- Daily outflows dropped from $640 million to $255 million.

- Bitcoin recovered significantly over the weekend.

Bitcoin’s [BTC] disappointing run since the approval of spot ETFs has spoiled the party for many market participants who were expecting an instant spike in prices.

The king coin was exchanging hands at $42,176, down 13% from the peak on the ETF approval day, according to CoinMarketCap.

Grayscale threat looms large

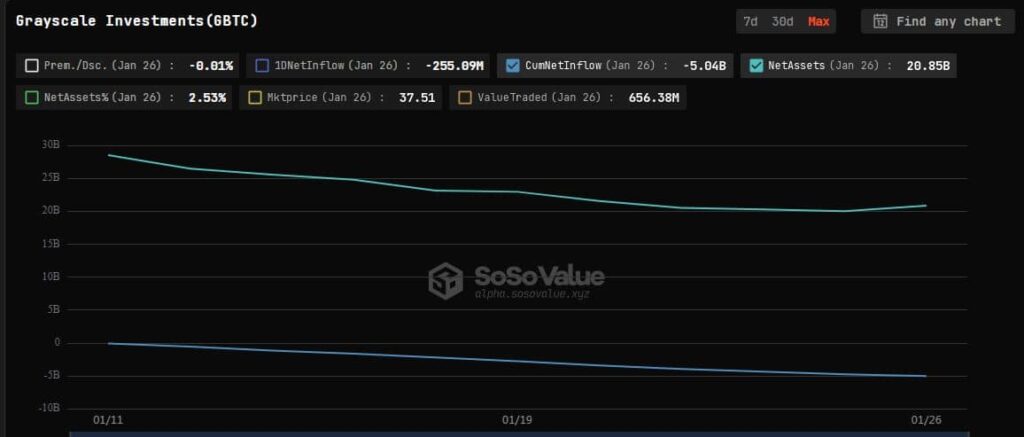

As has been widely reported, outflows from the Grayscale Bitcoin Trust (GBTC), which has been transitioned to a spot ETF, were the primary bearish catalyst.

According to AMBCrypto’s analysis of SoSoValue data, Bitcoins worth over $5 billion have exited the trust since the transition.

GBTC shareholders, who were previously barred from accessing their holdings, started profiting once redemptions were allowed post-conversion to an ETF.

Source: SoSo Value

Considering Grayscale still held more than 500,000 Bitcoins in its custody at press time, there were concerns about prolonged bearish conditions.

Has the pain started to ease?

However, over the past few days, the rate of outflows has slowed down considerably.

As analyzed by AMBCrypto, the daily outflows progressively dropped from $640 million at the beginning of last week to $255 million by the weekend.

Head of Research at Coinshares, James Butterfill, also alluded to this gradual reduction in a post on social platform X (formerly Twitter).

The outflows in Grayscale aren’t pretty but it looks like they are beginning to subside. pic.twitter.com/IZXHZWbiKG

— James Butterfill (@jbutterfill) January 28, 2024

Moreover, all the recently-launched Bitcoin spot ETFs recorded net inflows on the 26th of January, after four straight days of net outflows.

The fact that Bitcoin jumped above $42,000 on the same day gave first indications that selling pressure might start to ebb.

Source: SoSo Value

Whales, analysts hopeful

Meanwhile, ignoring the short-term blip, influential whale investors continued to accumulate Bitcoin in large quantities.

According to AMBCrypto’s analysis of Glassnode data, the number of entities holding at least 1K coins shot up to the highest level since May 2022.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The trajectory has trended upwards since the spot ETFs got approved.

Source: Glassnode

Market observers also turned optimistic about Bitcoin’s next movements. Shivam Thakral, CEO of Indian cryptocurrency exchange BuyUcoin, said,

“Blackrock Bitcoin ETFs became the first to touch $2 billion in AUM and created a wave of positive sentiment around the world’s largest digital asset. We can expect Bitcoin to touch the $45,000 level if the current momentum sustains and there are no surprising news headlines.”