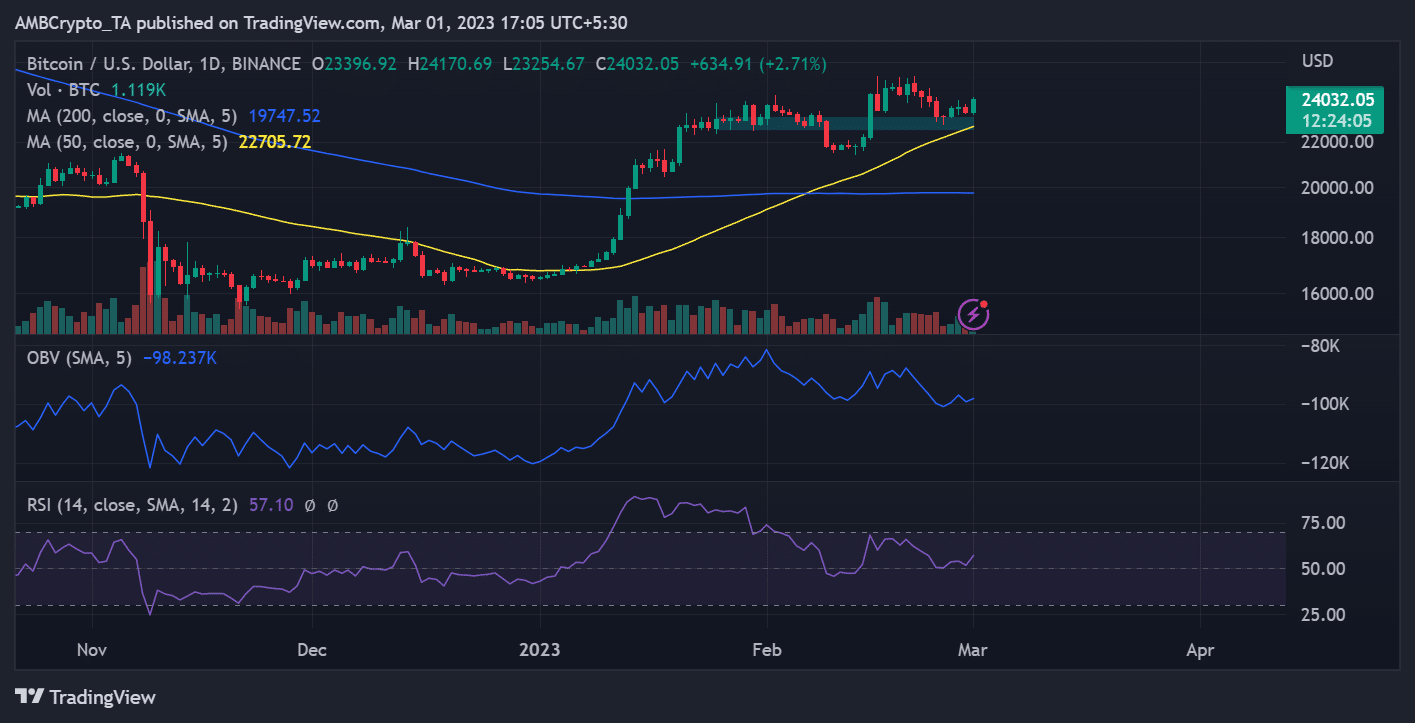

Although Bitcoin’s [BTC] price could not break over the $23,000 resistance zone, the network’s block production difficulty has continued to rise steadily. However, it had rebounded and was reattempting a test at the $24,000 price range at press time, according to the examined daily period chart.

Read Bitcoin’s [BTC] Price Prediction 2023-24

It was trading at about $23,900 as of this writing, with a value rise of approximately 3%. Also, on a daily timescale, the price range between $23,136 and $22,561 acted as its support area.

Source: TradingView

As the price dropped, the Relative Strength Index (RSI) also showed signs of a decrease. However, it continued to trade above the neutral line, demonstrating the dominance of a bull trend.

The lengthy Moving Average (blue line), located slightly below the price movement, also served as a support area at about $19,600. Yet, because of the rise in Mining Difficulty, investors and miners may not want Bitcoin to revert.

What do BTC analysts say?

According to a Glassnode analyst on 28 February, regardless of BTC’s fall, it was still higher than the Difficulty Regression Model (DRM) indicator.

The Difficulty Regression Model is an estimated all-in-cost of production for #Bitcoin. The value reflects an estimated production cost, which is $21,100.

As the price is above the DRM, miners have come back online, hash rate exploded.

A good indicator of a bear and bull market pic.twitter.com/zhZyNsPtr5

— James V. Straten (@jimmyvs24) February 28, 2023

Changes in Bitcoin’s mining difficulty can be predicted with the help of a statistical model called the Bitcoin Difficulty Regression Model. Using a statistical model, researchers can foretell how Bitcoin’s mining difficulty will evolve.

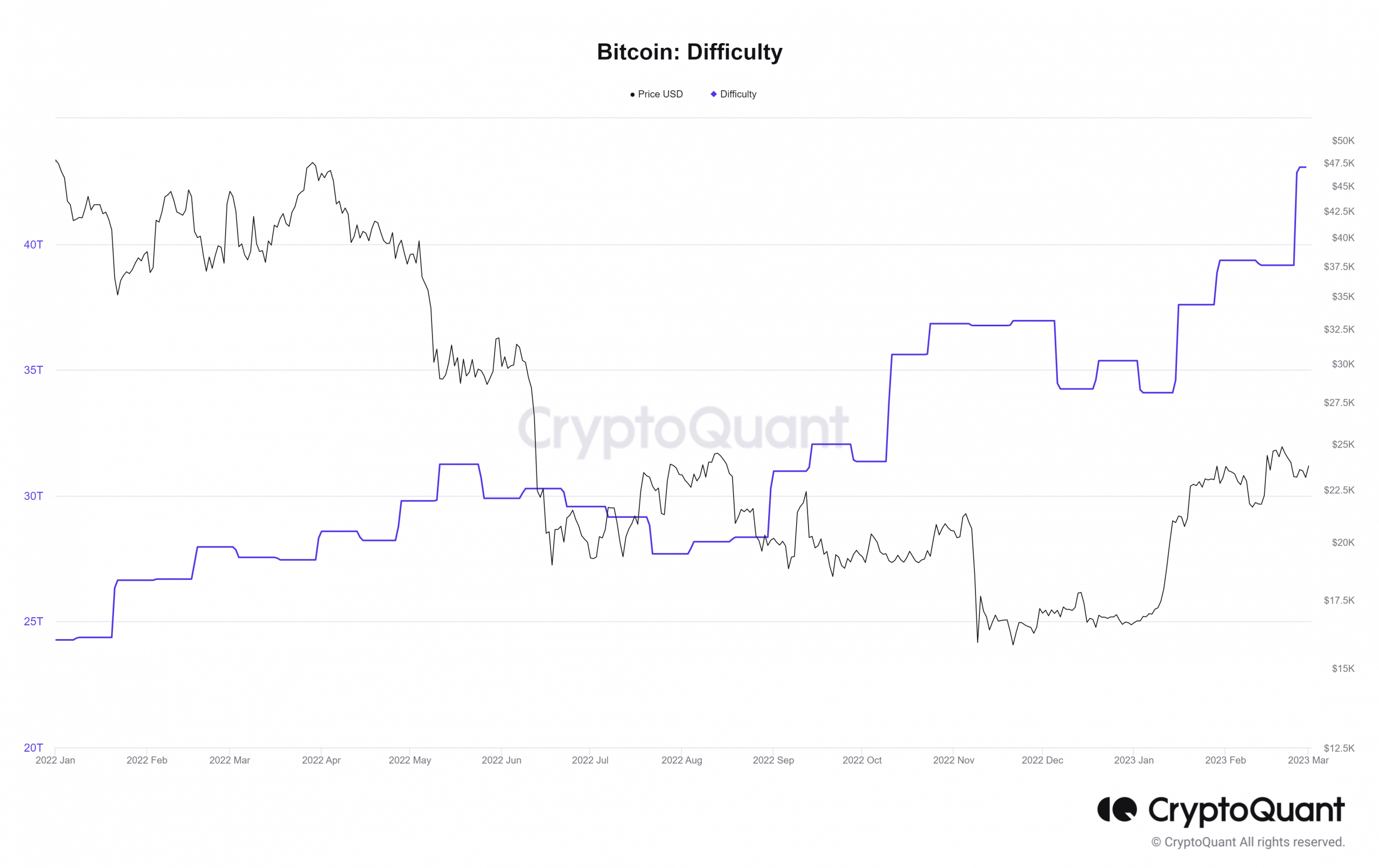

A look at Bitcoin’s mining difficulty

The difficulty level of mining Bitcoin was at an all-time high at press time. Mining difficulty has been rising steadily since the beginning of the year, as evidenced by CryptoQuant’s graph. In February, though, it accelerated its upward trend and was growing exponentially at the time of writing.

Since the difficulty has increased, the cost of making a network block has also increased. Moreover, mining revenue rose due to BTC’s high prices, providing miners with additional motivation.

Source: CryptoQuant

Is your portfolio green? Check out the Bitcoin Profit Calculator

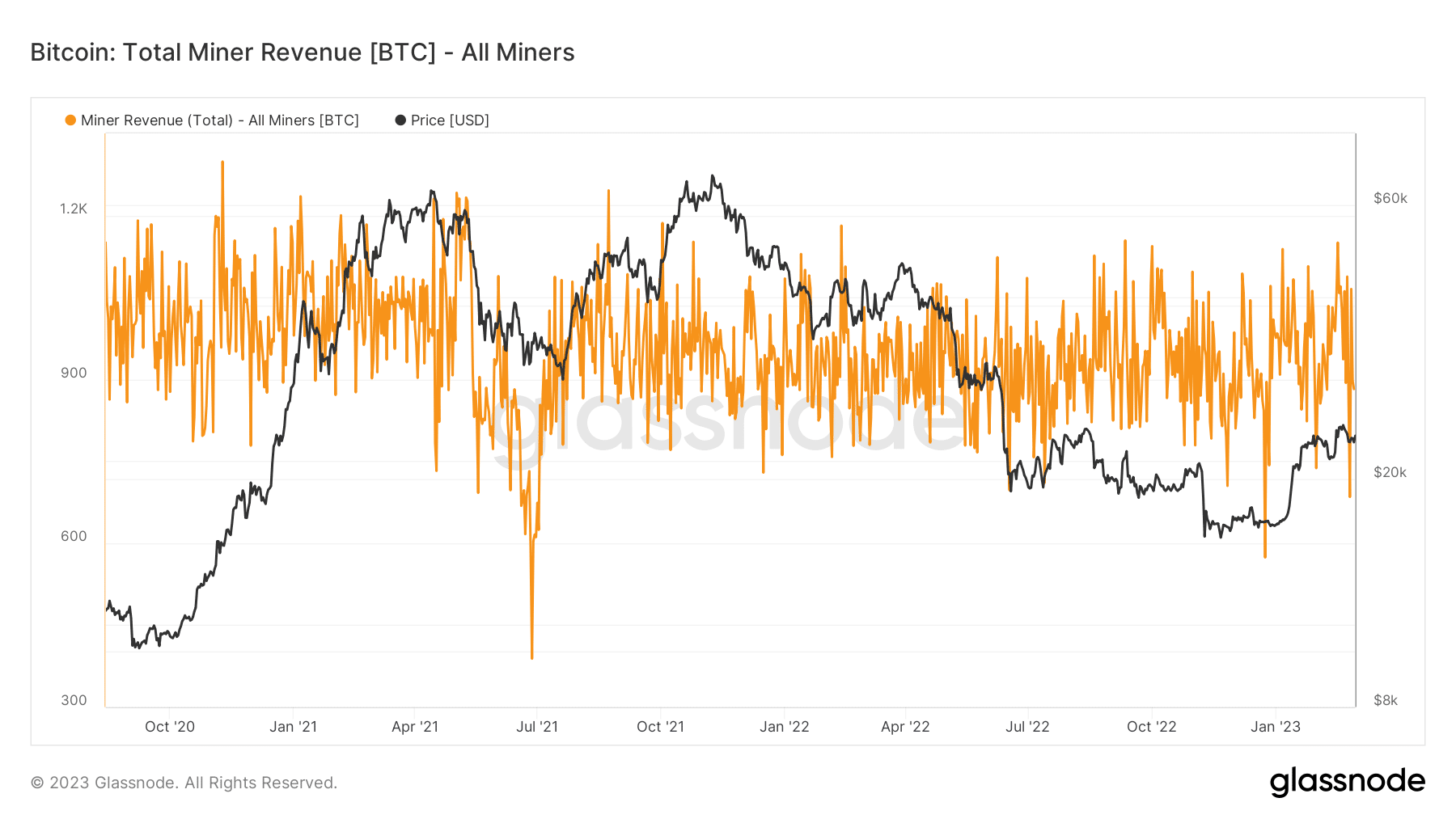

The historical trajectory of mining revenue revealed that it had been declining annually. Nonetheless, the currently visible level did not suggest a decrease from what has been possible for a time. The revenue per day seen as of this writing was approximately 882 BTC.

Source: Glassnode

The high mining difficulty at press time is caused by the rise in BTC’s price and, consequently, in earnings. Nonetheless, it remained in a precarious position, and a sudden price reduction could upset the equilibrium.