As the conflict intensifies, all eyes turn to two main players, PenPie and Equilibria, due to Stake DAO’s limited traction in the vePENDLE arena. In this article, Coincu delves into the current situation of the Pendle War.

Causes of Pendle War

With its unique features and tools, Pendle empowers users to maximize interest rates, increase yields during bull markets, and offer hedging plans during bear markets.

At its core, Pendle utilizes three main tools to achieve its objectives. First is the concept of yield tokenization, which involves creating encrypted versions of tokens that yield on the Pendle platform. These yield tokens (PT and YT) are crucial for participating in Pendle’s ecosystem.

The second tool is Pendle’s Automated Market Maker (AMM), allowing users to trade the PT and YT yield tokens, enabling them to capitalize on fluctuating yields in response to token price movements and other market factors.

The third tool is governance, where Pendle leverages vePendle for project administration. This mechanism incentivizes projects to accumulate and acquire vePENDLE, sparking a governance battle within the DeFi market, known as Pendle War.

Pendle War revolves around projects competing for vePENDLE and attempting to attract holders from the parent project to their own child projects. The allure lies in the possibility of acquiring a substantial amount of veTokens, which confers greater power in directing incentives, rewards, and emission flows into the pools for their benefit.

The ongoing Pendle War currently features a heated competition between two major projects, Equilibria (ePENDLE) and Penpie (mPENDLE), with others such as Stake DAO and Swell Network also joining the fray. As more projects are expected to participate in the near future, users stand to benefit from the optimized yield sources created by these subprojects.

The success of Pendle is evident in the continuous inflow of funds, propelling its Total Value Locked (TVL) to new all-time highs. According to Defilama, Pendle’s TVL has surged nearly tenfold since the beginning of the year, growing from $15 million to an impressive $150 million.

In addition to the TVL growth, the native token PENDLE has experienced significant price appreciation despite the overall market being in a downtrend. The token’s value surged from $0.04 to approximately $1, marking an impressive 25-fold increase in the second half of 2023. Furthermore, Pendle’s listing on Binance on July 3 has attracted additional attention and interest from the market.

Another factor fueling Pendle’s growth is its association with the booming LSDFi (Leveraged Staking DeFi) array. As LSDFi’s TVL continues to climb, Pendle’s prominence within this segment also rises. Reports from reputable organizations like Binance Research have contributed to a surge in community attention towards LSDFi and Pendle.

Pendle has created a new market in the Crypto market that is DeFi Yield – Trading Protocol. With Pendle, users can build strategies to generate profits from their own future profits. Currently, the assets that Pendle is aiming for are LST (Liquid Staking Token), such as sfxrETH, stETH. It can be said that up to the present time, Pendle is doing one of the platforms leading the recent LSDfi trend.

Pendle’s veToken model has some of the following characteristics:

It can be seen that the model of vePENDLE has many similarities with the model of veCRV. The key point here is that Pendle must have a large revenue stream, which is currently being shown when TVL and volume on Pendle are still growing very well.

This has opened up a real war that is Pendle War. In this war, two names are competing fiercely, which are Penpie and Equilibria. Now we’ll take a closer look at this war to see who is benefiting and which project’s strategy will help them win the Pendle War.

Overview of Pendle War

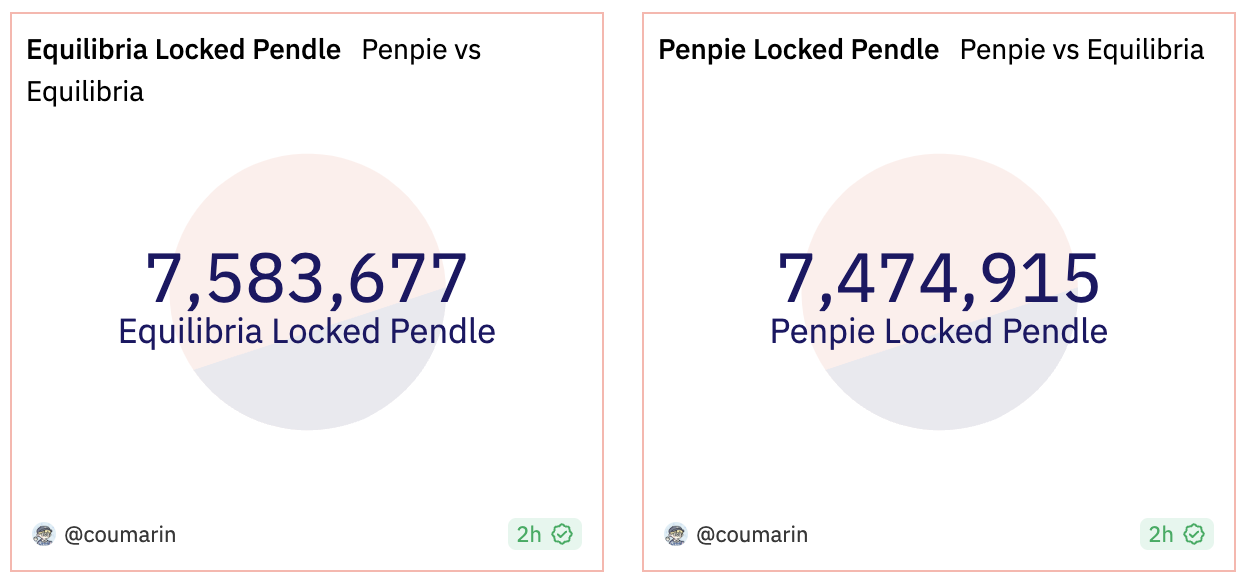

PenPie and Equilibria, are currently engaged in a heated battle for dominance in the Pendle War. The focus lies on their vePENDLE holdings, with both projects accounting for a substantial amount of this coveted asset, while Stake DAO trails behind with a mere 2.99 percent share.

VePENDLE, an essential asset for yield optimization, serves as the battleground for PenPie and Equilibria, and understanding their respective approaches is crucial.

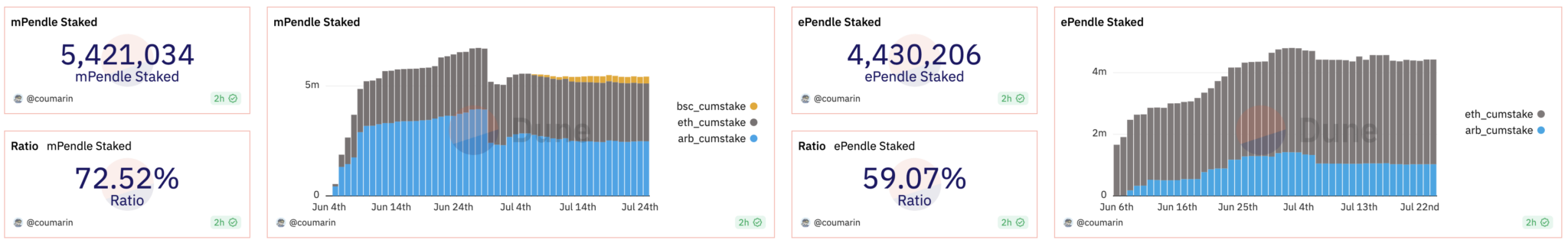

- PenPie, a robust Yield Farming platform, is deployed on both Ethereum and Arbitrum chains. The vePENDLE amount on PenPie is calculated by combining holdings on both chains, offering users the potential for higher rewards.

- On the other hand, Equilibria also operates on two chains but solely calculates its vePENDLE amount on Ethereum. Although it provides a Yield Farming solution for vePENDLE holders, it lacks the cumulative approach offered by PenPie.

A Brief Introduction to PenPie and Equilibria:

- PenPie, designed by the Magpie team, aims to maximize profits for PENDLE holders. It leverages the expertise gained from the successful Wombat Wars project on both BNB Chain and Arbitrum.

- Equilibria, on the other hand, provides a platform for PENDLE holders to profit from vePENDLE without the concern of locked assets in the protocol.

The Battle Factors

In this Pendle War clash, several factors will determine the ultimate victor:

- APR from PENDLE deposits: PenPie holds a clear advantage in terms of profitability metrics for PENDLE depositors into the protocol. Its higher APR attracts users seeking greater returns.

- Peg holding during AMM switches: The ability to maintain the peg when users switch back to PENDLE on the AMM is a crucial factor. Both platforms will be evaluated based on their efficiency in this regard.

- Native tokens for Liquidity Mining: The availability of remaining Native Tokens to use for Liquidity Mining will play a significant role in attracting users and Total Value Locked (TVL).

- Team Experience: The development teams’ experience in similar battles will be a determinant in ensuring a robust and reliable platform.

Current Status

As of now, both platforms hold a comparable amount of vePENDLE. PenPie, apart from its substantial vePENDLE holdings, has also established itself as a successful project on Camelot, the premier Launchpad platform on the Arbitrum ecosystem. Its token price has experienced a fivefold increase compared to the initial IDO price, adding to its allure for users.

Equilibria, while offering a slightly better option for compounding Pendle profits, faces stiff competition from PenPie. Both platforms have recently launched their native tokens, creating incentives to attract users, with TVL levels remaining on par.

Conclusion

The Pendle War is in full swing, with PenPie and Equilibria battling it out for supremacy in the yield farming landscape. PenPie’s cumulative vePENDLE holdings, higher APR, and successful track record provide a competitive edge. However, Equilibria’s unique proposition for mitigating locked assets may also resonate with some users. As the war unfolds, factors like user adoption, community support, and platform innovation will ultimately determine the winner in this highly contested arena.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.