What is Rollup.Finance?

Rollup.Finance was built using ZK-Rollups and was deployed initially on the zkSync Era, a decentralized perpetual derivatives exchange run by the community. The platform supports different contract trading modes, such as RLP index contracts, RUSD margin contracts, and coin margin contracts. It applies the vAMM algorithm to achieve smart market regulation and provide liquidity, allowing users to make slip-free and leveraged trades.

With various derivatives contract exchange, providing pledges to obtain high returns and liquidity solutions for personal notes.

The vision of the platform is to create the largest multi-decentralized derivatives trading platform on zkSync, supporting multiple currencies, supporting zero slippage, and solving liquidity and capital efficiency issues. Community orientation to achieve decentralized governance and community orientation and no financial planning, to achieve a completely fair distribution method.

What makes Rollup.Finance stand out?

Main products on Rollup.Finance

Stake

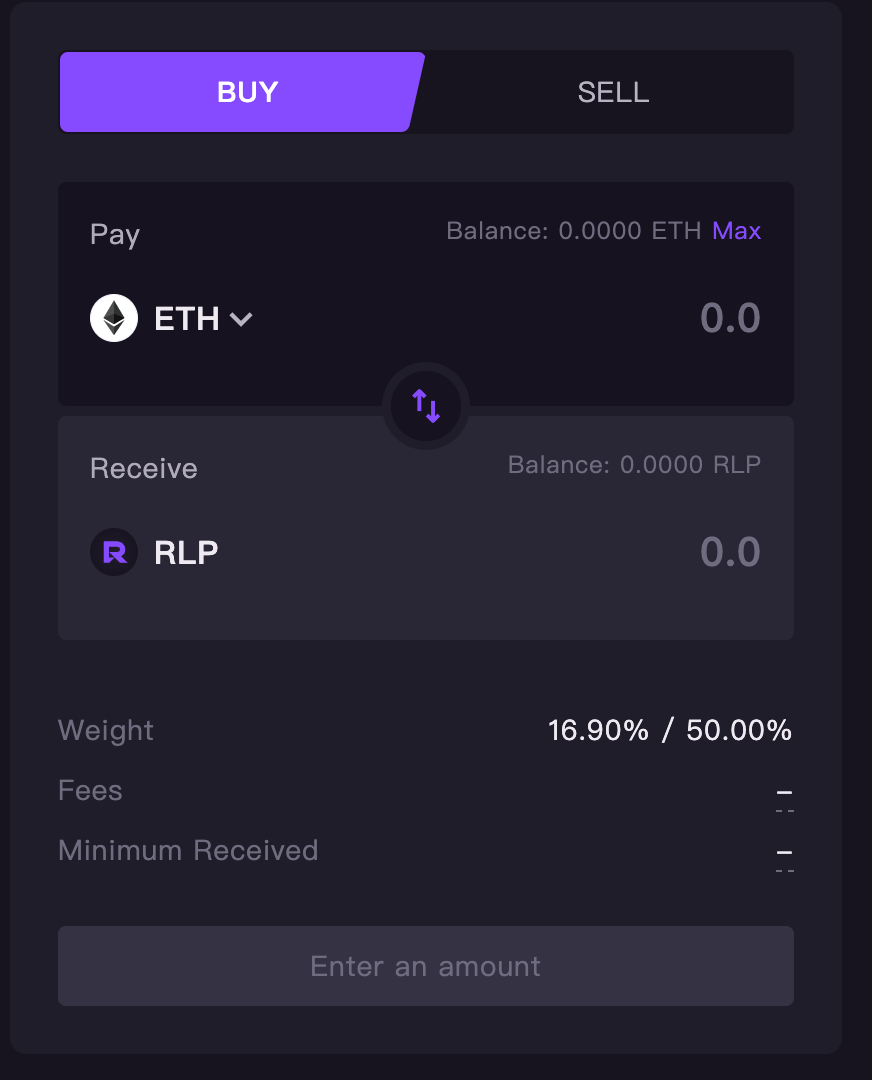

On the “Stake” page of Rollup Finance, you can complete the bet and cancel the chance by clicking “BUY” and “SELL” respectively. Staking your ETH will earn you liquidity rewards.

Rollup Finance uses Virtual Automated Market Maker (vAMM) algorithm to implement intelligent market regulation, providing sufficient liquidity to the market. vAMM means that the trader’s real assets are not stored in the vAMM, but in the smart contract that manages all vAMM collateral.

With the special vAMM system, Rollup.Finance brings many differences from traditional AMM:

- zero trading slippage: vAMM does not require other liquidity providers to pre-place assets to provide liquidity, the trader’s real assets are stored in the smart contract that manages the collateral, so there is no unearned loss in the vAMM model.

- Low liquidity impact: vAMM’s liquidity is not dependent on the liquidity provider and comes directly from the collateral outside vAMM. In vAMM, traders themselves can provide liquidity to each other and do not need other liquidity providers. Therefore, liquidity is always present in vAMM.

- Asset diversification: Since no actual assets are exchanged, non-crypto related products such as stocks, funds, precious metals, etc. can be easily launched for trading

The RLP index contract is a liquidity token representing a basket of assets, including BTC, ETH, UNI, USDT, USDC, and more. 50% are stable coins, and 50% are non-stable coins. Users can deposit these assets to mint RLP tokens, provide liquidity to the protocol, and earn rewards. When traders make a profit, the RLP team pays them the corresponding profit. Conversely, when traders experience a loss, it becomes income for the RLP team. The liquidity token in this context is provided by the RLP, which represents the asset index, hence the name “index contract”.

Trade

Click “Long” or “Short” depending on which side you want to open a leveraged position on.

- Buy position

- Make a profit if the price of the token goes up

- Take a loss if the price of the token falls

- Sell position

- Make a profit if the price of the token drops

- Take a loss if the price of the token goes up

After choosing your side, enter the amount you want to pay and the leverage you want to use. At this stage, Rollup Finance supports a maximum leverage of 30x.

In the RUSD perpetual contract, RUSD is a liquidity token. Users can deposit stablecoins like USDT, USDC to mint RUSD and provide liquidity to the protocol in exchange for rewards. RUSD is used as a settlement asset for traders’ profits and losses. The RUSD perpetual contract will support multiple altcoin contract trading pairs, and anyone can sign up for the RUSD perpetual contract for the altcoins they support.

Besides that, users can also trade through margin contracts with coins that allow Rollup.finance to access a large amount of assets without permission, like Uniswap, to gain a large number of users. maximum transaction. Anyone can open a coin margin contract for any coin without permission. In addition, anyone can deposit any asset to provide liquidity to the protocol and earn rewards.

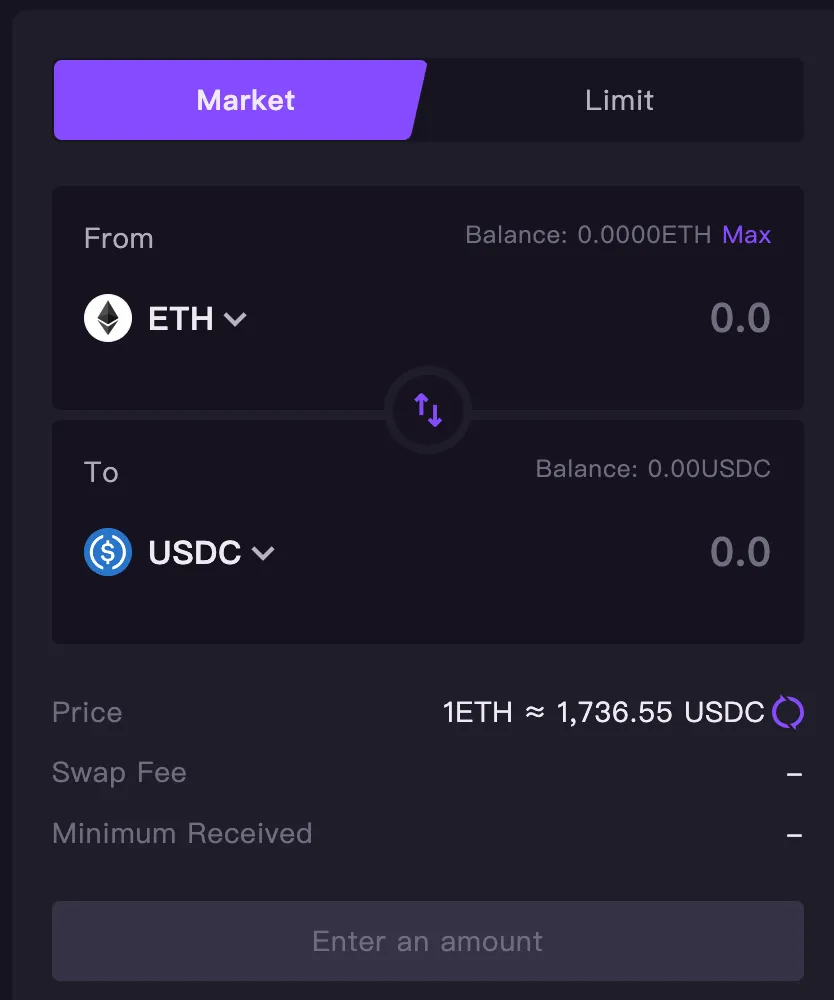

Swap

Rollup.finance supports both swaps and leverage trading. For swaps, click on the “Swap” tab on https://app.rollup.finance/#/Swap, this will open the interface to swap tokens with zero price impact.

Fees

Rollup.Finance reserves the right to change fee policy at any time.

- Position fee for perpetual trading: 0.1% of position size (open/close)

- Liquidation fee: $5

- Dynamic borrowing fee: Traders pay a borrowing fee every hour. The fee is calculated dynamically based on the asset utilization rate:(assets borrowed) / (total assets in the pool) * 0.01% per hour.

- Maximum borrowing fee: 0.01% per hour (at 100% utilization)

- Swap fee: ranging from 0.25% to 0.45%, around 0.35%

- LP minting and burning fee: 0% to 0.2%, around 0.1%.

- The base LP, minting and burning fee, is equal to 0.1%

- Each asset’s fee is dynamically determined to incentivize actions that bring the actual weight closer to the target weight.

- The minting and burning fee, whenever adding/removing liquidity, would bring the actual weight closer to the target weight, and vice versa.

- Execution Fee: 0.0015 ETH

- Keepers scan the blockchain for these requests and carry out their orders.

- The “Execution Fee” is the price of the second transaction that is shown in the confirmation box. The blockchain network is charged for this network fee. The execution charge is flexible and can change depending on how much gas the chain uses.

Tokenomic

ROP is the native token of Rollup.Finance, with a maximum supply of 150 million and an initial fixed supply of 100 million. The maximum supply of ROP is 150 million ROP depends on the Hedge Fund. When the Hedge Fund is activated, ROP will be minted, with a maximum minting amount of 50 million.

Token allocation:

- Protocol Incentives – 72.5 million ROP: The tokens will be allocated for Rollup. Finance’s protocol incentives, will be distributed to users through retroactive airdrops, RLP& RUSD incentives, trader incentives, and ROP staking.

- Team and core contributors – 20 million ROP: The release of ROP for the team and core contributors is 800,000 per month, which takes 25 months to complete the unlocking process.

- Protocol Development Fund – 7.5 million ROP: Used for initiatives that benefit the development of the protocol, such as Market promotion, Toke listing, ecosystem cooperation, and social welfare and etc.

- Risk Protection Fund- 50 million ROP: Activated when the price of RUSD falls below 1 USD. ROP will be minted and sold in exchange for USDC to maintain the RUSD price at or above 1 USD. The maximum minting quantity of ROP is 50,000,000.

DAO

Rollup.Finance DAO is used to manage the key parameters of the ROP protocol, which control the accumulation and distribution of the protocol. ROP governance proposals mainly include the following categories:

- Protocol Upgrade Proposals

- Funding Proposals

- Community Proposals

- Event Proposals

- Other Propos

Community governance has the power to control the value accumulation and distribution of the protocol:

- Adjust protocol fees

- Protocol fund management: manage funds in the protocol, including custody, use, and distribution.

- Protocol upgrades: upgrade the protocol, fix bugs, and add new features.

- Resolve the use and distribution of the community treasure.

Governance can also execute these on-chain functions:

- Time lock: setting and adjusting time locks.

- Governance parameters: such as voting cycles, threshold requirements, proposal approval methods, etc.

- More: based on the specific protocol, propose appropriate governance proposals to better achieve the protocol’s goal

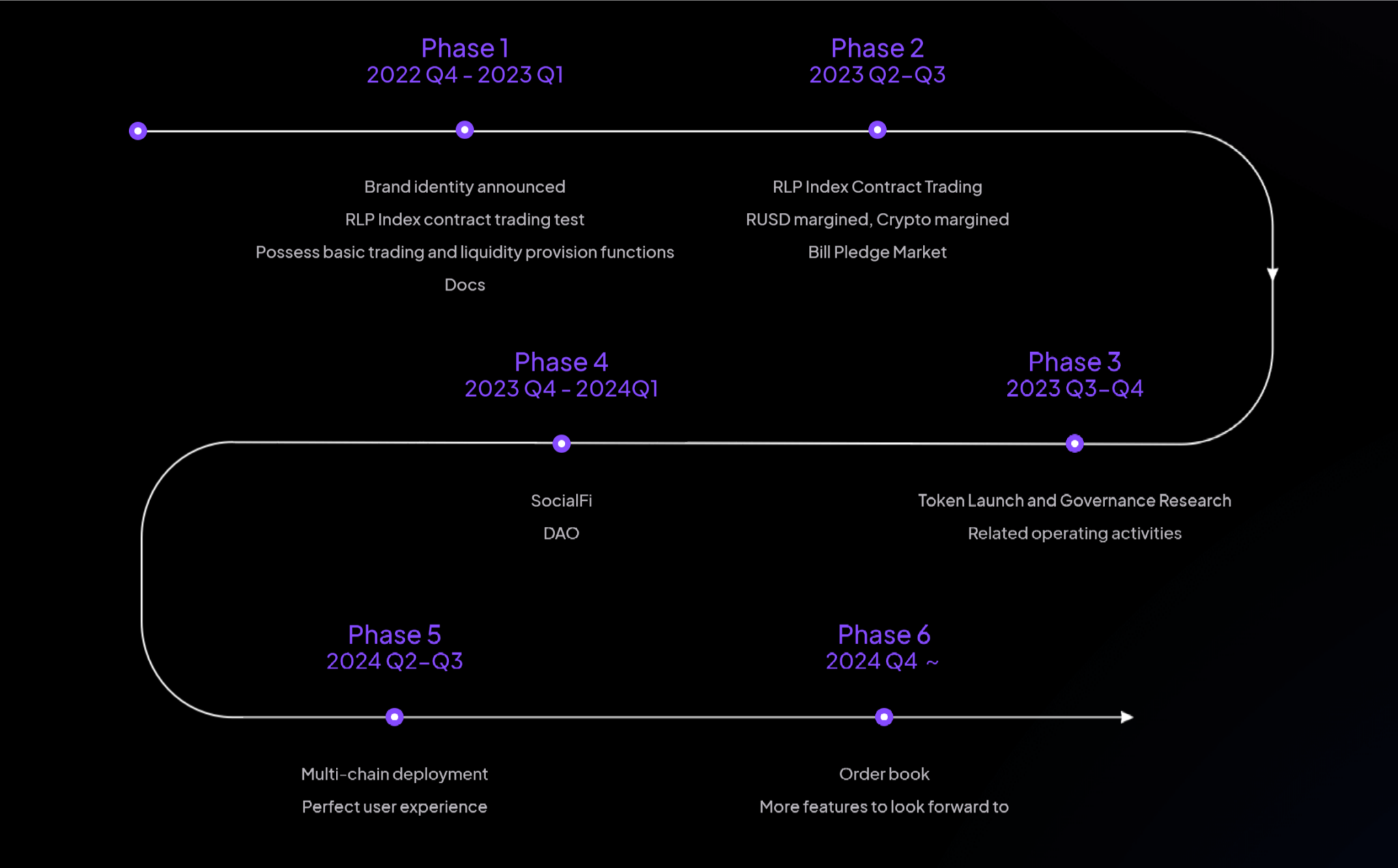

Roadmap

Team

CEO Boris Lee: Boris is a serial entrepreneur with deep experience in cryptocurrency market making, quantitative trading, cryptocurrency arbitrage, and has held key positions in well-known DEX startups.

CTO Albert: Albert is a passionate technical expert with more than 10 years of experience in the blockchain industry. He began to focus on DeFi research in 2017 and is familiar with multiple public chains such as Ethereum, BNBChain, EOS, and Solona.

Conclusion

Rollup.Finance regulates the smart market based on the vAMM algorithm to provide enough liquidity to the market along with zero slippage support, thereby providing high capital efficiency. Besides, the platform supports multi-project and multi-group decentralized perpetual contract on zksync with low cost and maximum leverage of 100x for trade and initial leverage is limited to 30x. This gives traders a wide range of options that can be highly profitable.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.