NFT

In the fast-evolving world of NFTs, the decision by leading marketplace OpenSea to temporarily eliminate its 2.5% fee on sales and reduce creator royalty protections in response to the emergence of a rival platform, Blur, has sparked a contentious debate.

But what if a different world existed, one where artists were freed from the shackles of the platform pimps?

Part of the reason I got into crypto was a love of open-source software and decentralization. The idea that anyone, anywhere, could participate in the digital economy that prioritized artists and royalties became a huge motivating factor and rallying for creators to adopt NFTs.

Blur is built using a royalty-optional model, which some argue is positive for the industry’s long-term health, but one that I think is ultimately squeezing artists like a cheap orange juice.

Permanent royalties, once seen as the holy grail of NFT advocates, were touted as a significant reason for artists to adopt blockchain technology. However, many NFT platforms, such as Blur and OpenSea, have elected to remove the requirement for buyers to pay royalties, which has threatened this principle.

Yet, this was not always the case, as numerous examples from art history can attest.

In the 16th century, the German artist Albrecht Dürer transitioned from painting into commercial printmaking, citing royalties as one of his primary motivations. It was simple, Durer reasoned. Now he could make not just one picture, but many. “My painting is well finished and finely coloured [but] […] I have little profit by it. Had I stuck to engraving, I would today be a richer man by 1,000 florins.”

Dürer added a vital caveat concerning royalties. A cold-blooded threat to potential copycats who thought they could just print and sell copies of his art without paying the priorly agreed upon fees (*ahem* OpenSea and Blur):

“Hold! You crafty ones, strangers to work, and pilferers of other men’s brains! Think not rashly to lay your thievish hands upon my works! Beware! Know you not that I have a grant from the most glorious Emperor Maximilian that not one throughout the Imperial Dominion shall be allowed to print or sell fictitious imitations of these engravings?

Listen! And bear in mind that if you do so, through spite or through covetousness, not only will your goods be confiscated, but your bodies will also placed in mortal danger!”

Mortal dangers notwithstanding, royalties continue to be a contentious topic.

In 1973, Robert Scull, a taxi tycoon and art enthusiast, sold Robert Rauschenberg’s artwork “Thaw” for $85,000, which he had purchased for a mere $900 fifteen years earlier. The artist was outraged by this transaction and exclaimed, “I’ve been working tirelessly for you to reap such profits?”

Fast forward fifty years, and here we are again.

“There’s been a massive shift in the NFT ecosystem,” OpenSea tweeted on Feb. 17. “In October, we started to see meaningful volume and users move to NFT marketplaces that don’t fully enforce creator earnings. Today, that shift has accelerated dramatically despite our best efforts.”

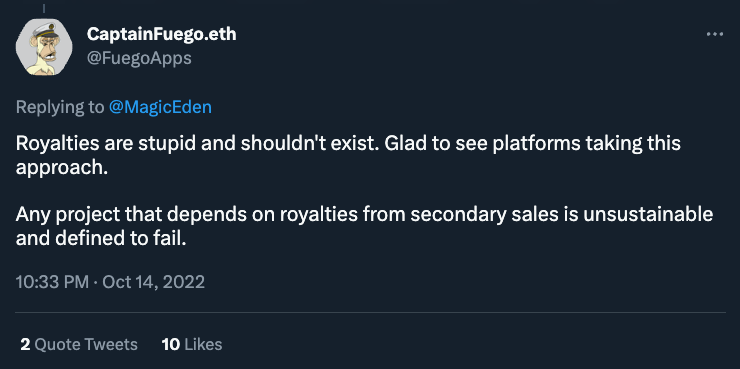

The main argument for royalty-optional platforms is that they allow NFTs to be freely trade among collectors, unhampered from the rights of those that created them to participate in their downstream revenue.

However, OpenSea’s sudden policy reversal has predictably left many wondering what the future outcome may be for NFT creators who rely on royalties in the Web3 digital economy.

Still, others have taken a more nuanced view, wondering if another dynamic at play may balance the needs of both creators and platforms.

As a crypto community, however, I believe we can do better. I believe royalties are an important lifeblood of any creative ecosystem, whether printmaking or digital art. That they are now under threat today feels like a two-step forward, one-step-back kind of moment.

My hope is that an open-source, more decentralized NFT marketplace will emerge. That the rat race to the bottom of digital creation takes a U-turn. Artists deserve better, the promises of blockchain should not turn out to be a lie.