- Polygon’s fees and revenue plummeted over the last 90 days.

- Supply distribution was bearish, but open interest declined.

Polygon’s [MATIC] network stats have stagnated over the past few months, which suggests decreased usage. However, Polygon’s gaming ecosystem has been flourishing with its latest partnership. Are achievements in the gaming space enough for the blockchain to recover?

Is your portfolio green? Check the Polygon Profit Calculator

Polygon’s dwindling network stats

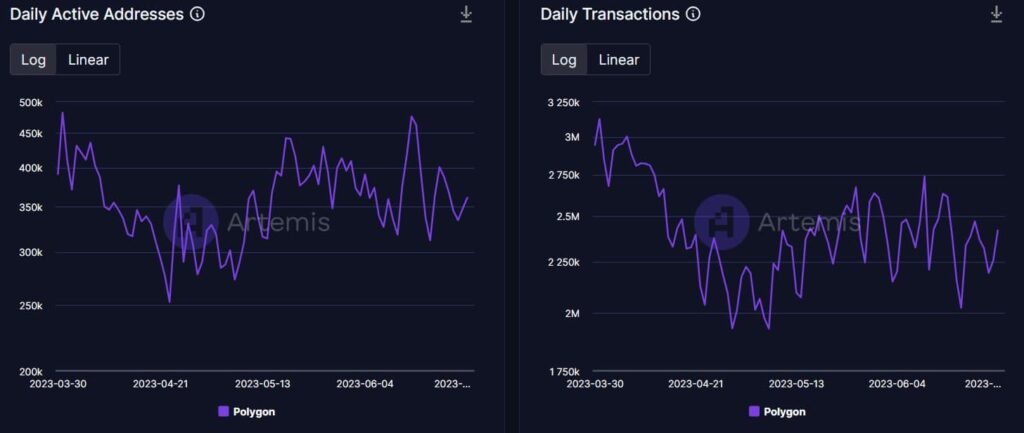

Artemis’ data revealed that Polygon’s daily active addresses plateaued over the last three months. A similar trend was also seen in the number of daily transactions, suggesting a decline in usage and adoption. Additionally, the network’s value also registered a decline, which was evident from the drop in its TVL.

Source: Artemis

To add to the story, the decline in Polygon’s usage was also proven by its network fees. As per Token Terminal, the blockchain network fees declined sharply over the last 90 days. Thanks to that drop, the blockchain’s revenue also plummeted, which looked concerning for the network.

Source: Token Terminal

Gaming ecosystem thrives

While Polygon’s key stats dwindled, its gaming ecosystem, on the other hand, flourished. This happened primarily because of its recent partnership with Immutable.

Robbie Ferguson, co-founder of Immutable, mentioned in a tweet about the deal. As per the tweet, Immutable onboarded more games last month than ever in its lifetime.

Sandeep Nailwal, co-founder of Polygon, said in a separate tweet that with Immutable’s behemoth of a AAA gaming ecosystem, Polygon’s zk powered Appchains have become the de facto for gaming. Now, whether the growth in gaming will be enough for the blockchain to stabilize its statistics is a question only time can answer.

MATIC investors are having hardships

Amidst all this, MATIC’s price registered a decline in the last 24 hours, which was concerning. According to CoinMarketCap, MATIC’s price declined by more than 2% in the last 24 hours. At the time of writing, it was trading at $0.6396 with a market capitalization of over $5.9 billion, making it the 13th largest crypto. A look at MATIC’s supply distribution gave more reasons for concern.

For instance, its supply on exchanges increased while its supply outside of exchanges declined. This is a typical bearish signal. Additionally, the percentage of supply held by top addresses also declined slightly.

Source: Santiment

Read Polygon’s [MATIC] Price Prediction 2023-24

Polygon’s days can get colder

As per Coinglass, Polygon’s open interest has declined. A plummet in the metric generally means that the on-going price trend can come to an end.

Therefore, the chances of a trend reversal can’t be ruled out. However, CryptoQuant’s data revealed that MATIC’s exchange reserve was increasing, suggesting that it was under selling pressure.

Source: Coinglass