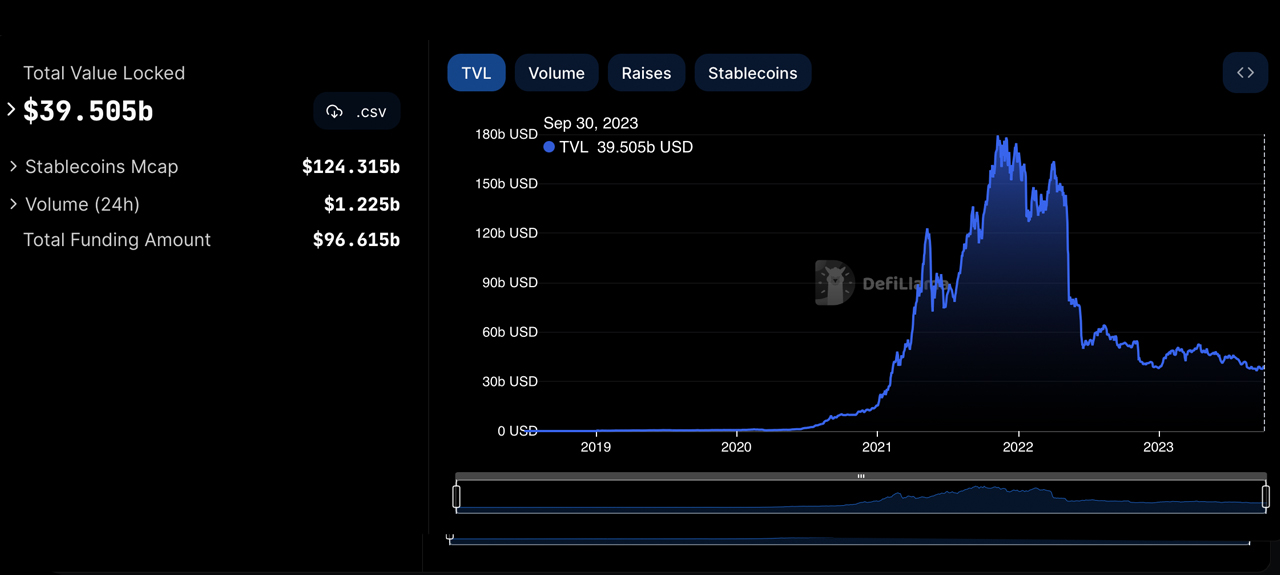

As of October 1, 2023, $39.50 billion is nestled within decentralized finance (defi) platforms. Let’s dive into the top five categories, spotlighting the diverse array of defi protocols, the count of these applications, and the wealth they encompass.

A Look at 5 Defi Categories Commanding Billions in Crypto Assets

Defillama.com, a decentralized finance (defi) industry aggregator, showcases an array of defi protocols, their underlying blockchains, and their held values. It features around 35 unique categories of applications. Dominating the scene are liquid staking derivatives applications, with 119 of them controlling $23.05 billion.

The total value locked (TVL) in defi as of Sunday, October 1, 2023, at 8:00 p.m. Eastern Time.

Liquid staking derivatives represent tokens that are backed by staked assets in blockchain networks, allowing users to remain liquid while their assets are staked. In essence, they let you earn staking rewards without locking up your assets, by converting them into tradable tokens.

The total value locked (TVL) among the top five categories in defi as of Sunday, October 1, 2023, at 8:00 p.m. Eastern Time.

Lending, the runner-up in the defi realm, encompasses protocols enabling users to lend or borrow assets. Approximately 302 protocols fall under this lending umbrella, collectively holding $15.14 billion in crypto assets as of October 1, 2023. Following closely, the decentralized exchange (dex) category claims the third position with a total value locked (TVL) of $11.82 billion across 1,026 protocols.

Dex protocols are platforms that allow users to trade crypto assets directly with one another, without the need for an intermediary or central authority. Essentially, dexs offer peer-to-peer trading, ensuring transactions are transparent and secure on the blockchain.

Occupying the fourth rank in the defi landscape is the bridge category, protocols designed to shuttle tokens between networks. Acting as vital links between diverse blockchain networks, these bridges currently oversee $9.17 billion, spread across 46 distinct platforms. Securing the fifth position in the defi hierarchy is the CDP, or collateralized debt position category.

CDP defi protocols give users the ability to pledge assets as collateral, granting them the ability to borrow different assets or tokens. At their core, they extend loans anchored to the value of the pledged collateral, letting users tap into funds while their primary assets stay safeguarded. A notable 105 CDP protocols exist, amassing a combined value of $8.23 billion.

Following the ranks of liquid staking, lending, dex platforms, bridges, and CDPs are protocols zeroing in on yield, real-world assets (RWAs), and derivatives. Leading the parade, Lido Finance is the top dog in liquid staking, Aave reigns supreme in lending, Uniswap dominates the dex space, WBTC stands tall as the chief bridge, and Makerdao is the titan of the CDP realm.

What do you think about the top five defi categories in terms of total value held by these distinct types of protocols? Share your thoughts and opinions about this subject in the comments section below.