Speculation is mounting that Tether’s USDT, the largest stablecoin by market capitalization at around $83.4 billion, may be under pressure.

There is currently no indication of a USDT depeg and USDT is trading at almost exactly one dollar. However, a stablecoin, which is nominally pegged to a stable asset (in the case of USDT, the US dollar) can lose parity with that asset.

Specific liquidity pools on the Uniswap and Curve protocols — the deepest pools in the DeFi ecosystem — currently seem to be flooded with USDT sellers.

When sellers flood the market it can cause a rapid depeg, a situation noted during the Silicon Valley Bank collapse, when the well-regarded USDC stablecoin (issued by Circle and Coinbase) lost its peg and fell as low as $0.93 before regaining its dollar parity within a couple of days.

According to Blockworks Research analyst Ren Kong, two major pools appear susceptible to significant selling pressure right now: The Curve 3pool, which holds $380 million of USDT, USDC and DAI, and the Uniswap v3 USDC/USDT pool, which holds $75.85M of USDC and USDT.

The Curve 3pool is the third largest DEX pool, and the largest USDT and DAI pool in the DeFi (decentralized finance) arena.

Both are considered key to DeFi and both are rapidly seeing USDT compositions rise dramatically, with the stablecoin rising from a 22% share of the Curve 3pool three days ago, to over 50% at the time of writing.

(Curve 3pool composition / Blockworks Research)

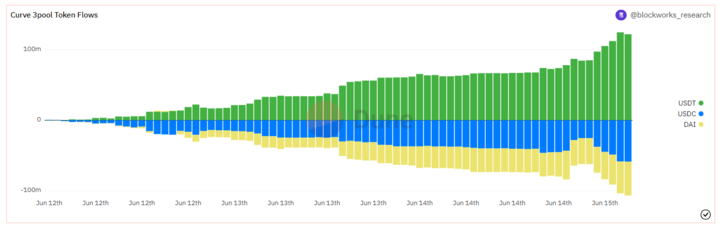

In other words, USDT holders have been fleeing the stablecoin, aggressively selling USDT for USDC/DAI. The aggregate impact has been around net $120 million of USDT inflow (sell pressure) for the Curve 3pool.

Curve 3pool USDT inflows / Blockworks Research

While the current selling activity does not constitute an attack, Blockworks Research analysts hypothesize that a dump of this magnitude could be considered a precursor to a more significant event.

The selling is particularly concerning since the speed and magnitude of a depeg, if it happens, can be accelerated by a lack of liquidity in the pool, especially for the Uniswap v3 pool where most of the liquidity is concentrated around the $1 price.

A depeg of the USDT stablecoin could be catastrophic for the crypto economy, particularly since USDT has been gaining market share at the expense of the well-regulated USDC stablecoin following aggressive SEC regulatory actions against US-based crypto companies.

Over the past three months, USDT has gained around $14 billion in market capitalization, while the USDC coin has lost almost the same amount.

Is Tether in trouble?

While there are no definitive conclusions right now, the abnormal levels of selling could reasonably be seen as concerning.

Tether has long maintained that USDT is backed by equivalent assets held in reserve, including cash and bonds, but it has never delivered a proper audit; simply ‘attestations’ as to its ability to meet its obligations.

Instability in Tether would come at a particularly inopportune time for crypto, which has faced an onslaught of enforcement actions from the SEC and other regulators.

Both the CFTC and the SEC have indicated a particular interest in stablecoins, and after USDC’s depeg in March a problem with Tether would potentially cause the kind of systemic meltdown that regulators and legislators have come to fear in the crypto industry.