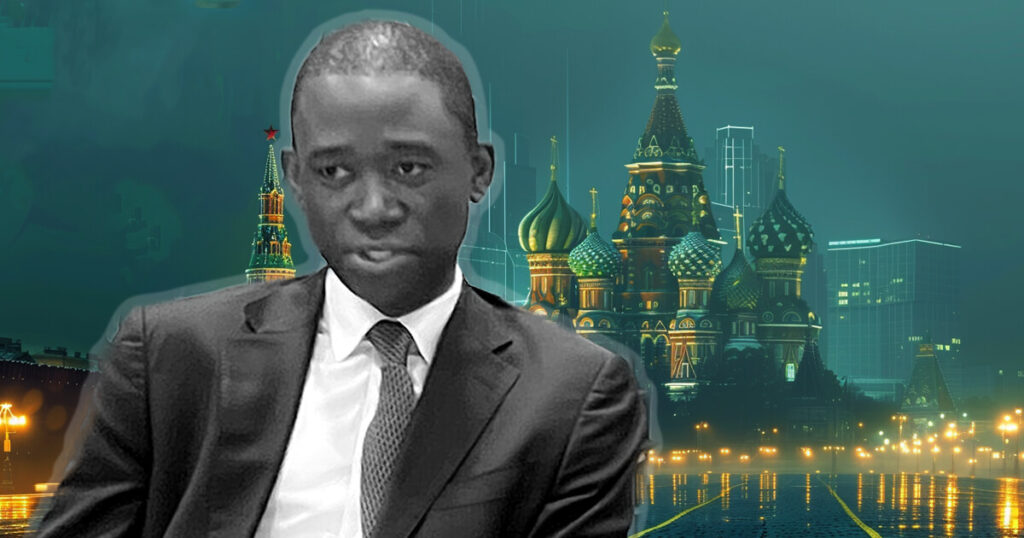

US Treasury Deputy Secretary Adewale Adeyemo said Russia was increasingly using alternative payment mechanisms like Tether’s USDT stablecoin to bypass economic sanctions, according to his written testimony on April 9 to the Senate Banking, Housing, and Urban Affairs Committee.

This remark follows increasing reports that malicious actors used Tether’s stablecoin for their illicit activities. Notably, the US and UK governments launched a joint investigation into crypto transactions worth over $20 billion that may have violated Russian sanctions involving the stablecoin.

Despite these issues, Tether has maintained its commitment to compliance standards and ongoing cooperation with law enforcement bodies to fight against illicit financial activities.

Meanwhile, Paul Grewal, the Chief Legal Officer of Coinbase, asserted that stablecoin legislation would help the US government address this issue. He said:

“US security interests are served by centering dollar-denominated stablecoins in the home of the dollar. Reserve management rules, redemption rights and all that aren’t hard to address if we have the will to do more than politic.”

Terrorist financing

Adeyemo’s testimony further pointed out that terrorist organizations like Al Qaeda and the Palestinian Islamic Jihad (PIJ) were taking advantage of “innovations in crypto” to bypass the traditional financial system.

He said:

“Our problem is that actors are increasingly finding ways to hide their identities and move resources using virtual currency…The more effective our targeting has been, the more reason there is for these terrorist groups to look into virtual assets.”

Consequently, Adeyemo said the US needs “to build an enforcement regime that is capable of preventing this [illegal] activity as more terrorists, transnational criminals, and rogue states turn to digital assets.”

Reforms

Adeyemo further disclosed that the Treasury Department has submitted proposals to the Committee to strengthen the government’s capabilities in countering terrorist financing.

These proposals encompass three key reforms, including implementing a secondary sanctions tool, the modernization and tightening of existing authorities, and mitigating jurisdictional risks posed by offshore digital asset platforms.

Adeyemo emphasized that these reforms are crucial in clarifying how US “authorities can reach extraterritorially when digital asset entities harm our national security while taking advantage of our financial system.”

Additionally, the reforms will create a fair playing field for US-based Virtual Asset Service Providers (VASPs).

He concluded:

“The United States has a strong interest in ensuring that our tools and authorities are available and ready to mitigate the risks in this quickly evolving ecosystem, including for dollar-based digital assets in particular.”

The post US Treasury official targets Tether USDT stablecoin in Russian sanction evasion appeared first on CryptoSlate.