About Lido

Lido is a group of liquidity staking protocols on multiple blockchains headquartered on Ethereum. Liquidity refers to the ability of a user’s stake to become liquid. Upon a user’s deposit, Lido issues a stToken, representing the deposited asset along with all rewards and penalties accrued through deposit staking.

There are two versions of Lido’s stTokens, stETH and wstETH. Both tokens are ERC-20 tokens, but they reflect the cumulative staking rewards in different ways. stETH implements a rebasing mechanism, meaning the stETH balance increases periodically. In contrast, the wstETH balance remains constant, while the token will eventually increase in value (denominated in stETH).

Users will receive tokens when using Lido to stake their ETH on the Ethereum signaling chain. The Lido website is designed to solve the problems primarily related to the initial ETH 2.0 staking – inaccessible, illiquid, and unmovable. It helps to make staking ETH liquid and allows participation with any amount of ETH. Users can stake their ETH without locking their assets while engaging in online activities such as lending.

Unlike staking, this stToken is liquid – it can be transferred freely between parties, making it usable across various DeFi apps while still receiving daily deposit rewards. Preserving this property when integrating stTokens into any DeFi protocol is paramount.

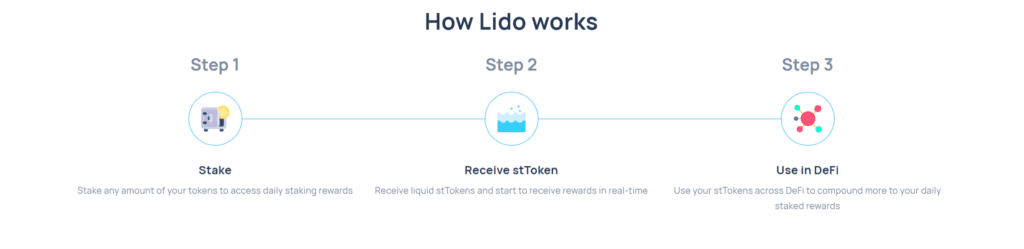

How does Lido work?

Lido allows users to earn staking rewards in cryptocurrencies without locking their assets or maintaining a staking infrastructure. Instead, users will receive stETH tokens on a 1:1 basis representing their staked ETH. stETH balance is updated daily to reflect your ETH staking reward and can be used like a regular ETH to earn interest and lending rewards. Furthermore, there is no lock or minimum deposit when staking with Lido. While using this platform, users will receive real-time safe staking rewards, further securing Ethereum without the potential risks and risks involved. These rewards are then updated daily at noon UTC.

Main features of Lido

Lido has become one of the top choices of traders and investors due to its industry-leading features. Some of them include the following:

Who is Lido for?

Lido Finance is an excellent option for many who have seen ETH as a possible way to earn money in crypto. Instead of buying and holding ETH hoping that the price will rise, you can bet as much or as little as you want while still using the derivative token elsewhere.

- Crypto investors are new to staking and want a user-friendly platform where they can stake their ETH.

- Cryptocurrency enthusiasts want to learn more about the potential of the staking-as-a-service model.

- Investors feel confident in staking and want to be able to move their staked ETH across different DeFi protocols freely.

Liquid staking

Traditionally, staking on projects based on the Proof-of-Stake (PoS) protocol has been about locking up one’s tokens in a project for a long time and expecting a fixed staking reward predetermined, predefined in return. While it guarantees returns on staked tokens just like a bond, it also limits the chances of generating higher returns for those tokens from the DeFi ecosystem. If you have staked all your crypto holdings, you cannot invest or trade more profitable crypto pairs on exchanges.

Liquid staking allows stToken to be used in other trading opportunities to enable users to get the best of both worlds – rewards on your staked tokens and profits from New trading opportunities. Liquid bets offer various fundamental benefits:

- Make the staking process simple – no need to worry about hardware setup and maintenance;

- Make it possible for users to receive rewards with as small of a deposit as they want (ie Ethereum requires a minimum of 32 ETH bets);

- Provide st[token] building blocks for other applications and protocols (e.g. as collateral in lending or other transactional DeFi solutions). Liquid bets offer an opportunity to maximize potential while getting the best of both worlds;

- Provides an alternative to exchange staking, staking alone, and other decentralized and semi-custodial protocols.

In addition, it is possible to make bets through centralized exchanges. Crypto tokens and CeFi don’t fit together from a fundamental point of view. The economic aspect should also be mentioned – by staking in some centralized entity, in return, the user does not receive the corresponding token and, thus, loses the opportunity to perform any further operations in DeFi or the same centralized entity where the tokens have been staked. Yes, APR, when staking on centralized exchanges can be higher, but with a significant amount aggregated in the centralized entity, there will be a potentially massive impact on the underlying designed ecosystem version is decentralized.

Using a liquid staking solution like Lido, users can eliminate these inconveniences and benefit from non-custodial staking backed by industry leaders. Liquidity staking is unlocking the potential of PoS by giving users the ability to not only stake their tokens but also have the liquidity to use those tokens in DeFi projects in a way that increases not only individual rewards but also increases staking participation in general.

Lido Dao

The Lido DAO is a Decentralized Autonomous Organization that develops the Ethereum liquidity staking system. It aims to solve the problems for Ethereum 2.0 with unattended staking. Users can stake their ETH using the Lido staking solution to avoid constraints such as asset-locking requirements.

The rewards on the Lido DAO cryptocurrency platform are dual. In addition to incentives earned from staking tokens on the Layer 1 network, Lido DAO users receive rewards through staking rewards tokens pegged 1:1 to the underlying staked asset.

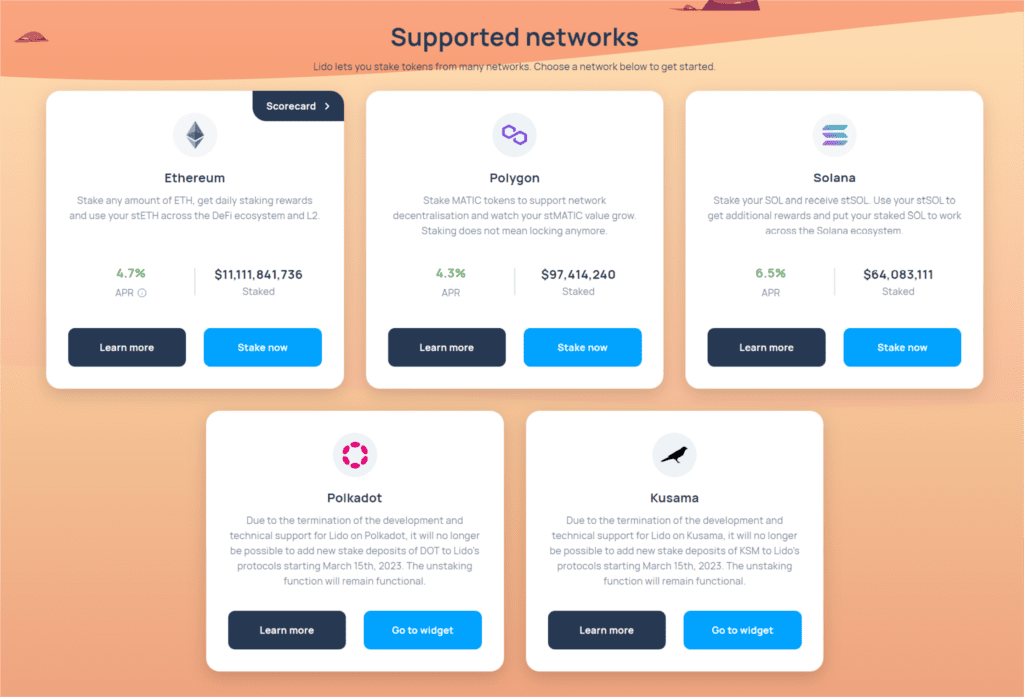

In the early stages, Lido mainly focused on Ethereum. Expansion of Solana, Polygon, Polkadot, Kusama chains is available.

Lido token

stETH

The stETH token represents Lido user deposits, penalty reduction, and staking rewards, respectively. It is a liquid alternative to staking Ether and can be transferred, traded or used in DeFi applications. It can also be used in various decentralized financial products just like it can be used as collateral.

stETH is an ERC20 token that represents Ether staked with this platform. Unlike staking Ether, it is liquid and can be transferred, traded, or used in DeFi applications. The total stETH supply reflects the amount of Ether deposited into the protocol with the staking reward minus potential validators’ penalties. The stETH tokens are minted on ether deposit at a 1:1 ratio. When withdrawing from the Beacon chain will be introduced, you can also exchange Ether by burning stETH in the same 1:1 ratio.

Lido has implemented staking limits to reduce the impact of post-Consolidation staking increases on its staking queue and socialization reward distribution model.

stETH is a resoldable ERC-20 token. Normally, stETH token balance is recalculated daily as Lido oracle reports Beacon chain ether balance update. Updating stETH balances happens automatically on all addresses holding stETH at the time of rebase.

LDO

Lido’s mission with Lido DAO is to distribute all decision-making power to create a trustless staking service built on community growth and self-sustainability. Users can purchase this token from various popular exchanges such as Uniswap, DeversiFi, SushiSwap, Hotbit, Hoo, and Bilaxy.

Key Metrics

- Token Name: LDO token.

- Ticker: LDO.

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: https://etherscan.io/token/0x5a98fcbea516cf06857215779fd812ca3bef1b32

- Token type: Governance.

- Total Supply: 1,000,000,000 LDO.

- Circulating Supply: 868,700,541 LDO.

Token Allocation

- DAO Treasury: 36.32%

- Investors: 22.18%

- Initial Lido Developers: 20%

- Founders & Future Employees: 15%

- Validators & Signature Holders: 6.5%

Fee

While staking bonus fees are not uncommon in staking services, Lido charges a 10% staking bonus fee on any money you earn. This 10% fee is split between node operators and the protocol’s treasury.

Depending on your situation and location, ether rewards from staking with Lido may be taxable. While tax regulations are not Lido’s fault, its decentralized financial nature means you won’t get the tax forms you need to report income easily from staking ETH.

Pros and cons of Lido Finance?

How to Stake Ethereum on Lido?

Step 1: Go to Lido and then tap ‘Connect Wallet’ present in the upper right corner of the screen.

Step 2:You will be redirected to several wallet options where you need to choose a preferred one. You can now view your ETH balance in the Lido widget because you have connected your wallet to Lido.

Step 3: Enter the amount of ETH you want to deposit and then press Stake. Before confirming, note that you will now be able to view your stETH Balance, Transaction Fees and Annual Percentage.

Step 4: Now, confirm the transaction in your wallet.

Step 5: Finally, you should now see the amount of ETH you have staked in stETH. You will be able to see your staking rewards reflected daily as your stETH balance is also updated daily.

Conclusion

Lido is doing everything right: it offers superior staking services with a simplified user interface, collects competitive fees, provides liquidity for ETH staking, and offers generous referral rewards launched and supported by foremost industry leaders. With its staking model, users can stake their tokens and get the equivalent amount pegged to their stake for productive farming in the ecosystem DeFi state. Although it has risks associated with staking, it is still working hard to make it risk-free for every user.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.