Dogecoin (DOGE) has found itself in a precarious position, with its price being squeezed into a narrow range, hinting at a potential decisive breakout in the near future.

Market analysts closely monitor the crypto’s struggle to breach a longstanding resistance trendline, as an upside breakout could trigger a fresh rally, while a continuation of the current stalemate may lead to a further decline.

Earlier this week, DOGE encountered its fifth rejection from a persistent resistance trendline that has thwarted its upward momentum. The rejection left its mark on the daily candlestick chart, characterized by a prominent high wick, indicative of aggressive overhead supply.

Historical data reveals that such patterns often precede significant corrections in the cryptocurrency market.

The current price of DOGE, according to CoinGecko, stands at $0.058295, with a 24-hour dip of 1.5% and a minor seven-day loss of 0.1%.

DOGE seven-day price action. Source: Coingecko

In the event that the prevailing selling pressure continues, there is a high probability that the value of the coin will see a further decline of approximately 4-5%. This decline may potentially lead to a reevaluation of the annual support trendline, with a projected value of approximately $0.055.

Presently, the price of this memecoin is situated inside the confines of two prominent trendlines, indicating an impending occurrence of either a definitive upward surge or a downward decline.

Dogecoin: Glimpse Of Hope Amidst Mixed Data

Despite the gloomy price outlook, there is a glimmer of hope for DOGE enthusiasts. The report also predicts that if the coin manages to sustain a breakout above the resistance trendline, investors could witness a sharp 16.8% surge, targeting the $0.068 level. This possibility is poised to keep traders and investors on the edge of their seats.

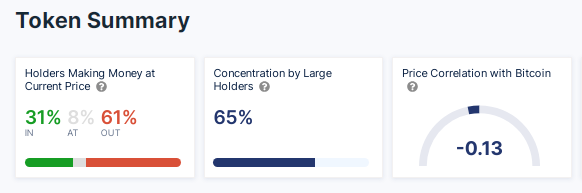

On the other hand, data from IntoTheBlock reveals some intriguing insights into DOGE’s current state. It’s been found that a significant portion of DOGE addresses, specifically 61%, are currently at a loss.

Source: IntoTheBlock

A deeper dive into the data exposes the fact that only 31% of the total DOGE holders are in profit, highlighting the challenging landscape for DOGE investors. An additional 10% of holders remain in a neutral position, while a substantial 59% of Dogecoin holders find themselves in a losing position.

DOGE’s Silver Lining

One silver lining in this scenario is the fact that 72% of DOGE holders have maintained their positions for over a year, signifying a strong commitment to the digital asset. A further 26% of holders have held DOGE for a duration ranging from one month to 12 months, while 2% of holders have relatively shorter-term positions, spanning less than a month.

DOGE market cap currently at $6.8 billion. Chart: TradingView.com

As the Dogecoin community eagerly awaits the impending breakout or breakdown, the cryptocurrency market remains a dynamic and uncertain space, where opportunities and risks are constantly shifting.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from MarketWatch