Fidelity, a leading financial services provider, has recently released a report on Ethereum (ETH) that sheds light on some key metrics to watch for the cryptocurrency in the coming months.

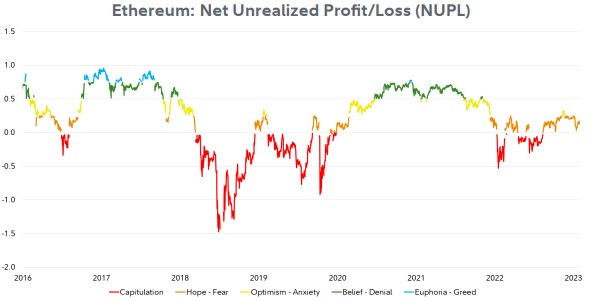

The report highlights several important indicators, including the 50-day and 200-day moving averages (MA), the realized price, the Net Unrealized Profit/Loss (NUPL) ratio, Market Value to Realized Value (MVRV) Z-Score, percent in profit, and the Pi Cycle indicators, all of which can provide valuable insights into market sentiment and potential price movements.

Ethereum Holds Strong Above Key Support Levels

Per the report, Ethereum has remained above key support levels, with the realized price serving as a strong support level since January 10th.

Additionally, the NUPL ratio suggests that Ethereum is currently in a neutral zone, while the MVRV Z-Score indicates that the cryptocurrency’s market value is estimated to be just over the “fair” zone, potentially setting the stage for a bull run or at least sideways price action, according to Fidelity.

Another interesting metric highlighted in the report is the percent of unique addresses in profit, which currently sits at nearly 66%. While this metric has not touched the green zone since January 2020, it suggests that Ethereum owners may be using the cryptocurrency for trading, DeFi, staking, or buying other digital assets.

Furthermore, the Pi Cycle indicators, which have historically been a good cycle top indicator, are showing that Ethereum is currently in a neutral zone. As the long-term moving average continues to follow the sunken price downward, it may be setting the stage for more volatility shortly.

However, whether this volatility will be to the upside or downside remains to be seen and could depend on a variety of macro factors.

ETH Adoption On The Rise

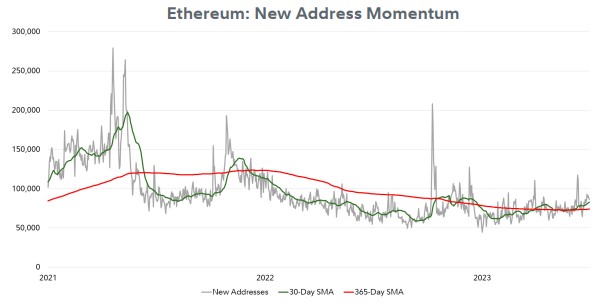

On the other hand, Fidelity’s report highlights that while monthly active addresses and the monthly transaction count have fallen by 1%, the number of monthly new Ethereum addresses has slowly increased by 9% in Q2 2023.

New addresses are defined as unique addresses that appeared for the first time in a transaction. This metric for momentum may not show direct network usage, but it does indicate a clearer picture of Ethereum adoption.

The short-term moving average of new addresses is shown to be rising back above that of the longer-term moving average, indicating that the rate of new users joining the network is increasing. New and existing projects are likely incentivizing new users and helping to drive this increase.

Another significant metric highlighted in the report is the net issuance of new supply issued by the network minus burned supply from transactions since The Merge.

This has driven a supply decrease for over five months now, with net issuance surpassing -700,000 Ether. The report notes that this is important because, in theory, as Ethereum’s supply is destroyed, it raises the relative ownership level of all remaining token holders.

As of writing, ETH’s price is at $1,849, which has decreased by 2% within the last 24 hours. Similar to Bitcoin’s situation, Ethereum has also lost its 50-day MA, which is currently positioned at $1,869.

If the market continues to decline, ETH can anticipate several key support levels that may help prevent a further bearish trend.

The closest support level is situated at $1,840, followed by another support level of $1,792. However, the most crucial support floor is the 200-day MA, which is located at $1,780. This will be a significant factor in determining who will dominate in the upcoming months.

Featured image from Unsplash, chart from TradingView.com