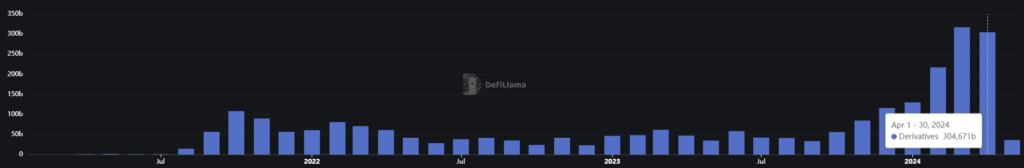

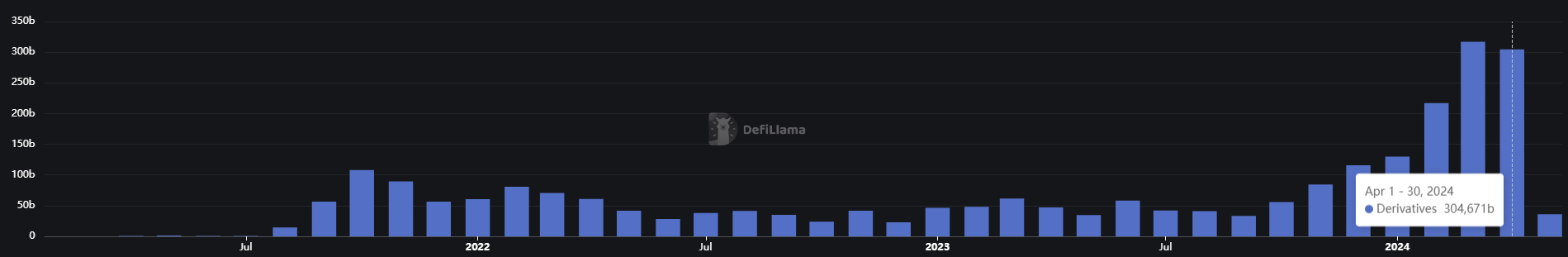

Decentralized perpetual contracts exchanges (perp DEX) registered an all-time high in monthly trading volume in March at $317 billion, according to data aggregator DefiLlama. Despite a slight slump in April to $304 billion, the volume managed to stay above the $300 billion mark and represents a 395% year-on-year growth.

Imran Mohamad, CMO at Zeta Markets, points to different reasons behind the perp DEX rising momentum. The first one is the developments made within the decentralized finance (DeFi) ecosystem since the “DeFi Summer” happened in 2020.

“I think DeFi Summer happened, and then you can start seeing a lot more DeFi innovation. And I think now you can see that DeFi is starting to gain a lot more prominence and interest, especially led by ecosystems like Solana, where they really focus on a unified user experience and making it easier for people to onboard,” stated Mohamad. “So you have all these enabling a lot more accessible transactions, a lot more accessible, they enable a lot more user-facing DApps to operate.”

Solana shows the largest growth in derivatives trading volume in the last 30 days, jumping 244%, while it shows the second-largest weekly leap. Zeta Markets is the major driving force behind this growth in the perp DEX sector, as its volume soared by 397% in the last 30 days and 188% in the past week, suggesting gradual and sustainable growth.

Moreover, Mohamad mentions the current airdrop mania and its points system, which consists of protocols rewarding users for interacting with their products. This strategy is commonly applied by perp DEX, and the results can be seen in the Ethereum layer-2 blockchain Blast numbers.

Through points rewards offered by different perp DEX in their ecosystem, Blast managed to soar in derivatives trading and it is dominating weekly volumes for the third consecutive week.

“The points are feeding a lot of retail interest, because people go ‘okay, if I have points, I get it, I understand what I need to do.’ Before, this was coded, like hidden messages in what the protocols were saying. And now with points, retail users know what they can work with,” shared Mohamad.

Competing with centralized exchanges

Centralized exchanges Binance and OKX were responsible for over $70 billion in derivatives trading volume in the last 24 hours, almost 25% of the April trading volume registered by perp DEX. This highlights how centralized platforms are still significantly more popular when it comes to derivatives trading.

However, Mohamad sees two DeFi features that could start capturing more retail investors using centralized exchanges currently, the first one being self-custody.

“In a centralized exchange, I don’t have access or custody of my assets. So no matter what happens, we can never fully prevent another FTX from happening. It’s not because the technology is ineffective. It’s not because regulators can’t do the job. It’s because that is an inherent flaw in custody.”

The second feature mentioned by Zeta Markets’ CMO is the possibility users have to influence perp DEX decisions through governance tokens. Mohamad uses Zeta Markets’ soon-to-launch native token Z, which will have a vote escrow model consisting of users being able to influence what affects them directly.

“What features should we include? Where should we direct rewards? How should we direct rewards? So these are things that if I’m a centralized exchange trader today, I cannot influence. I have zero say in how rewards are distributed. I have zero say in what’s going to happen in the protocol. I think you see what Jupiter has been doing with their working group proposals, they’ve done an extremely great job to get the community involved in working groups.”

Nevertheless, he highlights that DeFi must go through multiple developments in its infrastructure to really compete with the centralized ecosystem, such as lower-latency transactions and better price accuracy.