You’ve heard about smart contracts and the Ethereum blockchain, but maybe you don’t quite know what glues it all together. That glue is actually the Ethereum Virtual Machine (EVM). It’s the engine that runs the code behind every transaction on the chain, and updates the network so thousands of computers stay in perfect sync.

In this guide, you’ll see what the EVM is in crypto, why it matters, and what makes it so important in the Ethereum network. Let’s go!

What is the Ethereum Virtual Machine (EVM)?

The Ethereum Virtual Machine (EVM) is the engine that provides the runtime environment for running every dApp and contract on the Ethereum network. Think of Ethereum as a giant, shared computer and the EVM as its operating system. It executes smart contracts on every node at once, so all participants see the same results.

When you send a transaction, the EVM reads the instructions, checks the gas you supplied, and updates Ethereum’s state. This keeps thousands of independent computers in perfect sync. The EVM is also Turing complete, which means it can run any kind of computation, from simple math to complex logic, as long as enough gas is provided.

How the EVM Works

The EVM operates like the engine that runs the Ethereum blockchain. It takes the code developers write, turns it into low-level instructions that are executed for every transaction, and updates the blockchain’s state. Every node runs the same process, so thousands of independent computers stay perfectly in sync.

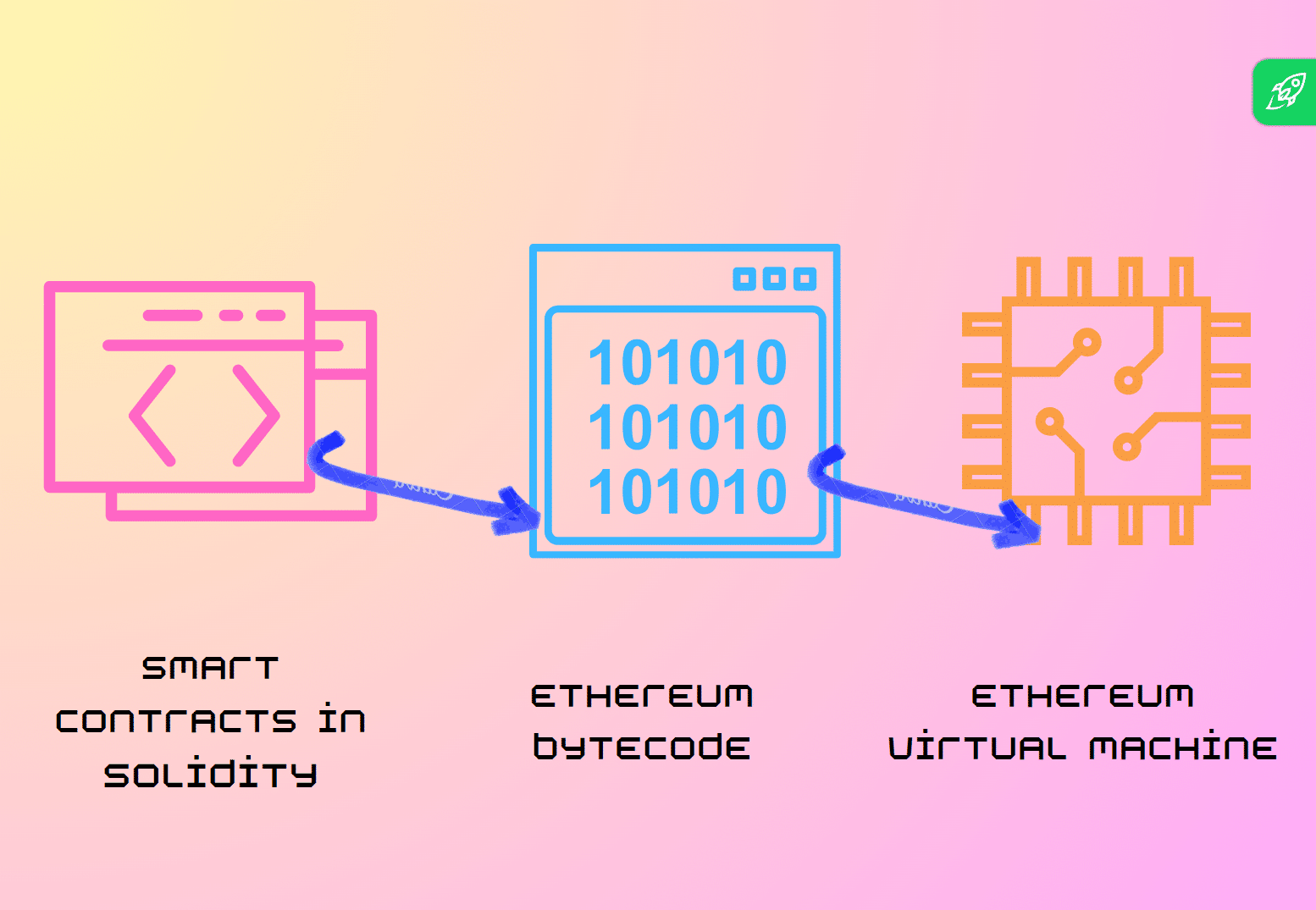

Smart Contract Compilation

Everything starts with the code. Developers write smart contracts in programming languages like Solidity or Vyper. These languages are easy for humans to understand, but not for the EVM. So first, the original code is compiled into EVM bytecode, which is a string of low-level opcodes the virtual machine can execute. (Opcodes are basic machine instructions, like “add” or “store”).

Some operations are handled by precompiled contracts, which run faster and cheaper than regular ones. After compilation, apps and wallets communicate with these contracts through an Application Binary Interface (ABI), which makes sure data moves correctly between the contract and the EVM.

Inside the EVM’s stack-based architecture, memory holds temporary data, while storage holds permanent data between transactions. This compilation process turns readable code into a format every Ethereum node can run exactly the same way.

Transaction Processing and State Changes

Once a smart contract is deployed, people use it through transactions. A transaction is a signed request sent to the network that may transfer ETH, call a contract function, or both. Each one uses the Keccak-256 hash algorithm, which is used in address generation and data verification. Each transaction also carries an account nonce, a counter that puts the account’s transactions in order.

The EVM handles two types of accounts. Externally owned accounts (EOAs) are user-controlled wallets that send transactions to the EVM. Contract accounts hold code and run it automatically when triggered. Knowing which account type you’re dealing with affects how the EVM processes the transaction.

When a node receives a transaction, the EVM checks the signature and nonce, then executes the instructions. As it runs those instructions inside a block, it updates the Ethereum blockchain’s state. During this process, smart contracts can also make inter-contract calls, in which one contract invokes another contract’s function during the same transaction.

Gas

At every step, the EVM operates using gas. Gas is a unit that measures how much computational work an operation costs. You set a gas limit and pay fees in ETH that cover a base fee plus a priority fee. Simple transfers use only a little gas, but complex processes can use a lot more. And if the EVM runs out of gas mid-execution, it stops and reverts the transaction.

This system prevents abuse, rewards validators for their computing effort, and gives developers a reason to write efficient code.

Read more: Ethereum (ETH) Gas and Its Purpose in Network Fees

Execution Flow and Consensus Among Nodes

After transactions are bundled into a block, validators execute them with the EVM in Ethereum’s proof-of-stake system. Every node runs the same opcodes on its own Ethereum client, and updates the same state. Because execution is deterministic, all honest nodes arrive at the same result. The consensus layer (Beacon Chain) selects the agreed-upon block, and the execution layer applies smart contract functionality. Together, they ensure no single entity can change outcomes or reorder the state. If a node’s result differs, the rest reject it. This process is how the EVM keeps the Ethereum network in sync and trustworthy.

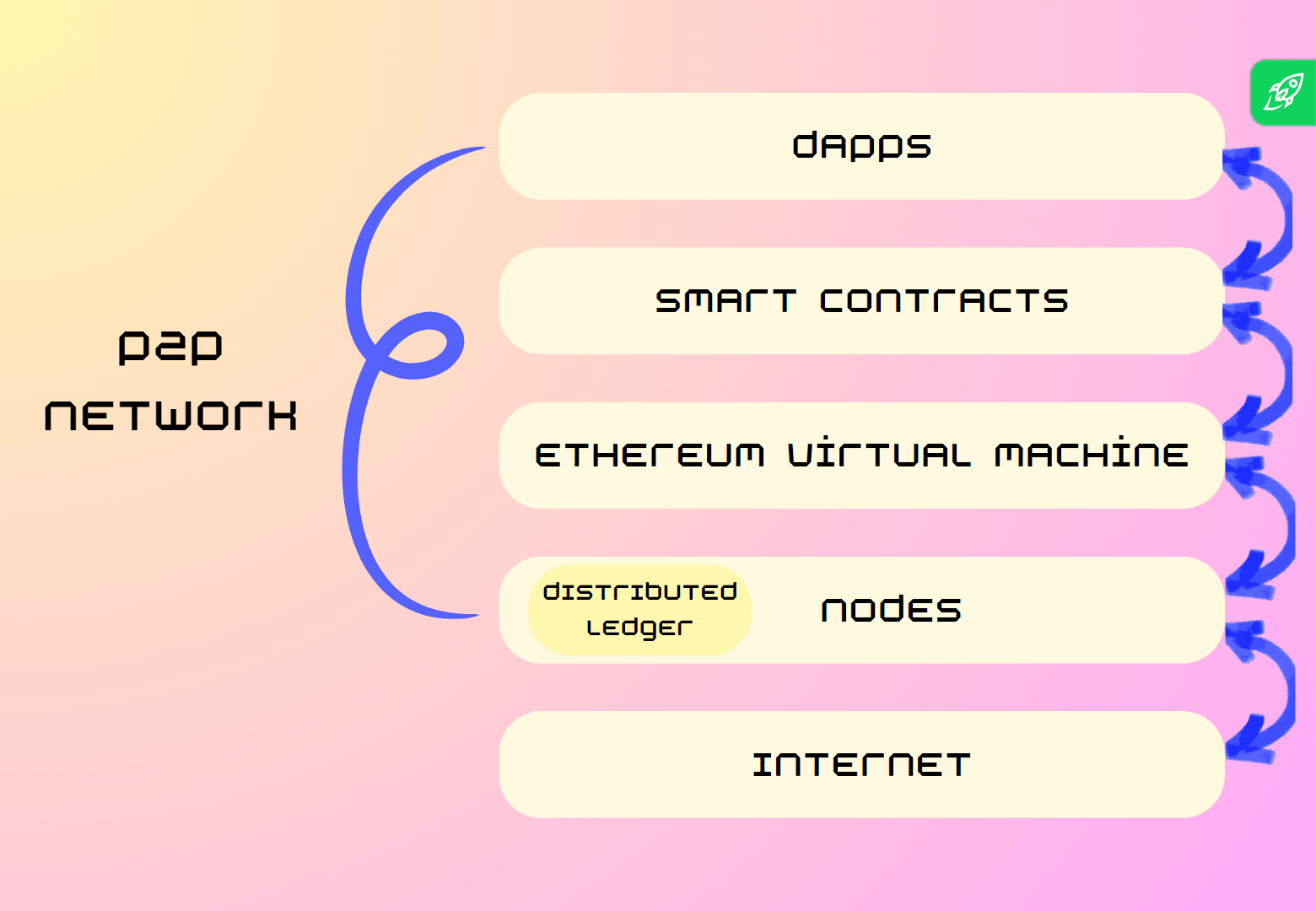

The EVM in the Ethereum Network

Every Ethereum node runs its own copy of the EVM. When a new block of transactions arrives, each node feeds those transactions into it, executes the code, and updates its local state.

This setup turns the Ethereum blockchain from a simple ledger into a decentralized computer. Instead of just recording balances, it can process rules and logic for thousands of applications at once. The Ethereum Virtual Machine enforces these rules uniformly, so a contract behaves the same no matter which node you query.

Who Uses the EVM

Everyone who interacts with Ethereum relies on the Ethereum Virtual Machine (EVM), even if they don’t know about it. Developers use it when they write and execute smart contract code. Node operators and validators run the EVM as part of their client software. They execute transactions and help maintain consensus across the network. Without their EVM instances, the blockchain would stop processing contracts altogether.

Everyday users also depend on the EVM. Each time you swap tokens, buy an NFT, or interact with a dApp, the EVM executes that transaction behind the scenes. Whenever you confirm an action in your wallet, the EVM turns it into state changes on thousands of nodes at once.

Key Features of the EVM

The EVM’s key traits make Ethereum work like a decentralized computer, not just a blockchain network. Each of these features shapes how code runs and how the network stays secure.

- Decentralized execution.

The EVM runs on thousands of independent nodes. Every node executes the same instructions, so no single entity controls the outcomes. - The opcode system.

The EVM breaks all logic into simple opcodes. Contracts compile to these opcodes, which the EVM executes step by step inside its stack-based architecture. - Smart contract execution.

The EVM executes smart contracts exactly as written. Once deployed, a contract’s code cannot be changed, and every node enforces its rules identically. - Deterministic execution.

The EVM always produces the same result from the same input. This determinism lets all nodes reach consensus on the state of Ethereum after every transaction. - Turing completeness.

The EVM is a Turing-complete virtual machine, meaning it can handle any computation you can describe, as long as you provide enough gas. Loops, conditions, and complex logic are all possible. - Isolation and security.

Each contract runs in its own sandbox. It cannot directly access files, the internet, or another contract’s private data. This isolation limits the impact of potential bugs or attacks. - Gas system.

Every instruction in the EVM costs gas. Users pay fees in ETH based on the gas consumed by their transaction. This mechanism deters spam, rewards validators, and encourages developers to write efficient smart contracts.

Use Cases and Applications Enabled by the EVM

The EVM makes Ethereum more than a ledger. Smart contract execution occurs on every node, which means decentralized apps, financial systems, digital assets, and even enterprise workflows can run without central control. Let’s break these use cases down in detail.

Decentralized Applications (dApps)

A decentralized application is an application whose core logic runs on a blockchain instead of a private server. Thanks to the Ethereum Virtual Machine, these apps are also totally open and verifiable. Developers deploy smart contracts once, and every node enforces their code. Users interact with the frontend, but the EVM executes the rules behind the scenes.

Decentralized Finance (DeFi)

DeFi uses the EVM to offer financial services without banks or brokers. Lending, borrowing, stablecoins, and automated trading all run through EVM contracts. Protocols like Aave and Uniswap rely on the EVM to hold funds, set rates, and match trades according to transparent rules.

NFTs and Gaming

NFTs are unique digital tokens that represent art, collectibles, or in-game items. The EVM enforces their scarcity and ownership history. Games use EVM smart contracts to manage assets, battles, or rewards. Because the rules live on-chain, players truly own their items and can trade them freely.

Enterprise Blockchain Solutions

Businesses also use the EVM to automate agreements and data sharing. Private or permissioned Ethereum networks run the same virtual machine, so companies can deploy smart contracts for supply chains, trade finance, or digital identity. Using the EVM gives enterprises a tested execution environment and compatibility with public Ethereum standards if they want to connect later.

EVM Compatibility Across Blockchains

The influence of the EVM now stretches far beyond Ethereum itself. Many other blockchains have adopted the EVM to attract developers and users. Networks which are described as “EVM-compatible” can run Ethereum smart contracts on their chains with little or no change.

Ethereum’s compatibility gives developers and users a huge advantage. Developers can deploy existing contracts written with programming languages like Solidity on different networks without rewriting the code. And for users, EVM-compatible networks offer familiar apps, lower fees, and faster confirmations while keeping the same basic experience.

Why Is the EVM Important?

The EVM is what makes the Ethereum network a programmable blockchain instead of just a ledger. With it, you can execute smart contracts that power exchanges, lending platforms, games, and thousands of other decentralized apps. Its design lets developers deploy code on multiple EVM-compatible chains without starting over. That reach extends Ethereum’s ecosystem and makes skills learned on one network useful on many others.

Limitations of the EVM

The EVM is powerful, but it comes with trade-offs. Knowing its limits helps you understand the challenges Ethereum and other EVM chains are working to solve.

- Gas costs and scalability issues.

Every EVM operation costs gas. In busy periods, gas fees can spike and complex smart contract deployment becomes expensive. - Performance bottlenecks.

The EVM prioritizes correctness and decentralization over speed. Every node must execute every transaction. Its stack-based architecture and block gas limits slow down computation, making high-frequency or computation-heavy apps hard to run on Ethereum’s base layer. - Security risks and vulnerabilities.

Bugs in smart contracts on the EVM can lead to lost funds or exploits. Developers must write secure code because once deployed, contracts are hard to change. - Future developments and improvements.

Researchers are exploring upgrades, such as Layer 2 rollups, which make execution faster and cheaper, or EIPs, which adjust gas costs and add EVM opcodes to improve efficiency. These efforts aim to keep the EVM’s benefits while reducing its weaknesses.

The Future of the EVM

The Ethereum Virtual Machine (EVM) will most likely keep evolving but stay central to Ethereum. Upgrades are already on the way to improve its speed and costs, all without losing the core principle of decentralization. The EVM of the future will likely become a hub of decentralized applications and blockchain innovation, driving wider adoption, richer applications, and deeper integration across the entire decentralized ecosystem.

Final Thoughts

The EVM is the heart of Ethereum. It turns a simple ledger into a decentralized computer capable of executing code and powering whole ecosystems of dApps. It has become the standard for blockchain applications and is continually evolving and improving. Understanding how it works helps you see why gas fees exist, why smart contracts operate the same everywhere, and why Ethereum remains a leading platform for decentralized innovation.

FAQ

Is the EVM the same as Ethereum?

Not quite. Ethereum is the entire blockchain network, while the EVM is just its execution engine that runs smart contracts and updates the state on every node.

Why do I need to know about the EVM if I’m not a developer?

Because every action you take on Ethereum—from sending ETH to using a dApp—runs through the EVM, so understanding it helps explain gas fees, failures, and how your apps stay trustworthy.

What does it mean when another blockchain is “EVM-compatible”?

It means the other blockchain uses the same virtual machine as Ethereum, allowing developers to deploy the same smart contracts and users to interact with familiar apps and tools.

Can I interact with the EVM without coding?

Yes! Each time you use a wallet or a dApp, the EVM executes your transactions in the background without you needing to write any code.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.