- Bitcoin was up by more than 3% in the last seven days.

- If BTC starts a bull rally, it might face resistance near the $45,000 mark.

As Bitcoin’s [BTC] price iced near the $44,000 mark, investors’ expectations of the king coin rose. In fact, if the latest data is to be believed, BTC might touch a new high in 2024.

Considering the hype around Bitcoin ETFs, the possibility of BTC reaching new highs seems likely.

2024 might be a year worth remembering

Bitcoin’s price action remained bullish last week, as it was just about to cross the $44,000 mark. According to CoinMarketCap, BTC was up by over 3% last week.

At press time, the king of cryptos was trading at $43,912.86 with a market capitalization of over $860 billion.

As BTC’s price steadily increased, analysts have been making bullish predictions for the king coin.

Notably, an analyst who created the Stock-to-Flow (S2F) model predicted that Bitcoin might surpass $100,000 in 2024 before reaching a price of $532,000 in 2025.

In 2015, when I bought my first btc at $400, people said bitcoin was dead.

In 2019, when btc was $4000, I wrote the S2F article, calling for $55k btc. People said I was crazy.

Today, btc is $40k, and S2F model predicts $532k after 2024 halving. People say it is impossible.

— PlanB (@100trillionUSD) January 7, 2024

The prediction was made at a time when Bitcoin ETFs were a hot topic of discussion in the market. If ETFs get approved, investors might expect BTC’s price to reach new highs.

In fact, Crypto Tony, a popular crypto analyst, also shared that he also anticipated BTC reaching $50,000 if ETFs get approved.

ETF anticipation plan. I remain in my long while we hold above $41,000 right now. My plan would be to take profit at the $47,000 – $50,000 region, and anticipate a sell off over the coming weeks

If the ETF is approved that is, if declined we drop first pic.twitter.com/4HJ9f1FkcP

— Crypto Tony (@CryptoTony__) January 8, 2024

Anything for investors in the short term?

Though the figure of $100,000 looked ambitious, and it would be pretty early to make such predictions, there was good news for investors. Captain Faibik revealed in a tweet that BTC’s Bollinger Bands were tightening in the daily time frame chart.

The analyst remained bullish on BTC and expected its price to move up in the coming days.

$BTC Bollinger Bands are tightening in the Daily timeframe Chart.

Expecting a Big Move in Upcoming week.

By the way, I’m Still Bullish on Bitcoin 😊#Crypto #Bitcoin #BTC pic.twitter.com/HxbJh5ZYSR

— Captain Faibik (@CryptoFaibik) January 7, 2024

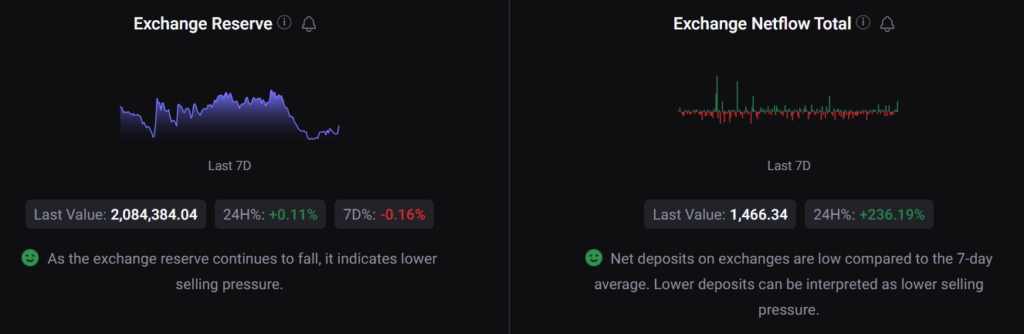

Therefore, to better understand what to expect from BTC, AMBCrypto took a look at its on-chain metrics.

Our analysis found that buying pressure on BTC was increasing as its exchange reserve and exchange netflow were in the green.

Source: CryptoQuant

Our look at CryptoQuant’s data also revealed that BTC’s binary CDD was green. This meant that long-term holders’ movements in the last seven days were lower than average.

Buying sentiment among US investors was also dominant, as evident from BTC’s Coinbase Premium.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

If Bitcoin manages to initiate a bull rally in the coming days, it might face a few resistance zones. AMBCrypto then checked Bitcoin’s liquidation heatmap to find out those troublesome zones.

Our analysis revealed that BTC’s liquidation increased last time when its price reached the $45,000 mark. Therefore, it must go above that level to maintain its bull rally.

Source: Hyblock Capital