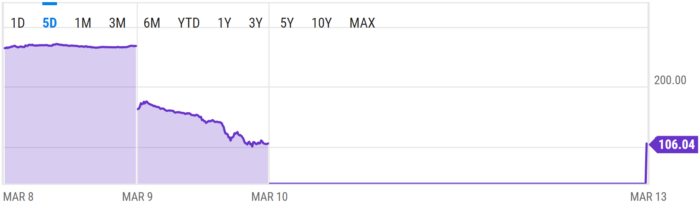

On March 10, after days of uncertainty spurred on by $1.8 billion in surprise bond losses, Silicon Valley Bank (SVB) collapsed, sending a tidal wave’s worth of ripple effects throughout the financial industry. The event quickly prompted the U.S. Treasury, Federal Reserve, and the FDIC to step in to effectively circumvent catastrophe and assure depositors of access to all of their funds, whether insured or not.

While the situation is still developing, the seeming fiasco has left those in traditional finance to shudder in remembrance of the 2008 financial crisis. Yet, the context of the collapse — that SVB was a significantly popular choice for venture capitalists and tech startups — has urged more contemporary investors (like those in Web3) to remark about the potential of decentralization in eschewing central bank issues.

But even so, in the days since the debacle, it’s become clear that the NFT space might’ve actually dodged a bullet itself with help from regulators. Because while Web3 staunchly purports to be decentralized, some of the most prominent players seemingly only narrowly escaped being caught up in the debacle.

What happened

How did the 16th largest bank in the United States become the second-biggest bank failure in U.S. history? To summarize, the collapse came down to two major factors.

The first is that, within the last year, the Federal Reserve has raised the Federal funds rate by nearly five percentage points in an attempt to tame inflation. These higher interest rates significantly chipped away at the value of long-term bonds that SVB and many other banks took on previously when interest rates were next to nothing.

The second factor concerns the quick and broad decline in tech revenue and venture capital experienced within the U.S. In response to the wane, startups had opted to withdraw funds held in SVB, meaning that the bank was facing significant unrealized losses in bonds while simultaneously, customer withdrawals were escalating. This, in turn, caused a run on the bank where customers panicked and all attempted to withdraw their money at once.

Only two days after the SVB closure, the Department of the Treasury, Federal Reserve, and FDIC released a joint statement saying that “depositors will have access to all of their money starting Monday, March 13,” and that no losses associated with the resolution of SVB would come from taxpayer dollars.

The statement also mentioned that regulators took these unusual steps because SVB presented a significant risk for the U.S. economy. While regulators continue to look for a buyer for SVB and the uncertainty for what comes next is mounting, HSBC has acquired SVB UK for a symbolic £1.

Outside the traditional finance world, those in the blockchain industry are doing their best to understand how the situation might have, and could still, affect their stomping grounds.

Who could’ve been affected?

Not to be confused with the fall of FTX, this latest three-letter acronymous fiasco had a significantly less detrimental effect on the NFT space than the aforementioned failed crypto exchange. Thanks to the actions of the Federal Reserve and FDIC, the many accounts housed under SVB — which included consumer accounts as well as those of high-profile companies like Roblox, Buzzfeed, Etsy, and more — were made whole as of March 13.

But the fact remains that the SVB collapse could’ve very significantly affected the blockchain industry. Because apart from crypto companies like Avalanche, BlockFi, Ripple, Pantera, and others that had funds locked up in the SVB debacle, numerous NFT adjacent entities would’ve been in for a world of hurt as well. Here are a few examples.

Circle

One of the most immediate and impactful concerns arose from the untethering of the USDC stablecoin. USDC lost its 1/1 peg to the U.S. dollar only hours after SVB was closed, and Circle’s $3.3 billion cash reserves (about eight percent of the funds backing USDC) went into limbo. Although the situation has since been rectified, USDC has yet to return to the $1 peg as Signature Bank (another institution critical to USDC holdings) was seized in the wake of a similar bank run.

Proof

The Proof Collective — which has grown increasingly in popularity over the past few years thanks to the success of projects like Moonbirds, Oddities, and Grails — became an immediate concern for the NFT community in the aftermath of the SVB news. Addressing the Proof community via Twitter, the project team confirmed that Proof held cash in SVB, although they didn’t state how much. Further, they noted that they had diversified assets across ETH, stablecoins, and fiat.

Azuki

When word first came down about SVB, many also looked to the popular PFP project Azuki (helmed by ex-big tech entrepreneur Zagabond) to see if it was affected. Yet, Zagabond quickly dispelled worry, stating to the project’s thousands of Discord members that SVB was only one of their many banking partners and that the bank held less than five percent of project funds.

Yuga Labs

NFT community members also quickly voiced concern for Yuga Labs following SVB’s closure. Yet, similar to Azuki, the brand made it clear that the fiasco wouldn’t affect their business or plan in any way. Yuga founder Greg Solano announced via Discord that the company had “super limited financial exposure” to the situation.

Memeland

Memeland, the Web3 venture studio created by Hong Kong-based meme-centric entertainment website 9GAG, was similarly minimally affected by the SVB collapse. Taking to Twitter, Ray Chan, CEO and Co-founder of 9GAG, shared that Memeland had only around $40,000 held in the bank, with no plans of withdrawing. He went on to voice his lack of concern about the fiasco as well, stating, “when SVB falls down as quickly as FTX did, crypto and NFT don’t look so risky at all.”

What does it all mean for Web3?

It’s no stretch to say that the implications of the SVB closure might’ve been significantly worse had regulators not stepped in to guarantee deposits. Even considering the minimal exposure that most major NFT players had to the bank, Web3 would’ve surely felt ripples from the Circle situation alone, as USDC is a highly popular stablecoin to those in the NFT space.

Yet, a few key takeaways have emerged in response to the near-catastrophic experience. The most prominent of which has everything to do with the already widely held Web3 ethos: decentralization. Of course, this goes far beyond advocating for decentralization and keeping funds out of the central banking system (as many already do). Because the major lesson learned from the SVB fiasco is that to mitigate crypto and NFT risk, users should absolutely not keep all their assets in one place.

Surely, NFT-native users will have heard this warning time and time again. Aside from following the best practices in Web3 security, locking up assets for safekeeping or even simply spreading assets throughout multiple secure wallets and accounts could help mitigate risk significantly.

So goes the adage: Don’t put all your eggs in one basket.