- Bitcoin prices rise despite traders taking short positions.

- BTC options expiry, bullish sentiment, and market volatility impact Bitcoin’s performance.

Bitcoin has experienced notable volatility in recent times, driving many traders to hold short positions against the cryptocurrency. However, despite this, BTC’s prices have started to rise again, potentially favoring bullish sentiment.

Read Bitcoin’s Price Prediction 2023-2024

Bulls vs Bears

According to CryptoQuant founder and analyst Kim Young Ju, the surge in BTC prices over the past few days has primarily been driven by direct purchases of Bitcoin through perpetual swaps, a type of derivative contract. Nevertheless, it appears that short positions taken by bears have not been liquidated at this point.

#Bitcoin short squeeze hasn’t happened.

Most perpetual swap buying volume came from pure $BTC purchases, not forced short liquidations.

More bullets for bulls.https://t.co/gkt9JiizM3 pic.twitter.com/xxYbi0DmvD

— Ki Young Ju (@ki_young_ju) June 16, 2023

This suggests that the current rise in Bitcoin’s price may not have been substantial enough to trigger the closure of short positions, or that short sellers are still holding onto their positions despite the potential losses incurred.

If Bitcoin’s price continues to climb, these lingering short positions may eventually get liquidated, resulting in a short squeeze scenario. A short squeeze occurs when the price of an asset sharply rises, forcing short sellers to cover their positions by buying back the asset. This buying pressure can amplify the price surge, triggering further short-covering and potentially significant price spikes.

Traders “Put” their chips in one basket

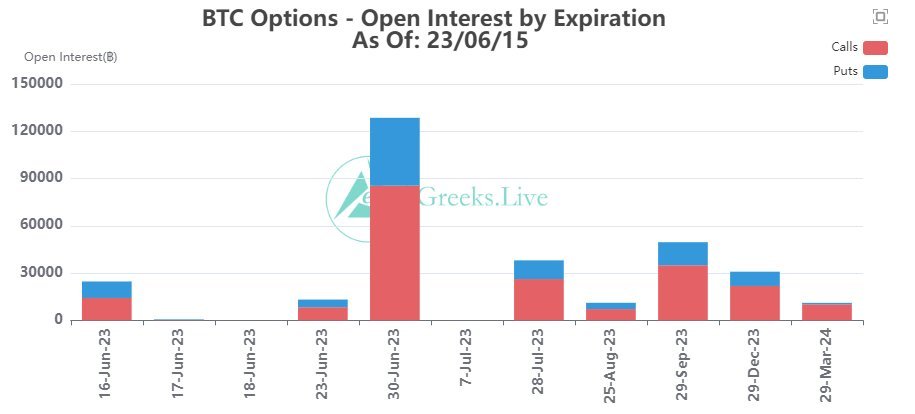

Recent data from GreeksLive highlights that approximately 25,000 BTC options are set to expire soon. The Put Call Ratio, standing at 0.73, indicates a higher number of bullish positions in the market.

The maximum pain point, at $26,000, represents the price level where option holders would face the most significant financial loss. The total notional value of these options amounts to $650 million, reflecting the underlying value of BTC options contracts.

Furthermore, market data reveals that the withdrawal of market makers and reduced liquidity has heightened the risk of recent price fluctuations. However, this situation also presents a unique opportunity for investors.

Currently, buyers are benefitting from low implied volatilities (IVs) in various significant terms, offering favorable value for their investments. Notably, large whales and institutions are actively engaging in the purchase of options, demonstrating confidence in the market.

Is your portfolio green? Check out the Bitcoin Profit Calculator

In terms of other aspects within the network, the data indicates that inscriptions are following the familiar boom-bust cycle often associated with crypto meme coins. This information can assist ordinal and NFT investors in better-predicting market cycles for inscriptions and ordinals in the long run.

#Bitcoin inscriptions are following a classic boom-bust cycle of crypto meme coins.

Inscriptions hit a daily high of 400,000 on May 7, 2023 but by May 24, have fallen 73% to just 146,000. pic.twitter.com/kuMydqMF1J

— Messari (@MessariCrypto) June 17, 2023