Real Vision founder and macro guru Raoul Pal is expressing bullish sentiment on the stock market and Ethereum (ETH).

In the latest installment of the Global Macro Investor newsletter, Pal says the bullish thesis on the stock market partly stems from the recent weakness of the US dollar index (DXY), which suggests that investors are leaving the safety of the dollar in favor of risk assets like equities and crypto.

According to the macro guru, the DXY is flashing a bearish pattern that if confirmed, could give stocks and crypto a boost.

“The DXY looks to be forming a big head-and-shoulders top. A break of 101 will lead to significant downside (but all within a secular dollar bull market). This should give risk assets a tailwind…”

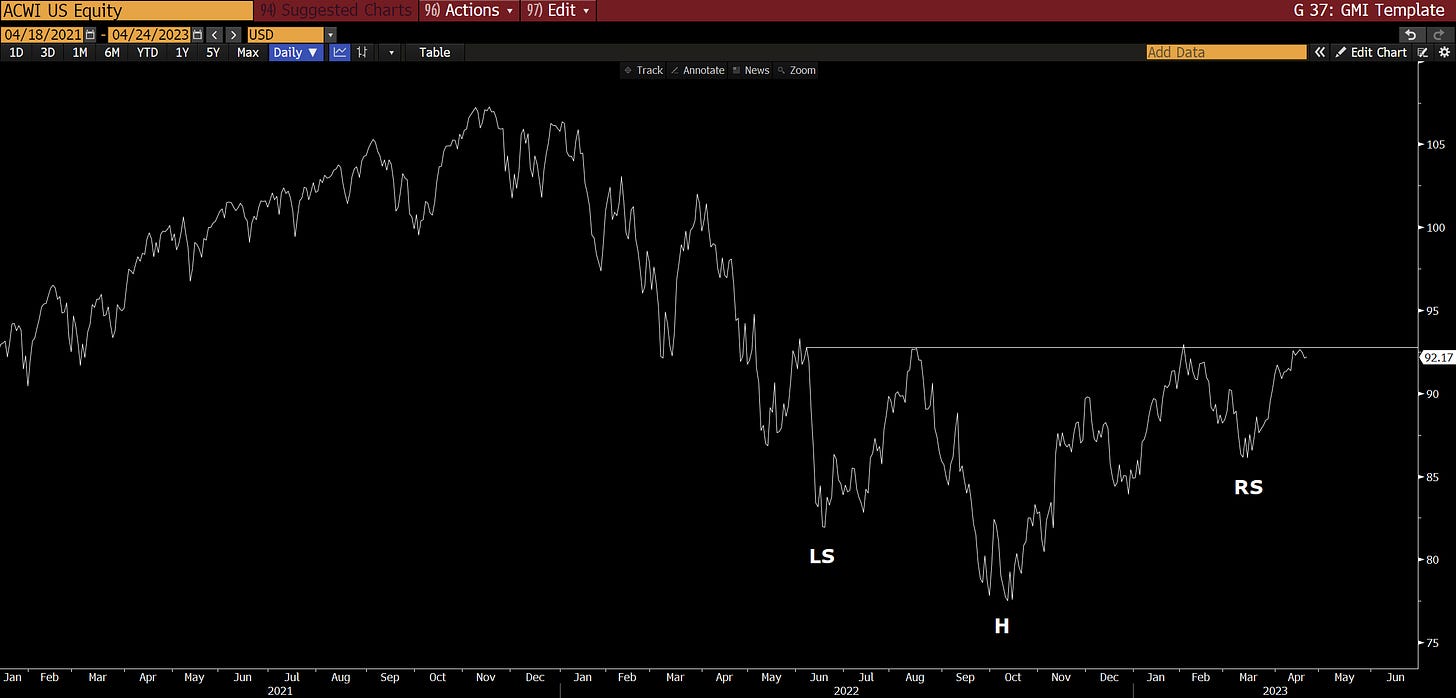

Looking at global equities, Pal says that the stock market looks poised to break out from a bullish head-and-shoulders pattern.

“Global equities just look like the mirror image of the DXY and appear to be forming a large head-and-shoulders bottom. Again, all eyes on a potential DXY breakdown of 101. That’s the signal to watch for and will probably suggest equities head much higher from here…”

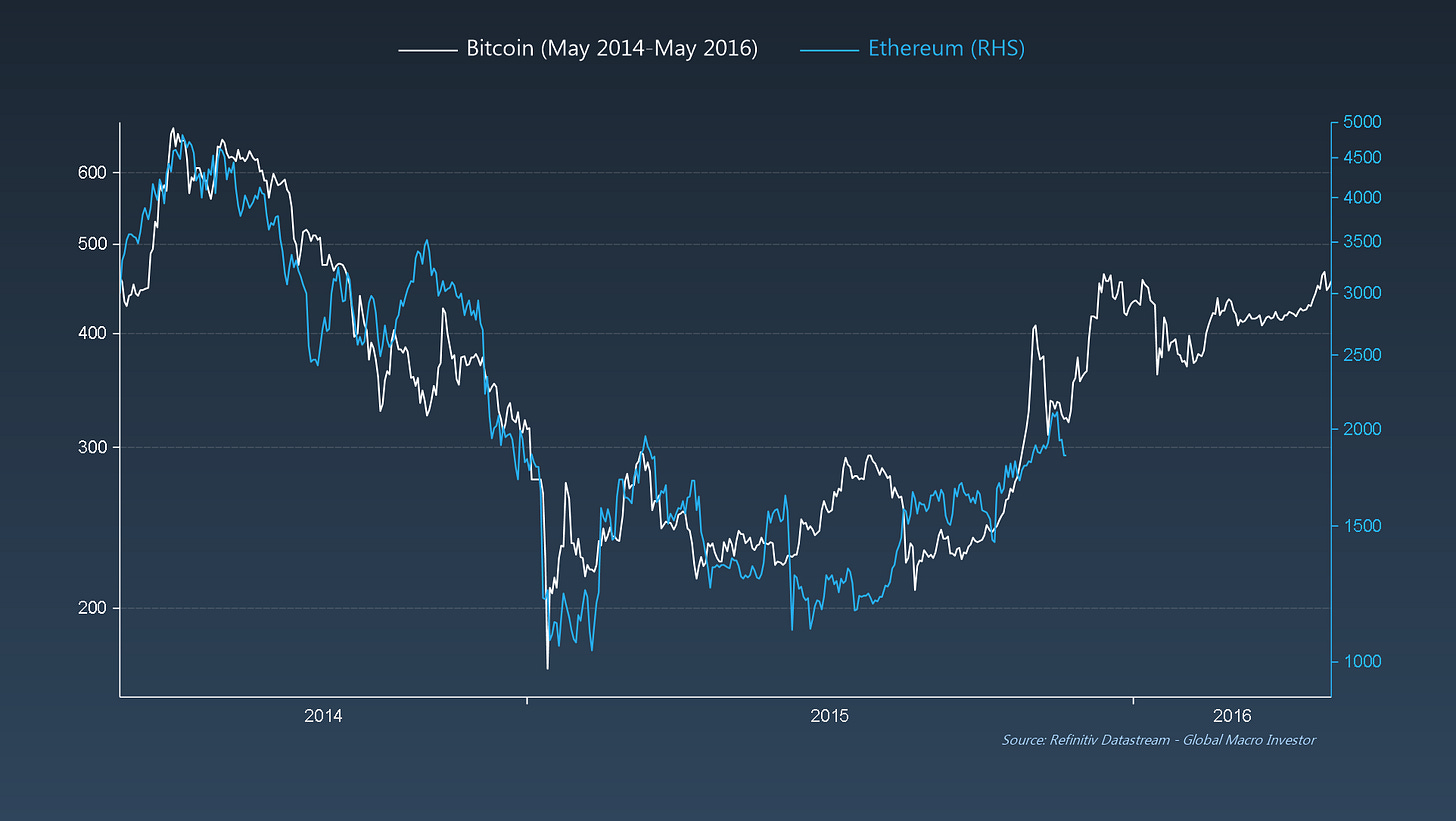

As for Ethereum, the macro guru says that the second-largest crypto asset by market cap appears to be following in the footsteps of Bitcoin’s (BTC) 2015 price action when it rallied from below $2,000 to above $3,000 in less than a year.

“We’ll also throw in this chart on ETH that, as we’ve been flagging for quite some time, continues to trade a lot like Bitcoin during the 2014-2016 period…”

At time of writing, Ethereum is trading for $1,842.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney