NFT

In Q1 2023, the general statistics of the NFT market increased strongly compared to Q4 2022, consolidating the strength of an industry that until a few months ago had been given up for dead.

Let’s take a look at what the main drivers of this growth were and which NFT collections had the highest volumes.

All the details below.

Market statistics: NFT volumes growing strongly

In Q1 2023, we saw an increase in NFT sales volumes compared to Q4 2022, confirming that the non-fungible token market is more vibrant than ever.

The data shows an increase in both ETH and USD volumes: specifically, in the last months of 2022, there were sales of more than 9 million NFTs, equivalent to 1,525,471 ETH or approximately $1.97 billion, while in the first three months of 2023, sales were just under 11.5 million with a volume of 2,839,354 ETH or $4.54 billion.

The number of users also increased from 11.23 million in Q4 to 14 million in Q1, indicating not only that the collections are more popular, but also that public interest in this market has increased.

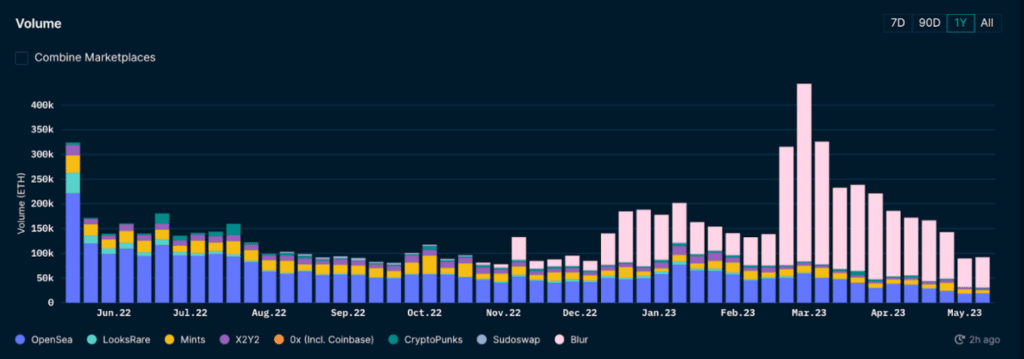

The main reason for this growth seems to be the launch of Blur, NFT’s marketplace for professional traders, which has attracted the involvement of the crypto community.

In this sense, the beginning of 2023 signalled the end of OpenSea’s unchallenged hegemony as the industry’s leading platform, in favour of the newly formed Blur, which was more popular both for its user-friendly dashboards and for the rich data available for each marketplace collection.

Currently, the two marketplaces compete for the majority of the NFT sector’s sales volume.

However, there was a brief dip in April and the downward trend seems to have continued into the first days of May, although the forecast for Q2 2023 is positive.

It remains to be seen whether interest will match or exceed this Q1 2023 level in the coming months and whether Opensea, in particular, will be able to regain some of the market share lost to Blur.

It will also be interesting to see if NFTs on Bitcoin, enabled by the emergence of Ordinals, become mainstream and ‘steal’ some of the volumes currently flowing on Ethereum and other compatible EVM chains.

Which NFT collections have the highest sales volumes?

After this brief overview of the NFT market, let us analyse which collections have the highest sales volumes by distinguishing 3 precise moments: the last 7 days, the last month and the all-time data. All data is taken from the CryptoSlam platform.

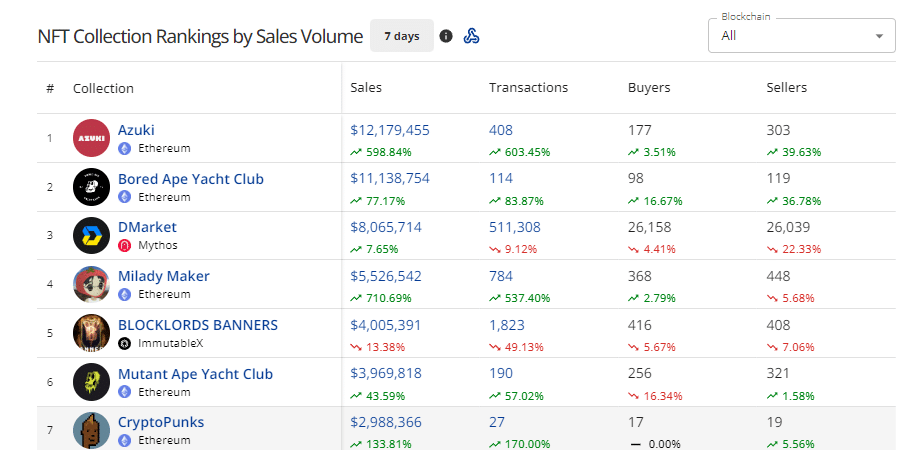

Regarding the last 7 days, the top 3 collections with the highest volume were those of Azuki, Bored Ape Yacht Club and DMarket.

The first two belong to the Ethereum blockchain, while the last one belongs to the Mythos chain.

In total, the 3 collections generated a total volume of $31.3 million.

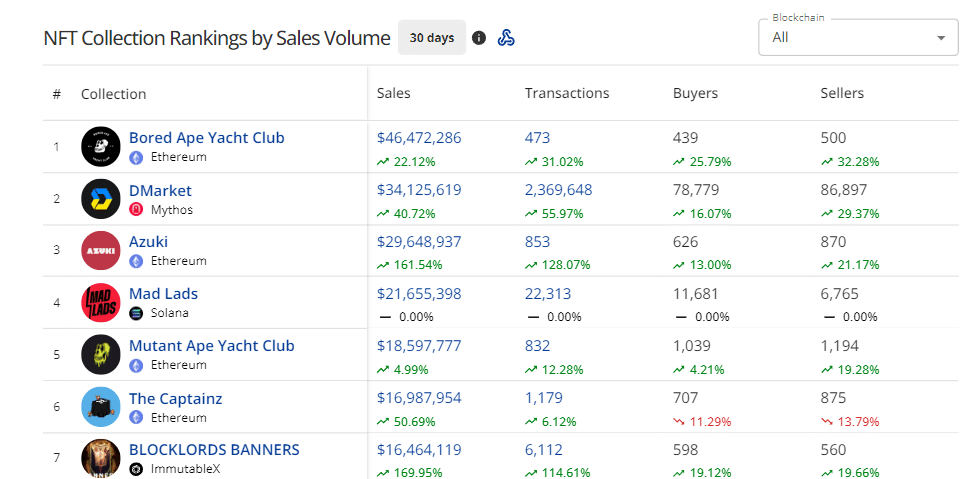

In the last 30 days, the same collections are present on the podium, but in different positions.

In fact, Bored Ape Yacht Club is in first place with $46.47 million in sales, followed by the DMarket collection with $34.1 million and finally Azuki with $29.6 million.

Also noteworthy is the entry of Mad Lads, a collection developed on Solana, in the top 5, while Blocklords Banners, part of the ImmutableX network, appeared in the top 10.

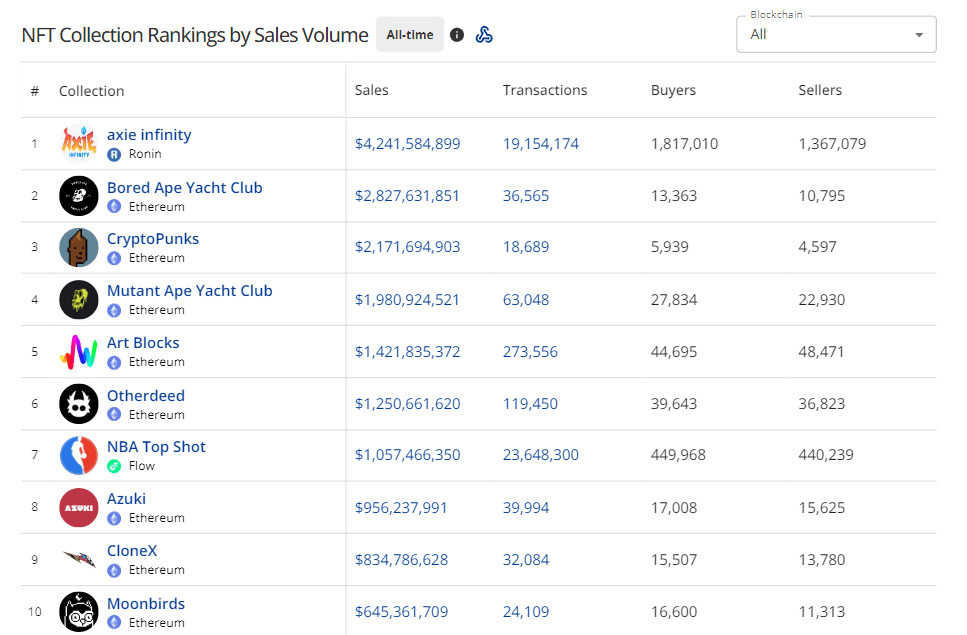

Finally, looking at the historical values (all-time), we see how Ethereum confirms itself as the leading blockchain for the development of NFTs, as almost all of the top 10 collections of all time have been deployed and sold on this network.

In particular, the only non-Ethereum collection and the one with the most sales is Axie Infinity, developed on the Ronin chain, with a volume of $4.24 billion.

Next comes Bored Ape, which confirms the public’s interest in both the short and long term with $2.82 billion in sales, and the very popular Crypto Punks collection with $2.17 billion.

The last 7 collections in the top 10 include names such as Mutant Ape Yacht Club, Art Blocks, Otherdeed, NBA Top Shot, Azuki, CloneX and Moonbirds.

Together, these names have sold a total of $17.36 billion. The highest selling NFT was Crypto Punk #5822, which sold for $23.2 million a year ago.

Trend of the moment: Ordinals and non-fungible tokens on Bitcoin

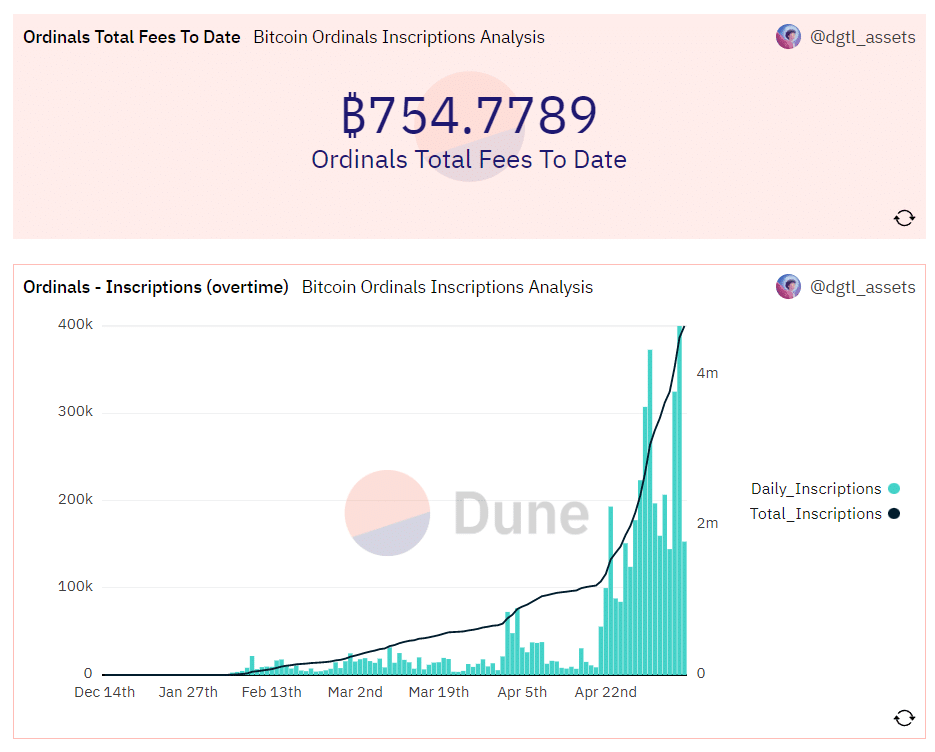

Beyond the volume of NFT sales data, it is very interesting to analyse the trend of the moment, namely Ordinals and inscriptions on the Bitcoin blockchain.

As most people know, the Bitcoin network does not support smart contracts like all modern blockchains, so it is impossible to issue fungible tokens and NFTs on it.

However, Ordinals, a protocol invented by Bitcoin Core developer Casey Rodarmor, has made it possible to create digital artefacts from the smallest units of Bitcoin, the Satoshi.

The trend seems to have exploded in recent days, with thousands of people creating NFTs and fungible BRC-20 tokens on top of Bitcoin.

In terms of non-fungible tokens alone, there have been more than 4.5 million registrations since February 2023, when word of the trend began to spread, with projections for growth in the coming months.

While this represents a huge step forward for the usefulness of the Bitcoin network, the Ordinaries inscriptions do not seem to be appreciated by many users, who have been forced to pay more than usual to use the blockchain, even if only to transfer BTC from one wallet to another.

In this regard, on Sunday 7 May, Binance was forced to temporarily suspend BTC withdrawals (all other withdrawals remained open, including FIAT withdrawals) due to very heavy network congestion and the hundreds of thousands of transactions stuck in the mempool waiting to be confirmed and added to a blockchain.

So while this trend may seem like a game changer for Bitcoin’s blockchain architecture and the prospects for its future use, it has to be weighed against the difficulties experienced on the user side.

Perhaps one solution would be to temporarily switch to the Lightning Network, which has now become an institution for the Bitcoin community, and reduce the amount of work that Layer 1 is forced to process through off-chain computation.

Unfortunately, a “single layer” solution for all web3 transactions seems disappointing for both Bitcoin and Ethereum, while the future is moving towards a differentiation of the areas in which each layer has to compete, based on its own level of security, transparency and decentralisation.

In the future, it would be nice to see an interoperable platform capable of automatically managing any kind of cross-chain operation through a unified solution, easy to use and suitable even for novice users, who unfortunately are currently unable to handle the complexity of the blockchain world.