zkEVM gives us access to a new ecosystem built on top of the cutting-edge zk execution layer. However, more crucially, we now need to be aware of emerging high-quality DeFi dApps on this layer in order to stay one step ahead.

Some of the new native zkEVM protocols have not issued tokens yet, and they have every chance of getting in early to master the game. Let’s go with Coincu to learn about them.

MantisSwap

MantisSwap is a single-sided AMM for trading pegged assets, with the goal of maximizing capital efficiency and minimizing principle losses for liquidity providers. MantisSwap’s novel design will push the limits of existing AMMs by providing improved capital efficiency, cheaper trading costs, principle protection for liquidity providers, and a highly intuitive user interface to drive DeFi growth and acceptance.

MantisSwap would enable smooth swaps of various stablecoins and pegged assets while providing reduced slippage, lower gas costs, and safer transactions. The ecosystem-centric DEX is expected to become the liquidity center on Polygon, and the preferred location for trading pegged assets, with the bulk of liquidity inside a DeFi ecosystem flowing via its local DEX.

The protocol supports three kinds of stablecoin assets: USDT, USDC, and DAI.

Mantis proposes the notion of Asset Liability Management (ALM), which records assets and obligations by maintaining the status of each token, a concept influenced by conventional finance. This architecture is what allows for one-sided liquidity.

In addition to ALM, MantisSwap employs the notion of a liquidity ratio to value an asset rather than a number of tokens like a typical AMM. The liquidity ratio is defined as the ratio of assets in the pool to liabilities that the protocol must repay to its LPs (Liquidity Ratio = Assets in Pools / Deposits Made by LPs in Pools).

The protocol employs the veToken architecture for the project’s governance token in order to motivate users to keep the Token in order to increase earnings. Make war in the same manner that Curve Finance did and succeeded.

QuickSwap

QuickSwap, a Polygon-based automated market maker (AMM), is a fork of Uniswap and employs the same liquidity pool methodology. Since it is based on Polygon, the DEX has quicker transaction speeds and lower costs.

Nicholas Mudge and Sameep Singhania created QuickSwap. The network employs an AMM paradigm to provide users with a decentralized exchange experience while exchanging tokens. Surprisingly, the Polygon-based DEX does not have an order book. This is due to the fact that users trade from liquidity pools.

Users may also transfer ERC-20 tokens from Ethereum to Polygon. Users may also utilize QuickSwap to trade any pair as long as it has a liquidity pool. It’s interesting to note that establishing a new liquidity pool is rather straightforward. To benefit from other users’ transaction fees, a user merely has to give a token pair.

Due to the constantly expanding demand for decentralized transactions, DeFi has hit a tipping point. Due to the overburden on the Ethereum main chain caused by the implementation of the DeFi protocol, transaction fees and confirmation times have skyrocketed.

Prominent decentralized exchanges such as Uniswap and SushiSwap depend primarily on the Ethereum main chain’s capacity. As a consequence, they not only contribute to increasing network congestion but also suffer from DeFi’s success.

To overcome these technological constraints and enable DeFi to flourish, we need low-cost, high-performance infrastructure. The Layer-2 solution is the answer, and QuickSwap is at the forefront of the Layer-2 DEX array, providing a solution to the present Layer-1 DEXs’ high transaction costs and congestion issues.

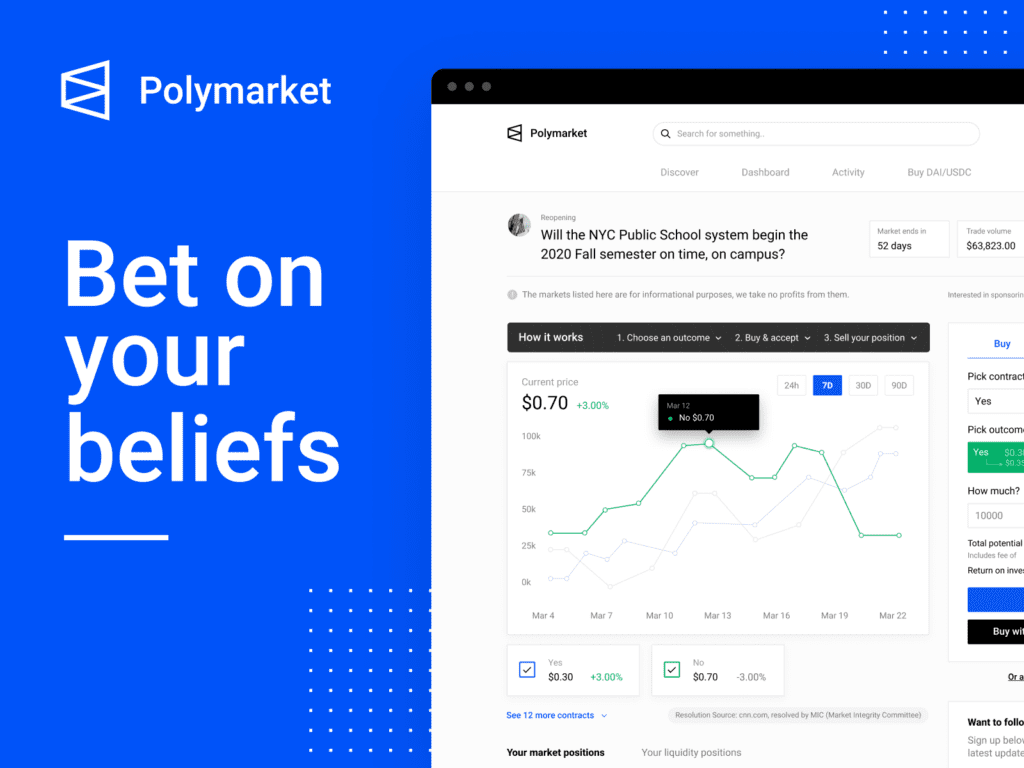

Polymarket

Polymarket is a decentralized trading protocol on Polygon that uses the Uma oracle to provide data infrastructure. Users may deposit into Polymarket via controlled exchanges like Binance or decentralized wallets such as Metamask. They can then forecast future market patterns and place trades appropriately. They may also exit the deal if things go wrong or take gains if all else is equal.

Polymarket has recently made a great name for itself in the community. It draws everyone’s attention to current events such as Arbitrum airdrops, Balaji prophecies, and others. Polymarket, in my view, has the potential to become one of the most important dApps in the field in the next months.

SynFutures

SynFutures is a decentralized and open derivatives platform that promises to democratize the derivatives market by allowing anybody to trade anything at any time. It enables traders to create and trade a diverse range of assets, including Ethereum-native, cross-chain, and off-chain assets.

Synthetic assets, or synths, are blockchain tokens that reflect an underlying asset, like equities, bonds, currencies, cryptocurrencies, options, futures, NFTs, interest rates, and more. Synths not only inject DeFi liquidity into the underlying asset, but they also provide traders with exposure to a variety of instruments, including real-world assets, without the hassles of ownership.

SynFutures allows users to build and trade synthetic assets in a permissionless manner. They may take long or short positions on a variety of assets, including real-world assets, NFTs, gold, hash rates, cryptocurrencies, BTC, and others. SynFutures may be purchased on a variety of blockchains, including Ethereum, Binance Smart Chain (BSC), Polygon, and Arbitrum.

Satori Finance

TimeSwap is the world’s first completely decentralized AMM-based money market protocol that is self-sufficient, non-custodial, gas efficient and does not need oracles or liquidators to function.

TimeSwap’s patented three variables The constant product AMM utilized by Uniswap motivates AMM. It gives the end-user freedom by letting them choose their risk profile and establish the interest rates and collateral for each lending:borrowing transaction. It is ruthlessly simple, gas-efficient, and permission-free, enabling anybody to launch a money market for any ERC-20 token.

Conclusion

Most of the above zkEVM projects are still in the process of being completed, and there will be improvements in the near future. But given what they are doing and aiming for, these are all projects to look forward to. Hopefully, through this article, you have learned more about potential zkEVM projects, as well as found investment opportunities with prominent ZK projects.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.