beginner

As the world of cryptocurrencies continues to expand, the need for secure storage of digital assets becomes increasingly important. One type of secure storage that has gained popularity among crypto enthusiasts is cold wallets.

In this comprehensive guide, we will explore what a cold wallet is, how to set one up, and what types of offline wallets exist. We will also discuss some of the best crypto wallet apps, including Mycelium.

Cold Wallet: Definition

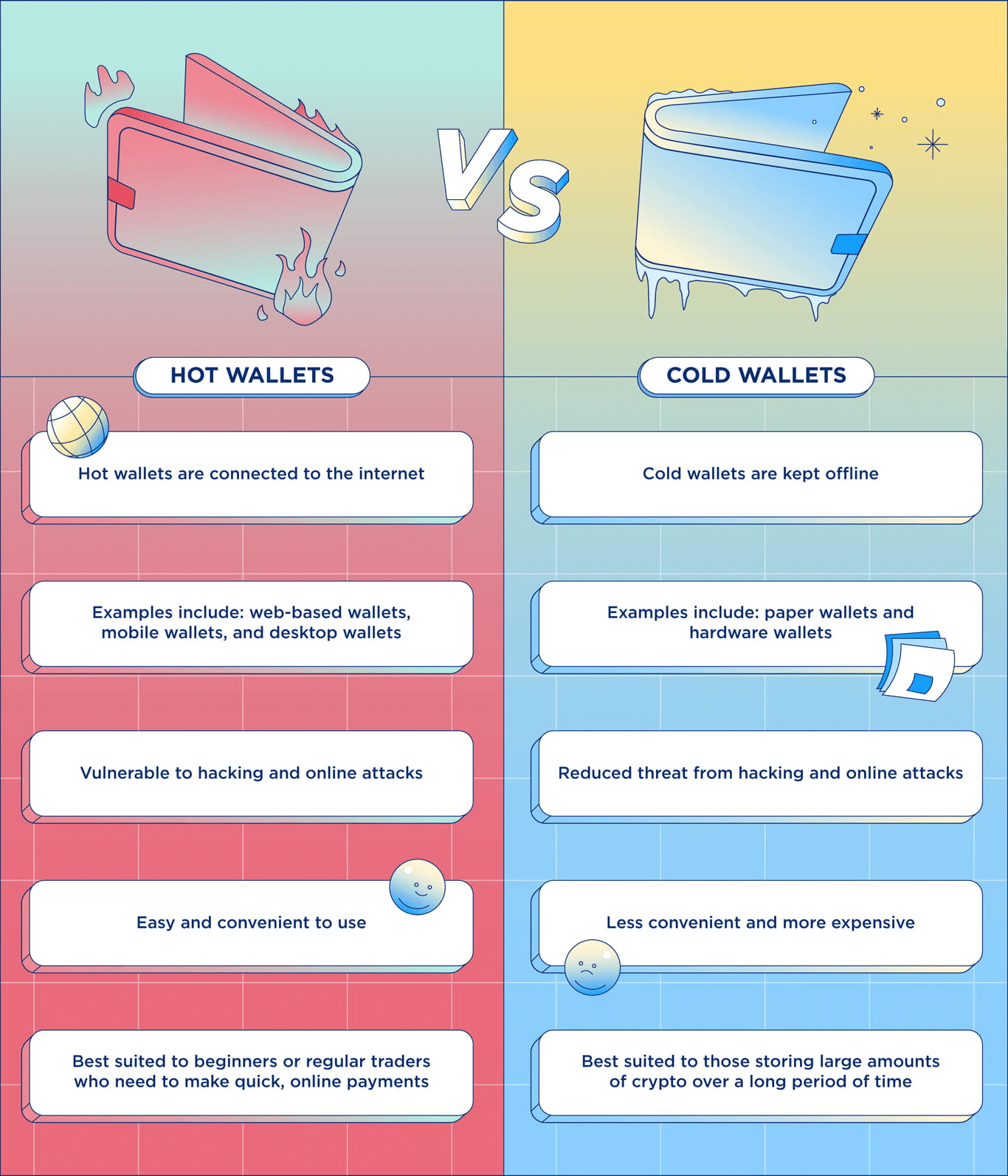

A cold wallet, also known as an offline wallet, is a type of crypto wallet that stores your digital assets without being connected to the internet. This stands in contrast to hot wallets, which are always connected to the Internet and, therefore, more vulnerable to hacks and cyber attacks. Cold wallets offer enhanced security for your cryptocurrencies by keeping your private keys offline, significantly reducing the risk of theft.

Hot vs. Cold Wallets

Hot wallets (or software wallets) are digital wallets that store and manage cryptocurrencies while being connected to the internet. They provide users with easy access to their digital assets, making them ideal for everyday transactions, trading, and other activities that require quick access to funds. These online wallets can come in the form of a website, a desktop or mobile app, or a browser extension.

Advantages:

- Convenience. Hot wallets allow users to access and manage their cryptocurrencies quickly and easily, making them suitable for daily use.

- Ease of use. Hot wallets typically feature user-friendly interfaces, allowing both beginners and experienced users to manage their assets effortlessly.

- Integration with platforms and services. Most hot wallets can be integrated into popular crypto exchanges, dApps, and other services, providing seamless access to various features and functions.

Risks:

- Security. Since hot wallets are always connected to the internet, they are more vulnerable to hacks, phishing attacks, and other cyber threats compared to cold wallets.

Cold wallets (also known as offline wallets) store your crypto assets without being connected to the internet. This substantially reduces the risk of theft and hacks, making cold wallets a more secure option for long-term storage or large amounts of cryptocurrency.

Advantages:

- Security. Cold storage wallets offer enhanced security for your cryptocurrencies by keeping your private keys offline, significantly diminishing the risk of theft.

- Long-term storage. This type of wallet is ideal for storing large amounts of cryptocurrency for extended periods, providing peace of mind for investors.

Risks:

- Accessibility. Cold wallets can be less convenient for daily transactions and trading because they require additional steps to access and manage your funds.

- Cost. Some cold wallets, particularly hardware crypto wallets, can be expensive, their prices ranging from $50 to $200 or more.

Nowadays, many cold wallets offer hot wallet-compatible interfaces, bridging the gap between the convenience of hot wallets and the security of cold wallets. These interfaces allow users to manage their cold-stored assets more conveniently while maintaining a high level of security.

For example, hardware wallets like Ledger and Trezor provide companion apps that can be used on the desktop or mobile devices. These apps offer a user-friendly experience similar to hot wallets, while private keys remain securely stored in the hardware wallet. This hybrid approach brings users the best of both worlds, combining the accessibility and ease of use of hot wallets with the enhanced security of cold wallets.

How to Set Up a Cold Wallet

Setting up a cold storage wallet can be a straightforward process, but it varies depending on the type and model of offline wallet. In general, you’ll need to follow these steps:

- Choose a cold wallet type (hardware or paper wallet).

- Purchase or create the wallet.

- Generate a pair of private and public keys.

- Securely store your private key (often in the form of a seed phrase).

- Transfer your cryptocurrencies to your cold wallet’s public address.

Types of Offline Wallets: Hardware vs. Paper

There are two primary types of offline wallets: hardware and paper crypto wallets. Each has its advantages and disadvantages, and understanding the differences can help you choose the best option for your needs.

Hardware Wallets

Hardware wallets are physical devices that securely store your private keys offline. They often resemble USB drives and are specifically designed to provide a secure environment for your digital assets. Some popular hardware wallets include Ledger, Trezor, and KeepKey.

Advantages:

- High level of security. Since private keys are stored offline, hardware wallets are less susceptible to hacks and online attacks.

- User-friendly. Many hardware wallets come with intuitive interfaces and companion apps, making it easy to manage your cryptocurrencies.

- Compatibility. Hardware wallets usually support a wide range of cryptocurrencies, making them suitable for users with diverse portfolios.

Disadvantages:

- Cost. Hardware wallets can be expensive, with prices ranging from $50 to $200 or more.

- Physical vulnerability. Like any physical device, hardware wallets can be lost, damaged, or stolen.

Paper Wallets

Paper wallets are physical printouts of your public and private keys, often in the form of QR codes. They provide a simple and cost-effective way to store your cryptocurrencies offline.

Advantages:

- Cost-effective. This type of wallet is inexpensive to create, often requiring only a printer and a piece of paper.

- Secure. As long as the private key remains hidden and the paper wallet is stored safely, paper wallets can provide a high level of security.

Disadvantages:

- Limited compatibility. Paper wallets usually support only one type of cryptocurrency.

- Inconvenience. To access your funds, you need to import the private key into a software wallet, which can be a cumbersome process.

There’s also an additional type of cold storage wallet called deep cold storage. It refers to an extremely secure method of storing crypto assets and involves creating a new wallet offline, generating private keys on an air-gapped device (a device that has never been connected to the internet), and securely storing the private keys or seed phrases in multiple locations. This can include using physical vaults, safe deposit boxes, or other highly secure facilities. In some cases, users may also opt to split their seed phrases or private keys into multiple parts, storing each part in a separate location to further mitigate the risk of theft or loss.

Keeping private keys or seed phrases in deep cold storage helps seriously reduce the risk of unauthorized access or hacking. However, the trade-off is a lowered level of convenience, as accessing the funds stored in deep cold storage can be a more complicated and time-consuming process. As a result, deep cold storage is generally recommended for long-term storage of large amounts of cryptocurrencies rather than for frequent transactions or trading.

Best Crypto Wallet Apps: 5 Wallets Worth Getting

Now that you understand the importance of cold wallets for securely storing your digital assets, let’s take a look at five popular crypto wallet apps worth considering.

1. Ledger Nano X

The Ledger Nano X is a premium hardware wallet that offers top-notch security and supports over 1,500 cryptocurrencies. It features a user-friendly interface, Bluetooth connectivity for mobile devices, and integration with various wallet apps like MetaMask and Mycelium. The company also has other wallet models, like Ledger Stax or Ledger Nano S Plus.

2. Trezor Model T

Trezor Model T is another popular hardware cryptocurrency wallet that provides robust security and supports over 1,000 digital assets. The wallet has a full-color touchscreen display, making it easy to navigate and manage your assets. The Trezor Model T is compatible with various software wallets and can also serve as a password manager and a U2F (Universal 2nd Factor) authentication device.

3. KeepKey

KeepKey is a hardware wallet that combines security with simplicity. It supports numerous cryptocurrencies, including Bitcoin, Ethereum, and ERC-20 tokens. KeepKey features a sleek design with a large OLED display, making it easy to view and confirm transactions. The wallet integrates with the ShapeShift exchange, allowing users to trade cryptocurrencies directly within the wallet.

4. Mycelium Wallet

Mycelium is a mobile wallet app that offers both hot and cold storage options. As a hot wallet, Mycelium provides an easy-to-use interface for managing and trading cryptocurrencies on the go. However, it also supports integration with hardware wallets like Ledger and Trezor, enabling users to benefit from the security of a cold wallet. Mycelium is available for iOS and Android devices and supports Bitcoin and Ethereum.

5. SafePal S1

SafePal S1 is a budget-friendly hardware wallet that offers security and convenience. It supports over 10,000 cryptocurrencies and features a large color touchscreen for easy navigation. SafePal S1 is completely offline, with no Bluetooth, Wi-Fi, or USB connectivity, ensuring maximum security. The wallet is compatible with the SafePal app, which allows users to manage their assets and trade cryptocurrencies via the Binance DEX.

Conclusion

Cold wallets provide a secure and effective solution for storing cryptocurrencies offline, significantly reducing the risk of theft and hacks. Thanks to multiple offline wallet options to choose from, such as hardware and paper wallets, users can find the right balance between security, cost, and convenience. By understanding the differences between hot and cold wallets, you can make informed decisions about the best crypto wallet app or device for your needs. Remember to always prioritize the safety of your digital assets and conduct thorough research before making any investment decisions.

FAQ

What is the best crypto wallet for beginners?

Generally, hot storage options would be the best choice for beginners. Typically free, they often don’t even require you to enter an email address. All you need to do is write down your recovery phrase and come up with a password for the app you’re using.

If you’re looking for the best crypto wallet app for beginners, check out Exodus wallets or MetaMask. And if you’re just making your first steps in the crypto world, you can go for a custodial wallet (a crypto wallet built into a cryptocurrency exchange like Binance) — just keep in mind that it is not a very secure option, even if you go for the safest crypto exchange on the planet.

Is there a free cold Bitcoin wallet?

The only “free” cold wallet device you can get is a piece of paper. Most hardware devices cost money and would typically set you back around $100.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.