Cryptocurrency markets follow predictable four-year cycles, but the psychology of bull and bear markets can be deceptive. The problem is that massive surges always follow every dip, just as they have in the past. However, investors often assume that every major downturn will last indefinitely, just like the upswings.

DeFi and its Potential

According to a World Bank report, 1.4 billion people worldwide do not have access to a bank account. This situation pushes rural areas, the elderly, and disadvantaged regions and groups into a more challenging life and poverty. Leora Klapper, the Lead Economist of the Development Economics Vice Presidency of the World Bank, says:

“To reach these individuals, governments and the private sector will need to work hand in hand to develop the necessary policies and practices to build trust in financial service providers, trust in the use of financial products, new product designs, and a strong and implementable consumer protection framework.”

Tokenizing assets is a vast field, and we will see how it will make our lives easier in the future. However, even at this stage, DeFi provides disadvantaged groups with access to finance through just a phone and internet connection.

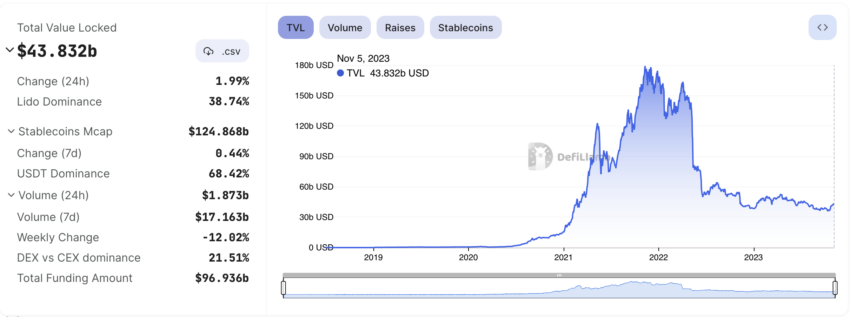

The daily trading volume in the DeFi space has surpassed $10 billion, and locked assets have gone from under $1 billion to over $100 billion in just two years. The elimination of intermediaries leads to lower costs.

Lars Seier Christensen, Chairman, and Founder of Concordium, says:

“Blockchain eliminates the need for intermediaries managing assets, allowing resources to be allocated in the most efficient way possible, thus enabling every member of society to have unbiased access to credit services. Blockchain is a powerful tool to correct the catalog of inefficiencies in the traditional financial sector by streamlining processes and facilitating greater inclusivity and higher levels of global accessibility.”

So why can’t the same be done with digital banking? There are thousands of issues, including the lack of banking services in certain regions, from the need for bank branches to registration procedures. However, DeFi offers a new financial environment where people from all over the world can participate.

The Crypto Bull and DeFi

Bitcoin and cryptocurrencies are widely used in many African and Latin American countries. DeFi could experience a similar wave of adoption in the upcoming bull season. It may not be a futile effort for JPMorgan Chase and Bank of America to explore options for adapting the existing DeFi system to traditional finance.

Bank of America stated:

“DeFi applications require development to differentiate themselves and produce a unique user experience that increases adoption and usage. Increased adoption and usage lead to increased revenues and appreciation of local tokens, both of which can be reinvested in further development. Although DeFi applications are still immature, we are in the early stages of a significant change that can occur in applications over the next 30 years.”

The following are some DeFi projects that are currently at the top in terms of volume and have the potential to grow in the next bull season:

- DYDX

- Uniswap

- PancakeSwap

- Curve

- GMX

- Orca

- Kine Protocol

- Apex

- Balancer

Disclaimer: The information in this article does not constitute investment advice. Investors should be aware of the high volatility and associated risks of cryptocurrencies and should conduct their own research before making any transactions.