Pendle is leading the way for a trend of DeFi 2.0, a new batch of networks building up its liquidity. Some projects in DeFi 2.0 are trending and often surpassing the growth of Bitcoin (BTC). DeFi 2.0 includes new L2 scaling networks, which have grown their infrastructure in the past few years.

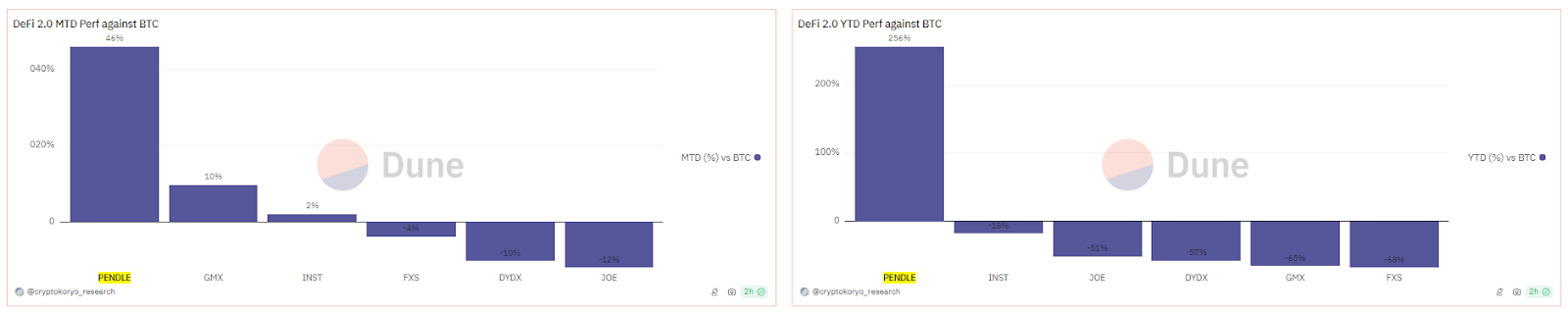

DeFi 2.0 designates multiple narratives, but recent analysis considers several representative projects. Pendle emerged as the rational leader in price growth, both in dollar terms and against BTC. Other projects in the DeFi 2.0 niche include Trader Joe (JOE), GameX (GMX), Instadapp (INST), Frax Share(FXS) and DyDx(DYDX).

The selection of tokens managed to expand against BTC in the past month, and Pendle achieved the biggest growth in the year to date. DeFi 2.0 comprises smaller tokens, some of which took a step back. However, in the year-to-date chart, DeFi 2.0 has a 46% risk-adjusted return and is the third-best narrative after Liquid Staking Derivatives and BTC itself.

The rise of DeFi 2.0 follows growth in the other extensive selection of projects known as DeFi 1.0. Those projects benefitted from the bull market with growing volumes and expanding value under management.

DeFi 1.0 also saw a similar performance, boosted by Uniswap (UNI), Aave (AAVE), Sushi Swap (SUSHI), Curve (CRV), Compound (COMP), and Maker (MKR). DeFi 1.0 still benefits from high and stable ETH market prices and more agile ways to prevent liquidations.

DeFi 2.0 is not in direct competition but rises alongside DeFi 1.0. A new set of DEX hinges on different communities but follows the same pattern of expansion. DeFi 2.0 is also connected to the expansion through Liquidity Restaking Tokens, a new tool for tapping the liquidity of staked ETH.

Pendle Leads Yield Sector in DeFi 2.0

Pendle is a yield protocol revealing a return to passive income. After the crash of FTX and other lending and yield protocols, a new bull market made these business models viable again.

The value locked in Pendle has been growing since the start of 2024, reaching $6.15B. Pendle carries value, which is used as collateral for USDC within the system, and yields tokens. The goal of Pendle is to serve as a platform for trading tokenized future yield.

Also read: Pendle Finance Regains Control: Swift Action versus the Unauthorized Use of Property

Pendle depends on direct user deposits and is a custodian of multiple crypto assets. When users deposit tokens, they receive Ownership Tokens (OT) and Yield Tokens (YT), representing a right to future yield. Yield tokens can then be traded to lock in the gains immediately.

Pendle thus takes tokenization a step further. Instead of a passive yield, depositors receive the immediate freedom to re-trade their yield. Token holders can also provide liquidity to support the price of OT and YT assets. Additionally, Pendle carries USDC and cDAI stablecoins for more intuitive trading.

Pendle Trades Close to All-Time High

Demand for yield helped Pendle achieve a double record in 2024. PENDLE market prices returned close to their all-time high toward the end of May. The token traded at $6.80, with volumes above $43M in 24 hours.

PENDLE broke out as it accrued value. Initially, the token was listed on the experimental Binance market, but it then acquired two relatively liquid trading pairs.

Pendle also grows by adding new pools and incubating liquidity. Through Pendle, users can generate points and benefit from “tokenless protocols.” To date, Pendle’s cumulative yield trading volume has reached $18B.

Also read: EigenLayer is Enhancing Ethereum’s Ecosystem with Six New Validated Services

The Pendle platform is also a tool to tokenize and extract value from Liquid Restaking Tokens, a new asset launched with few price discovery tools. Pendle, originally a neutral market, can provide liquidity and potential traders for the Liquid Restaking Token and Eigen Layer projects.

Pendle also has few competitors, especially after weeks of marking all-time highs regarding value locked and price action.

Cryptopolitan reporting by Hristina Vasileva