Bitcoin (BTC) is priming itself for a big move to the upside even amid higher-than-expected inflation data that came in last week, the founders of Glassnode say.

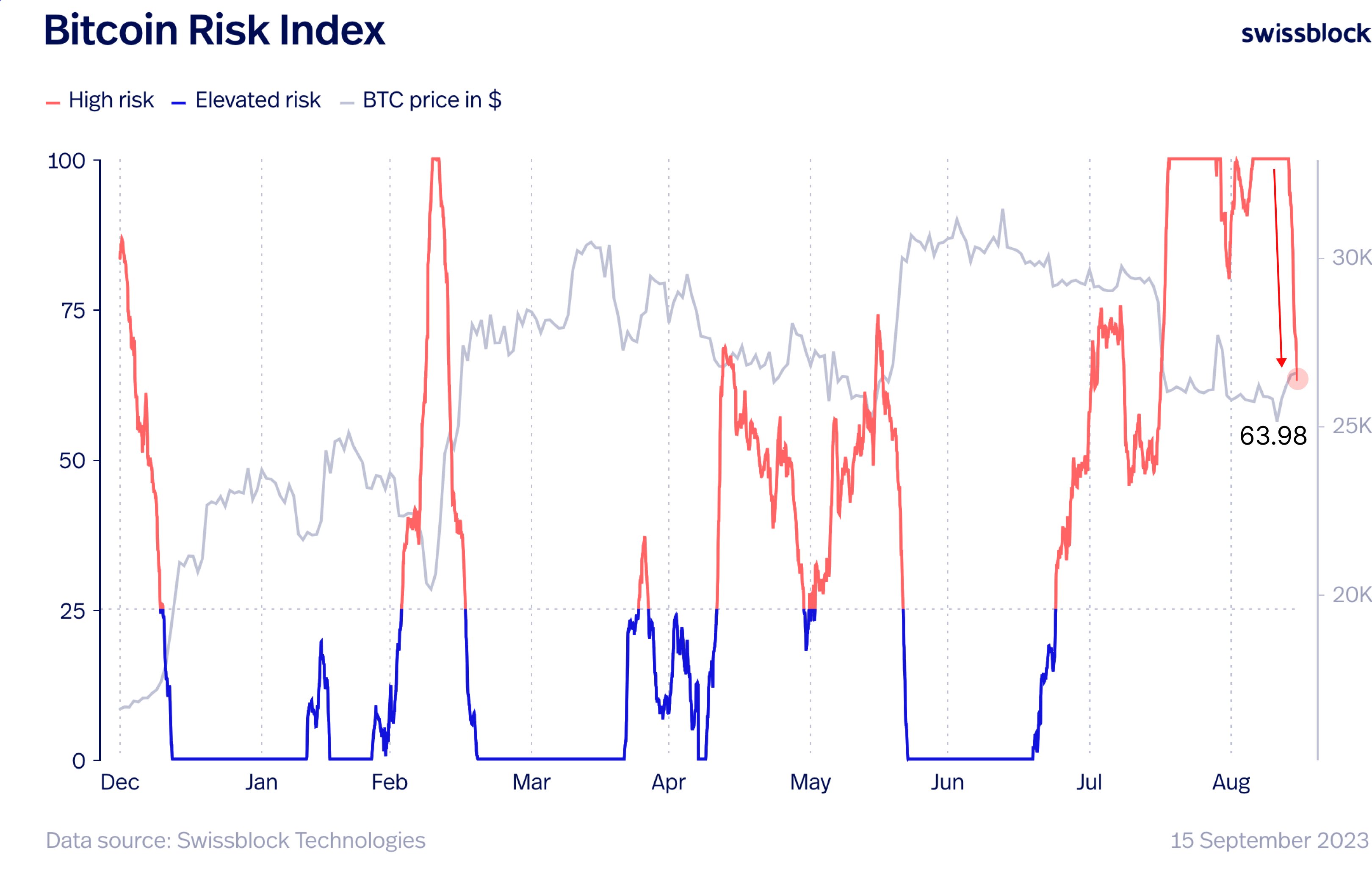

According to Glassnode founders Jan Happel and Yann Allemann, Bitcoin has reclaimed the $26,000 level as support, and BTC’s Risk Signal appears to have taken a nosedive.

BTC’s Risk Signal is a metric from Glassnode that gauges the level of risk of a major price drawdown for Bitcoin.

Say Glassnode founders,

“The US Consumer Price Index (CPI) jump by 0.6% was expected to stir the BTC price, and it has.

Reclaiming support above $26,000, BTC’s now eyeing a breakout past $27,000, potentially exiting a multi-week range.

Risk Signal’s nosedive into the 60s signifies this attitude shift. Profit booking pressure may loom around $27,400 and $28,200, but this climb seems poised as a step before tackling the psychological barrier at $30,000.”

Last week, the U.S. Bureau of Labor Statistics revealed that CPI rose from 0.2% in July to 0.6% in August, and the release of the data coincided with a bump in crypto and equities.

The Glassnode founders, who go pseudonymously as Negentropic on the social media platform X, appear to be forecasting a longer-term rally for Bitcoin to much higher prices.

The analysts share a chart suggesting that BTC has bounced off a large ascending channel and is set to start rising to the upper end of the channel near $150,000 where “greed, euphoria and FOMO (fear of missing out)” could occur.

At time of writing, Bitcoin is trading for $26,538.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DreamStudio