- Polkaot has completed its whitepaper.

- DOT has risen by over 9% in the current quarter.

The year marked a significant turning point for Polkadot [DOT]. A closer look at its performance in the third quarter reveals both strengths and weaknesses of the network.

Read Polkadot (DOT) Price Prediction 2023-24

Polkadot 1.0 completed

According to a recent analysis conducted by Messari, Polkadot showed significant progress during Q3 of the year, with key developments highlighted.

The report showed several key developments, including the completion of the whitepaper. The completion of the white paper also marked the completion of Polkadot 1.0.

Furthermore, this has led to the commencement of discussions about Polkadot 2.0. Additionally, the network introduced various enhancements, such as Asynchronous Backing.

Additionally, one notable metric that improved was the DOT staking percentage. The percentage increased by 12% quarter-over-quarter, reaching 49%.

However, this increase led to reduced staking rewards. Also, it led to a corresponding 12% quarter-over-quarter decline in the annualized nominal yield to 15%.

Despite these positive developments, the report also revealed a concerning trend of declining active addresses on the network.

Daily active addresses have been decreasing quarter-over-quarter, with 6,900 at the end of the first quarter. It dropped to 5,800 by the end of the second quarter and further declined to 5,200 in the third quarter.

Developer activity maintains momentum

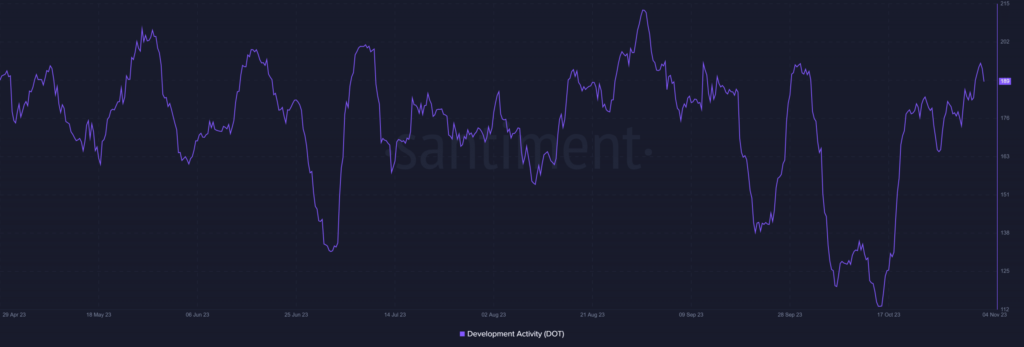

According to an analysis of the development activity chart, Polkadot has consistently maintained a strong level of developer contributions.

The chart indicates a history of high developer activity on the network. Although, a slight decline could also be observed as of this writing.

Source: Santiment

Furthermore, there is a high chance that development activity might increase. The possible increase is due to the ongoing discussions about a new version of the network. There is potential for an upswing in developer activity once this new iteration is activated.

Polkadot’s fortunes improve

A look at Polkadot’s daily price trend chart revealed a fall in its value at the end of Q3. During this period, DOT experienced a significant loss in value, falling by more than 22%.

At the start of July, it was trading at around $5.35 but had fallen to around $4.11 by the end of September.

Source: TradingView

Realistic or not, here’s DOT’s market cap in BTC terms

However, in the current quarter, Polkadot’s performance has improved. A notable increase in value of over 9% has been recorded so far. At the time of writing, it was trading at around $4.7, with a slight increase of less than 1%.

Also, it was currently in a bullish trend, as indicated by its Relative Strength Index (RSI). It was trending slightly below 80, signifying a very strong bullish trend.