Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The market structure was bullish but the buying volume was not encouraging.

- Solana was trading at a critical resistance zone and could face rejection.

Over the past two days, Solana appeared to reverse the bearish trajectory it had been on since late February. This was a trend across the crypto market following the short-term bullish sentiment behind Bitcoin in the early hours of Monday.

Is your portfolio green? Check out the Solana Profit Calculator

Was this the beginning of an uptrend, or was this a move into a liquidity pocket before a reversal? The highs and lows of Mondays generally provide information on the direction of the coming week.

Traders can also incorporate this information before formulating a plan of action regarding Solana.

The confluence of the bearish breaker and range lows could hurt SOL bulls

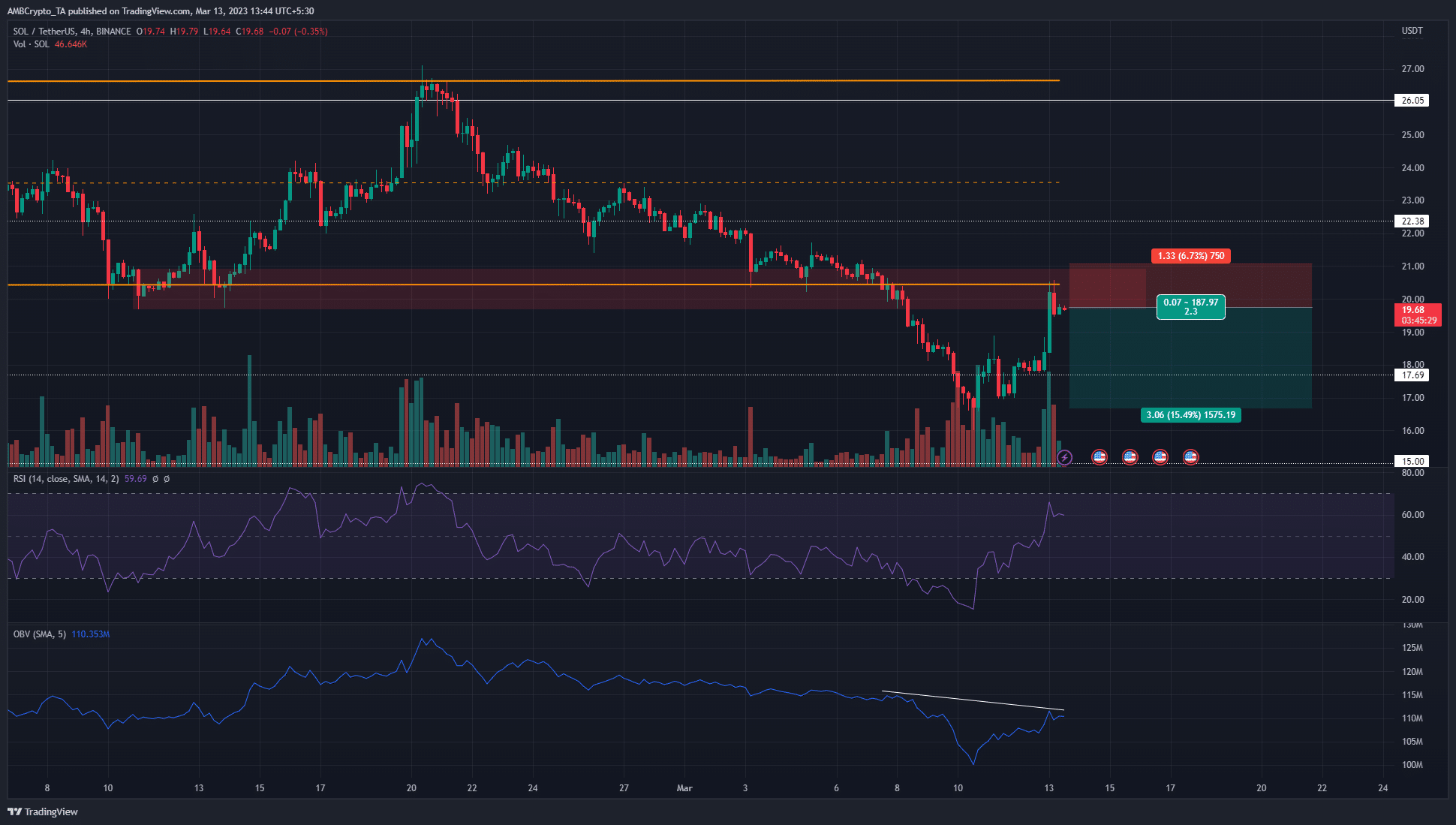

Source: SOL/USDT on TradingView

At the time of writing, Solana was trading at $19.68 and had retested the previous range lows as resistance. This range was highlighted in orange and Solana had traded within it from mid-January till the drop beneath it on 7 March. The range extended from $20.5 to $26.6.

The gains of Solana measured 28.6% when measured from the swing low at $16 that SOL registered over the weekend. The RSI was also above neutral 50 and showed strong bullish momentum.

However, the OBV was unable to form a higher high, which showed slightly muted buying pressure over the past three days of gains.

Even though the trading volume has been high over the past few H4 trading sessions when Solana made these gains, the trend has not reversed yet. From a technical perspective, the market structure was bullish, as the recent lower high at $18.9 has been beaten.

How much are 1, 10, or 100 SOL worth today?

However, the $20 area represented a confluence of resistance from the range lows as well as the bearish breaker from February. Hence, shorting the asset could interest aggressive bears. To the south, the $18.5 and $16.6 can be used to book profits.

Open Interest told a tale of bearish sentiment flipping bullish

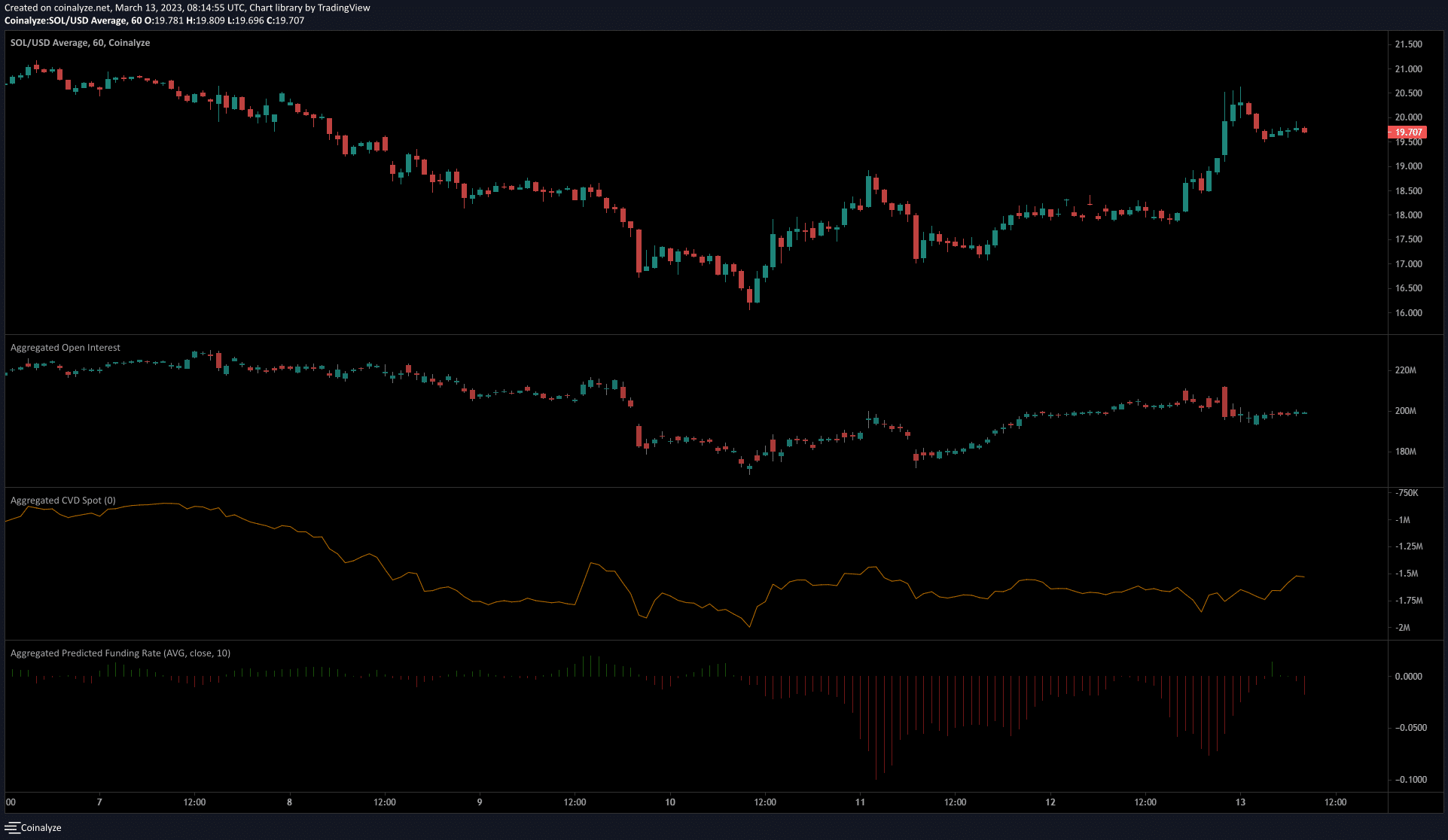

Source: Coinalyze

The spot CVD has been flat over the weekend after seeing some buying pressure on 10 March. The recent move did not spark an upward push on CVD. Meanwhile, the funding rate remained negative to show short positions paid the long positions.

This underlined the bearish sentiment behind Solana.

The Open Interest advanced over the past few hours and declined when the price faced resistance at the $20 mark. This likely showed bullish sentiment over the past few hours.