- Short-term holders’ profit neared zero since BTC lost hold of $30,000.

- Traders didn’t move to sell their coins as BTC was still close to the bottom.

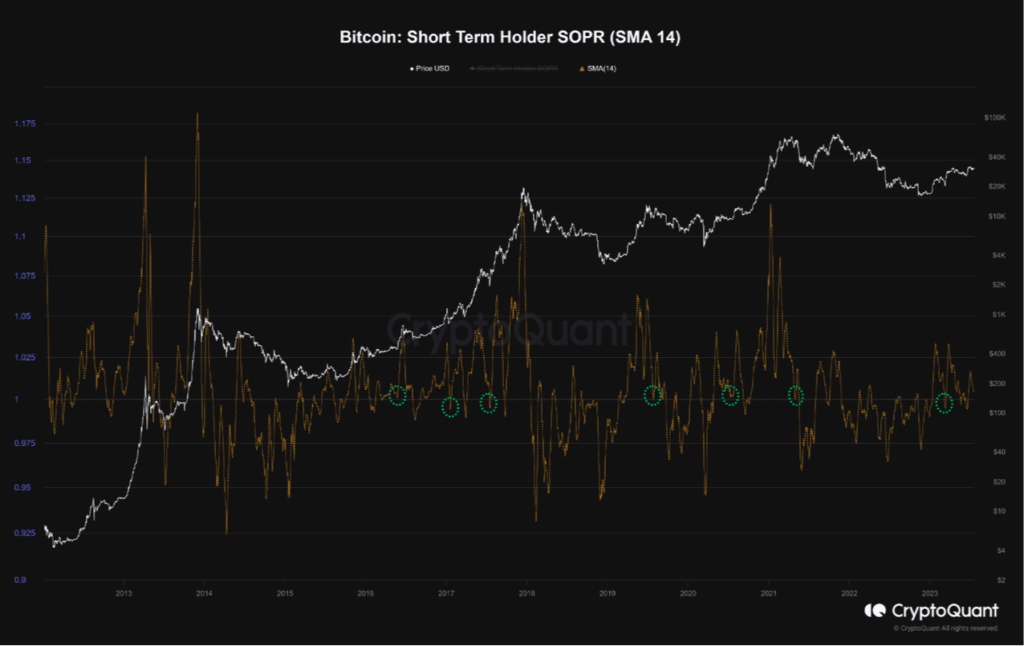

Bitcoin’s [BTC] plunge below $30,000 has affected the previous gains of the Short-Term Holders (STH). According to on-chain analyst Gustavo Faria, the Spent Output Profit Ratio (SOPR) of the STH cohort was operating near 1.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The season for quick profit is over

For the unfamiliar, SOPR provides insight into the realized profit and loss of all coins moved on-chain. A value less than 1 means that current sellers are losing money. Conversely, a higher value indicates that sellers are making profits.

Faria, who published his analysis on CryptoQuant, noted that the SOPR range was supposed to act as a support zone following the bullish period BTC had.

Source: CryptoQuant

However, that has not been the case. Because a push down toward 1 implies that most STH were making little to no gains. As the finance analyst mentioned,

“Following the pattern we’ve observed from the 14-day moving average SOPR in other upward price movements. It is important to note that, despite the tendency of investors to hold, this is a zone of price sensitivity.”

When considering the SOPR ratio, CryptoQuant showed that it was 1.38.

HODLing regardless

If this metric is extremely high, then it means that the LTH has a higher spent profit than the STH. And when this happens, it implies that BTC could be near the market top.

But the SOPR ratio at 1.38 was a relatively low value. This means that BTC could be considered closer to the bottom than the top. Therefore, realized profits by STH were still relatively close to those of the LTH cohort.

Source: CryptoQuant

Meanwhile, Santiment’s data showed that the Market Value to Realized Value (MVRV) long/short difference stabilized around 18.49%.

Like the SOPR ratio, the MVRV long/short difference also measures fair value and profitability. Negative values of the MVRV difference imply that long-term holders will realize higher profits than short-term holders if they sell at the current price.

But since the metric was positive, it means that the STH would still make more gains than the LTH.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

For the 30-day MVRV ratio, on-chain data showed that it had fallen into the negative region. This metric provides valuable information about traders’ buying and selling behavior.

Source: Santiment

The more the ratio increases, the more traders are willing to sell as potential profits increase. However, the decrease in the ratio means that traders are not inclined toward selling since unrealized profits have dwindled.