- Bitcoin’s annualized funding rate reached a two-month high, impacting trading activity and volatility.

- Whale interest surged and MVRV ratio declined.

In the last few days, Bitcoin[BTC] faced a brief slump, breaching the $27,000 mark. Despite this, the prevailing sentiment regarding cryptocurrency was predominantly positive.

Read Bitcoin’s Price Prediction 2023-2024

Funding rates grow

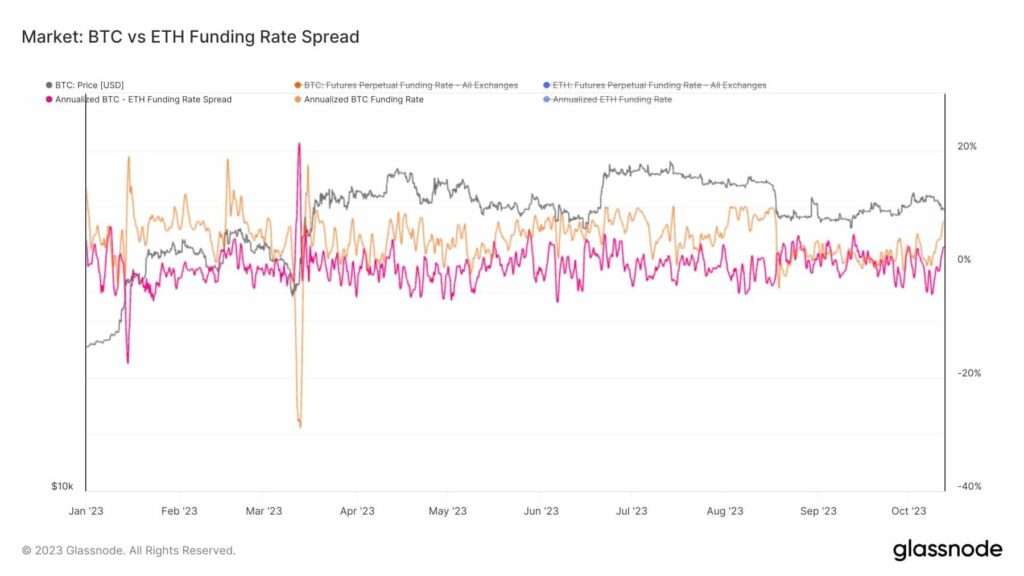

One notable development was the surge in Bitcoin’s annualized funding rate, which reached a two-month high of over 7.5%. This rate signifies the cost of holding a position in Bitcoin, influencing how traders approach the market.

A notable spike in this rate has the potential to entice more traders into the market, thereby increasing trading activity. However, it also introduces the possibility of elevated volatility, with traders seeking to capitalize on these funding rates.

Concurrently, Bitcoin’s open interest also soared to a two-month high as well. Elevated open interest often suggests a growing level of participation in the market.

This could potentially result in more liquid markets, a broader diversity of traders, and healthier overall conditions. However, it can also heighten market volatility.

Source: glassnode

Traders react

Moreover, the put-to-call ratio for Bitcoin experienced a shift from 0.5 to 0.46. This decrease indicates an increased inclination towards bullish positions in the market. This sentiment may influence their trading strategies, and it could also be indicative of a market ripe for price increases.

Additionally, there was an expansion of Bitcoin’s 25 Delta Skew in recent days. This Skew is used to gauge options traders’ perception of potential large price movements.

When this metric rises, it usually signals an increasing demand for protective options, indicating a degree of caution among traders.

Source: Velo

How are holders holding up

Moreover, the number of Bitcoin addresses holding 1 or more BTC grew. These large investors can significantly impact Bitcoin’s market dynamics due to their substantial holdings. This demonstrated ongoing interest from major players.

📈 #Bitcoin $BTC Number of Addresses Holding 1+ Coins just reached an ATH of 1,023,292

View metric:https://t.co/s7tx1xxyz3 pic.twitter.com/iKTEDQp2Iz

— glassnode alerts (@glassnodealerts) October 5, 2023

Is your portfolio green? Check out the BTC Profit Calculator

Conversely, Bitcoin’s Market Value to Realized Value (MVRV) ratio saw a notable decline. This ratio represents the average profit or loss of Bitcoin holders.

A decreasing MVRV might suggest that fewer BTC holders were sitting on substantial profits. While this could potentially alleviate selling pressure in the short term, it could also indicate a less speculative market.

Source: Santiment