- LINK’s supply on exchanges increased while its supply outside declined.

- Exchange netflow remained green.

Despite a bullish week, Chainlink’s [LINK] growth pace seemed to have halted. After registering double digit weekly gains, the token’s price just moved marginally in the last 24 hours.

Realistic or not, here’s LINK market cap in BTC‘s terms

However, new data revealed that investors were still willing to hold onto their tokens. Such episodes reflect investors’ confidence, which could translate into a price hike in the coming days.

CoinMarketCap showed that LINK’s price increased by more than 10% in the last seven days. However, the momentum slowed down as the token’s price only moved up marginally in the last 24 hours.

At the time of writing, it was trading at $5.85 with a market capitalization of over $3 billion, making it the 23rd largest crypto.

Investors’ confidence in Chainlink is high

IntoTheBlock’s 23 June tweet revealed another interesting development in the Chainlink ecosystem. As per the tweet, 82.9% of Chainlink investors were holding their tokens at a loss. This meant the investors were highly confident in the token.

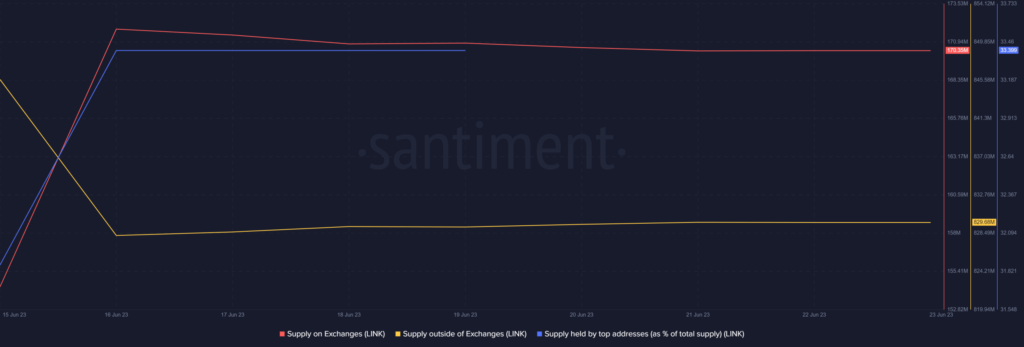

However, Santiment’s chart told a different story. LINK’s supply on exchanges increased while its supply outside of exchanges declined. Nonetheless, the supply held by top addresses rose last week, suggesting that the whales had faith in LINK.

Source: Santiment

Moreover, IntoTheBlock’s tweet also revealed that LINK’s Market Value to Realized Value Ratio (MVRV) touched an all-time low. However, things looked different at press time as LINK’s MVRV Ratio climbed up.

Source: Santiment

Metrics are bullish on LINK

A look at LINK’s on-chain metrics suggested that the possibility of LINK continuing its bull rally can’t be ruled out. This was because its net deposits on exchanges were low compared to the last seven days, suggesting increased buying pressure.

Its active addresses and number of transactions were also high, which too looked optimistic. However, as per LunarCrush, bullish sentiment around LINK declined over the last 24 hours, while bearish sentiment increased.

Source: CryptoQuant

How many are 1,10,100 LINKs worth today

This is what indicators suggest

Quite a few market indicators were also in the bulls’ favor. For instance, the MACD clearly suggested a bullish upperhand in the market.

Chainlink’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both registered upticks, which were developments in the buyers’ favor. Having said that, LINK’s Exponential Moving Average (EMA) Ribbon remained bearish, which could cause trouble in the near term.

Source: TradingView