advanced

OTC trading is a method of trading financial assets, including cryptocurrencies, that takes place directly between two parties without the oversight of an exchange. This decentralized form of trading is particularly favored by big players, such as hedge funds, looking for a private and efficient way to conduct large transactions without impacting the market price. Naturally, its format also attracts many crypto investors.

However, OTC trading comes with its own set of challenges. Due to less regulatory oversight, it may suffer from a lack of investor interest, affecting its liquidity. In this article, I will outline both the benefits and risks that you can encounter when you trade OTC stocks or crypto. Let’s dive in!

Over-the-Counter (OTC) Trading Definition

Over-the-Counter (OTC) trading refers to a method of trading that occurs directly between two parties without the supervision of an exchange. This trading happens via a decentralized market rather than on a centralized exchange. In OTC markets, trading can involve a broad range of assets — from commodities to financial instruments like stocks and cryptos. The key point here is that OTC trading bypasses the traditional mediums of stock market exchanges.

What Is an OTC Market?

An over-the-counter market is a decentralized market where the trading of financial instruments, such as stocks, commodities, currencies, or derivatives, takes place. This contrasts with auction markets (such as the New York Stock Exchange or Nasdaq), which are characterized by a physical location.

The OTC Markets Group, a crucial player in this domain, categorizes OTC-traded companies into three tiers based on various factors, including financial standards, corporate governance, and disclosure practices. These tiers are OTCQX (the top tier), OTCQB (the venture market), and OTC Pink (the pink market).

While market participants can trade blue-chip stocks, most OTC securities are from smaller companies. These may include penny stocks from early-stage or growth companies or securities from shell companies and larger foreign companies that don’t meet the eligibility requirements to be listed on a major exchange in the U.S.

Can You Trade Crypto in OTC Markets?

Yes, cryptocurrencies can indeed be traded in OTC markets. In fact, OTC trading desks have become a notable part of the cryptocurrency world, especially for larger trades. Crypto OTC trades can occur through email, private messages, or dedicated electronic platform trading systems.

via GIPHY

OTC trading lets you bypass third parties and exchange crypto in a more direct way.

Just like the way market makers facilitate the buying and selling of traditional OTC securities, they also play a critical role in the crypto OTC market, providing liquidity and setting the share price of the crypto coins. The market makers ensure there is enough trading volume to allow market participants to buy or sell a significant amount of a specific cryptocurrency without substantially moving the market price.

Types of OTC Securities

OTC markets facilitate the trading of a variety of securities, including:

- Equities – these often involve penny stocks or shares of smaller companies, as well as stocks of larger foreign companies that don’t qualify for listing on a major exchange.

- Derivatives – these are complex financial instruments whose value is derived from underlying assets like stocks, bonds, commodities, or cryptocurrencies.

- Bonds – corporate bonds, municipal bonds, and government bonds can be traded OTC.

- Cryptocurrencies – given the relatively decentralized nature of cryptocurrencies, OTC markets are a popular venue for trading these digital assets, especially for high-volume trades.

- Bank Certificates – bank certificates of deposit (CDs) can also be traded in OTC markets.

The Pros and Cons of OTC Trading

Pros:

- Flexibility and Convenience. OTC markets operate 24/7, enabling market participants to trade at any time. This is beneficial for cryptos, which also trade round the clock.

- Privacy. Since OTC trades don’t need to be publicly reported immediately, they offer greater privacy to traders.

- Less Market Impact. High-volume trades in OTC markets are less likely to affect the market price of a security, making them ideal for large trades.

Cons:

- Additional Risk. OTC trading carries additional risk due to the lack of regulatory oversight. This risk can be especially pronounced with penny stocks and cryptocurrencies, which are often subject to price manipulation.

- Lack of Transparency. OTC markets lack the transparency of exchanges, making it more difficult for traders to ascertain a fair market price.

- Regulatory Compliance. Especially for foreign companies, meeting regulatory compliance in OTC trading can sometimes be complex and time-consuming.

- Liquidity Risk. Some OTC securities may be less liquid than those traded on exchanges, potentially making it harder for traders to buy or sell them without impacting the market price.

In conclusion, while OTC markets offer an alternative trading venue for a range of securities, including cryptocurrencies, they also carry their own unique risks and challenges. Therefore, potential traders should carefully consider these factors and possibly seek professional advice before diving into OTC trading.

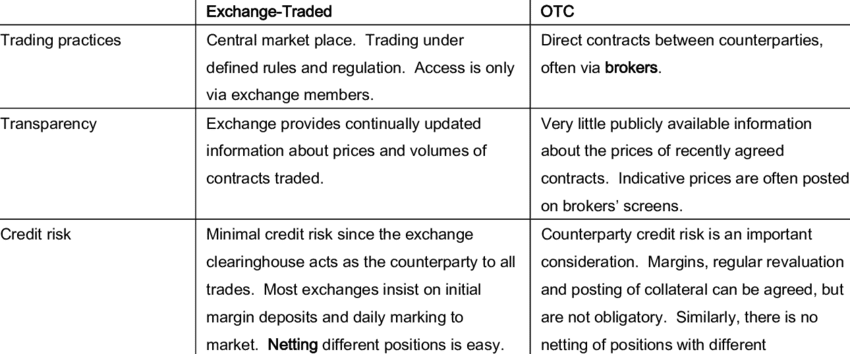

OTC vs. Exchange

OTC and exchange trading differ fundamentally in how transactions are conducted. In the OTC (Over-the-Counter) market, trading happens directly between two parties without the oversight of an exchange. It’s essentially a decentralized market without a physical location.

On the other hand, exchange trading, which happens on stock exchanges such as the NYSE and Nasdaq, is centralized. All trades are conducted and cleared via the exchange platform, ensuring transparency and regulatory compliance. In OTC markets, however, a broker-dealer network is responsible for conducting transactions.

The reporting standards also differ. OTC markets often have more lenient reporting requirements compared to exchanges. For example, while some OTC securities do report to the SEC (the US Securities and Exchange Commission), many others do not. This flexibility can be beneficial to smaller companies that can’t meet the stringent capital requirements of major exchanges.

How to Buy OTC Stocks and Crypto

Buying OTC stocks and cryptocurrencies isn’t truly different from purchasing other types of securities. You’ll need to follow these general steps:

- Find a Broker: Choose a broker that has access to the OTC market. Make sure it is registered with the Financial Industry Regulatory Authority (FINRA). If you’re looking to get OTC crypto, pick a platform that has great reviews and has proven to be reliable — and don’t forget to check out their security measures.

- Do Your Research: Research the investment merits of the OTC stock or crypto you want to buy. For stocks, this could involve reviewing the pink sheet listings.

- Place an Order: Once you’ve decided on an investment, place your order on your chosen platform. Be sure to specify the ticker symbol of the stock or the cryptocurrency.

Remember, OTC trades are less regulated than trades made on major exchanges. So, it’s essential to exercise due diligence before making investment decisions.

FAQ

What are OTC derivatives?

OTC derivatives are contracts that are traded (and privately negotiated) directly between two parties without going through an exchange or other intermediary. These derivatives transactions can involve various financial instruments like currencies, interest rates, commodities, or indices.

Unlike standardized exchange-traded derivatives, OTC derivatives are customized to fit the needs of the counterparty. The terms of these derivatives can be adjusted to accommodate future payments, notional amounts, and other specific needs of the parties involved.

OTC derivatives gained notoriety during the financial crisis of 2008, as they were a significant contributor to the financial system’s instability. As a result, the European Union and other jurisdictions have implemented regulations to increase transparency and limit risks related to OTC derivatives transactions.

What does OTC mean?

OTC stands for over-the-counter. In financial markets, OTC refers to the process of how securities are traded for companies not listed on an exchange. Securities traded over the counter are traded via a broker-dealer network rather than on a centralized exchange. These securities may include stocks, bonds, derivatives, or cryptocurrencies.

Are OTC stocks safe?

It’s important to remember that while OTC stocks can present big opportunities for gains, they also come with risks. Thus, it’s crucial for investors to thoroughly research any OTC stock before investing and consider seeking advice from a financial advisor or broker familiar with the OTC market.

As the safety of OTC stocks depends heavily on specific assets, it can vary widely. There are legitimate, well-run companies whose shares trade over the counter. Don’t forget to DYOR before investing in any OTC stocks.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.