In a significant development for the decentralized finance (DeFi) space, THENA, a leading decentralized exchange (DEX) on the BNB Chain, has integrated Liquidity Hub by Orbs. This integration marks a pivotal moment for THENA’s traders, granting them access to additional liquidity on the BNB Chain network that was previously untapped through the standard automated market maker (AMM).

Powered by Orbs’ Layer 3 (L3) technology, Liquidity Hub introduces a suite of benefits for THENA’s users, including lower fees, Miner Extractable Value (MEV) protection, gasless transactions, increased capital efficiency, and a simplified user interface. This collaboration stands as the second integration of its kind for Liquidity Hub by Orbs and is among the few instances in the DeFi space that aggregate liquidity from both on-chain and off-chain sources to a DEX.

Liquidity Hub, a fully decentralized, permissionless, and composable DeFi protocol developed by the Orbs project, leverages the Orbs Network to provide THENA’s traders access to the full spectrum of liquidity on the BNB Chain at no additional cost.

Orbs, a decentralized protocol executed by a public network of permissionless validators using Proof of Stake (PoS), has been a pioneer in introducing Layer 3 infrastructure. This innovative approach utilizes the Orbs decentralized network to enhance the capabilities of existing Ethereum Virtual Machine (EVM) smart contracts, ushering in new possibilities for Web3, DeFi, NFTs, and GameFi.

Liquidity Hub Mechanisms

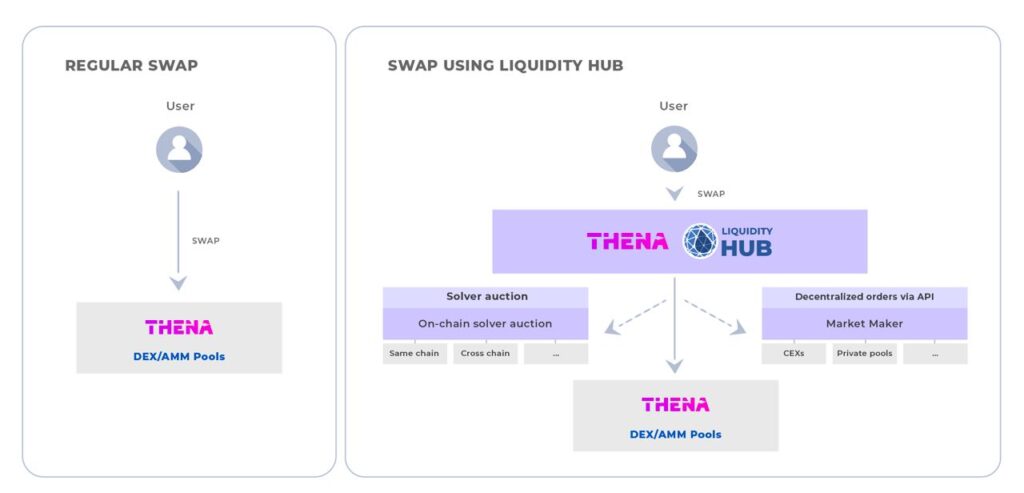

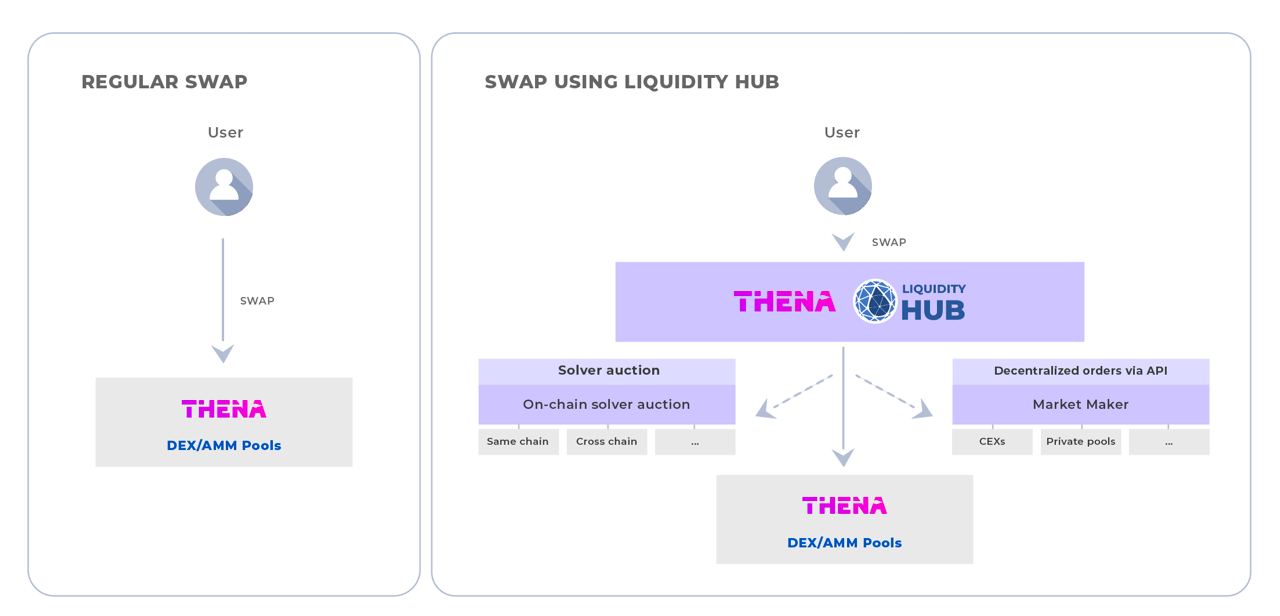

Liquidity Hub operates as a Layer 3 infrastructure software that optimizes the existing AMM model. By tapping into external liquidity sources, Liquidity Hub ensures better price quotes and minimizes price impact. The technology utilizes two primary methods:

1. On-chain solver auction: Third-party solvers compete to fill swaps using on-chain liquidity, including AMM pools or private inventory.

2. Decentralized orders via API: Institutional and professional traders can submit bids and compete to fill swaps through decentralized orders accessible via API.

Liquidity Hub allows DEXs to attempt trades without going through the AMM and experiencing price impact. If Liquidity Hub cannot execute the trade at a better price than the AMM, the transaction will return to the AMM contract and execute as usual, ensuring that users receive the best possible execution.

The architecture of Liquidity Hub involves a mix of an on-chain contract and backend logic running on Orbs decentralized L3 nodes. The on-chain contract safeguards end-users, ensuring the security of their funds and preventing significant price manipulations.

Liquidity Hub Architecture Overview

The Liquidity Hub functions through a combination of an on-chain contract, deployed alongside the AMM contract, and backend logic that operates on-chain through Orbs decentralized L3 nodes. In either scenario, the on-chain contract of Liquidity Hub safeguards end-users, ensuring the security of their funds and preventing substantial price manipulations.

Regular users engaging in swaps need not be aware of the existence of Liquidity Hub. The Liquidity Hub contract ensures that the swap’s execution price will surpass that of the AMM contract. Simply put, if Liquidity Hub is not competitive, the swap is bypassed. The assurance is embedded at the contract level, eliminating the need for trust in the process.

A segment of the Liquidity Hub’s logic operates outside the underlying chain of the DEX (off-chain risks can be managed through Orbs L3, as detailed below). As the data structure is maintained off-chain, the addition and removal of orders from the Liquidity Hub can be accomplished within a few milliseconds, without the need to wait for a new block to be closed, and without incurring gas costs.

These characteristics make it appealing to market makers, aligning it with the efficiency of Centralized Exchanges (CEXs). Every fund is securely held on-chain in a non-custodial fashion. Users placing orders within Liquidity Hub retain control of their funds in their wallets. The Liquidity Hub contract is granted approval to initiate transactions that transfer funds from the account upon a successful match.

Order verification consistently occurs on-chain through the Liquidity Hub contract, ensuring that the execution meets the requirements of both parties and that the execution price surpasses that of the AMM. Once a match is confirmed, funds are directly exchanged between the parties on-chain. Key product specifications include:

- No Change in the DEX UI for Users: Seamless integration maintaining the familiar user interface for a user-friendly experience.

- API for Solvers + Decentralized Order Interface for Market Makers (MMs): Efficient tools for solvers and market makers to streamline liquidity provision and trading.

- Nominal to Zero Latency Execution for MMs: Real-time trade execution for market makers to capitalize on market movements.

- Token Spending Approval by Users on MetaMask: Users maintain control and security over their transactions by authorizing token spending through MetaMask.

- Funds Remain in the User Wallet Until Trades Execute: Enhanced security and trust as users’ funds stay in their wallets until trade execution.

- Gasless Trades for Users: Significantly reduced transaction costs through gasless trades.

A Paradigm Shift in DeFi Trading

Liquidity Hub, powered by Orbs L3 technology, has set a new industry standard for achieving the best price without leaving the DEX. With implementations on QuickSwap on Polygon and THENA on BNB Chain, Liquidity Hub has facilitated over $12 million in trading volume to date.

Orbs, as a Layer-3 public blockchain infrastructure project, continues to drive on-chain innovation and has positioned itself as a crucial layer between L1/L2 solutions and the application layer. With a dedicated team spanning Tel Aviv, London, New York, Tokyo, and Seoul, Orbs remains at the forefront of blockchain technology, powering protocols such as dLIMIT, dTWAP, and Liquidity Hub.

Overall, Thena’s integration of Orbs’ Liquidity Hub marks a groundbreaking chapter in the DeFi landscape, unleashing new possibilities for traders on the BNB Chain. It stands as a testament to the ongoing evolution and maturation of decentralized finance, promising a more efficient, secure, and accessible trading environment for users worldwide.