- USDT volume slows down as the intensity of the bear market shows signs of a decline.

- Strong USDT value is more desirable in China as the stronger dollar pushes past important historical CNY levels.

The Cryptocurrency market just concluded an overall bearish week marking the second retracement so far this year.

Observing stablecoins may provide insights into how and where liquidity flows are headed. USDT, one of the biggest stablecoins by market cap and volume demonstrates some interesting observations.

According to the latest Glassnode data, USDT dropped to its lowest monthly transaction volume levels in the last 24 hours.

The last time the transaction volume was this low was at the beginning of the second week of January. This was right around the same time that the crypto market started experiencing a surge in volatility.

📉 $USDT Transaction Volume (7d MA) just reached a 1-month low of 132,693,185.339 USDT

View metric:https://t.co/7oXBoR4C4j pic.twitter.com/pwvQFFc0h3

— glassnode alerts (@glassnodealerts) February 25, 2023

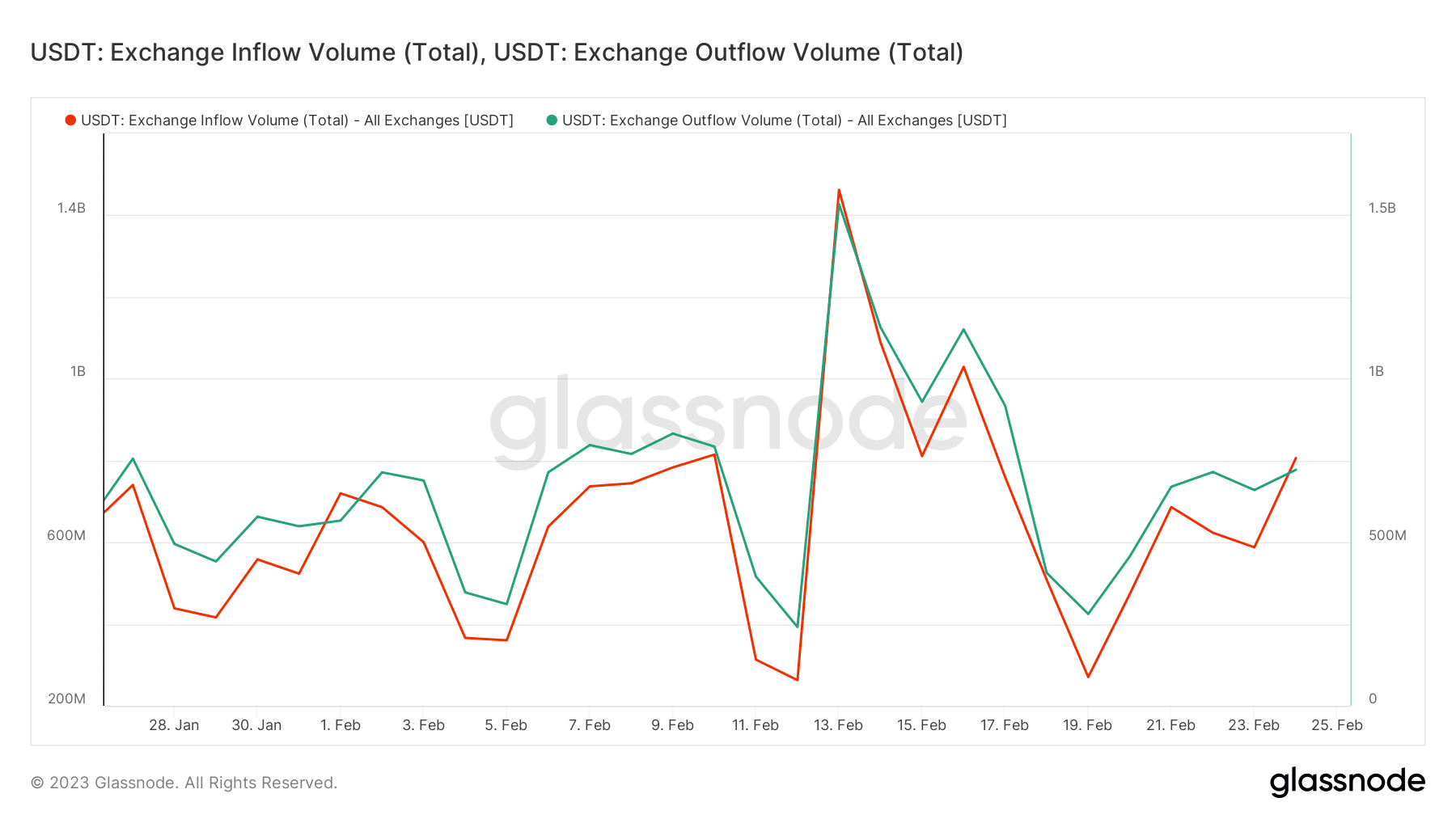

USDT was still involved in significant trading activity despite the drop in transaction volumes. The latest on-chain exchange flows reveal that USDT had a net flow of +$84.4 million. This means it had a higher liquidity inflow than outflows in the last 24 hours at press time.

📊 Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $763.0M in

⬅️ $702.3M out

📈 Net flow: +$60.7M#Ethereum $ETH

➡️ $567.4M in

⬅️ $415.8M out

📈 Net flow: +$151.6M#Tether (ERC20) $USDT

➡️ $806.2M in

⬅️ $721.7M out

📈 Net flow: +$84.4Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) February 25, 2023

A key point to note is that there was still a significant amount of exchange outflows. The last recorded exchange inflows averaged slightly over $806 million while the exchange outflow volume amounted to $721.65 million.

Source: Glassnode

A potential reason for this outcome is that the market maintained an overall bearish sentiment, hence many traders have been exiting their positions in favor of stablecoins.

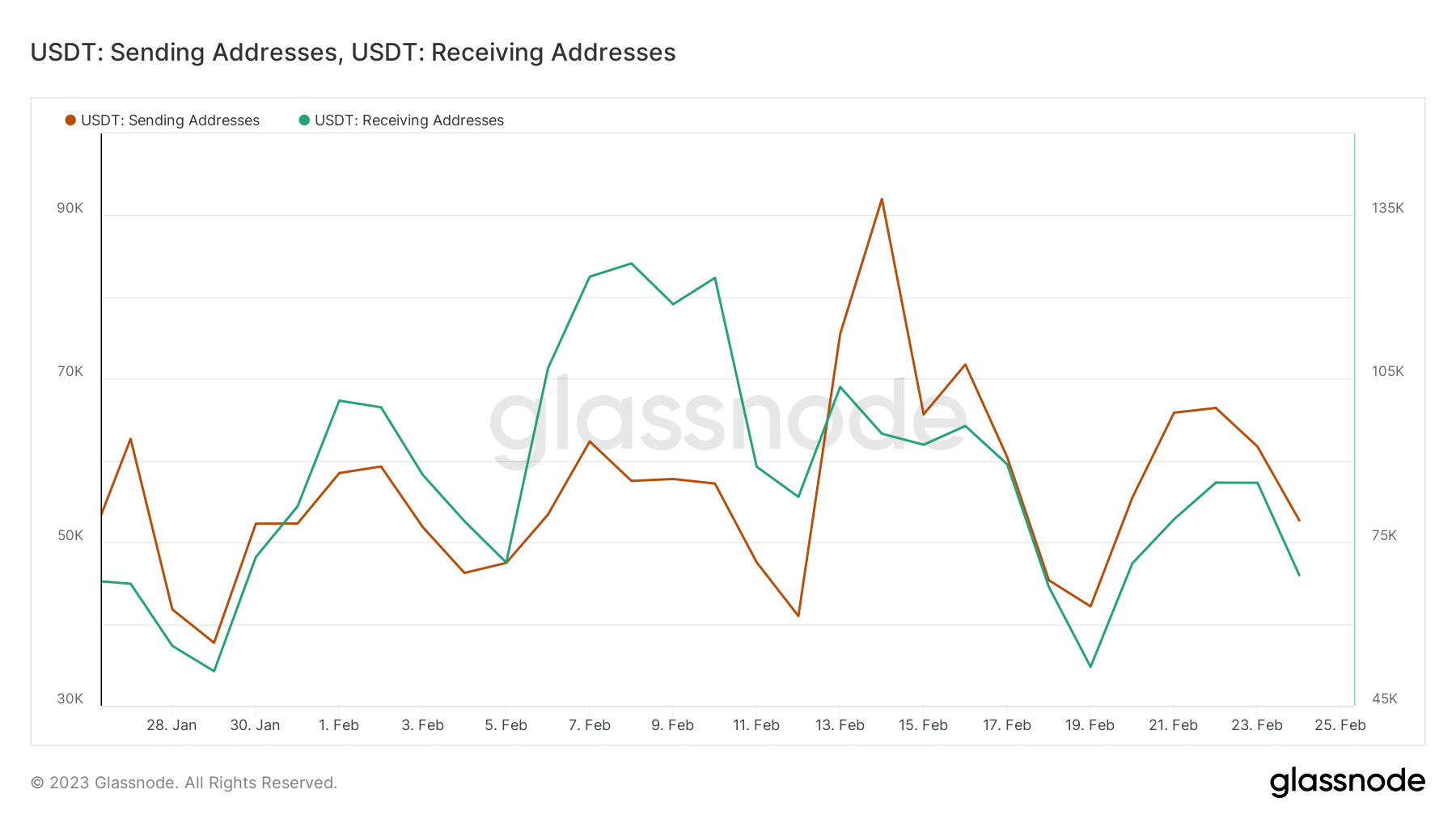

As such, there has been an increased demand for USDT on and off exchanges. Address flows offer a better picture of the level of demand for USDT in the market.

Demand for USDT remains high

The number of receiving addresses was higher in the last 24 hours at 68,969 addresses. In comparison, sending addresses came in at 52,675.

As expected, during a bear market, the higher number of receiving addresses confirms that more traders are opting to hold stablecoins. A good example of this is the strong demand for the USDT in China.

USDT’s fiat currency trading price in China has broken through 7 CNY. As the market’s expectations for a slowdown in the Fed’s interest rate hike have weakened, the U.S. dollar index has recently strengthened in stages.

— Wu Blockchain (@WuBlockchain) February 25, 2023

USDT’s value recently crossed above the 7 CNY price level. This was largely courtesy of the higher dollar strength which makes the equivalently valued USDT more desirable to hold especially during a bear market.

Source: Glassnode

A key point to note is that there is also a lot of sell pressure for USDT. This suggests that there is noteworthy re-accumulation taking place at discounted prices.