Blockchain analytics platform Santiment says one key metric is flashing a signal that suggests a crypto market reversal is on the horizon.

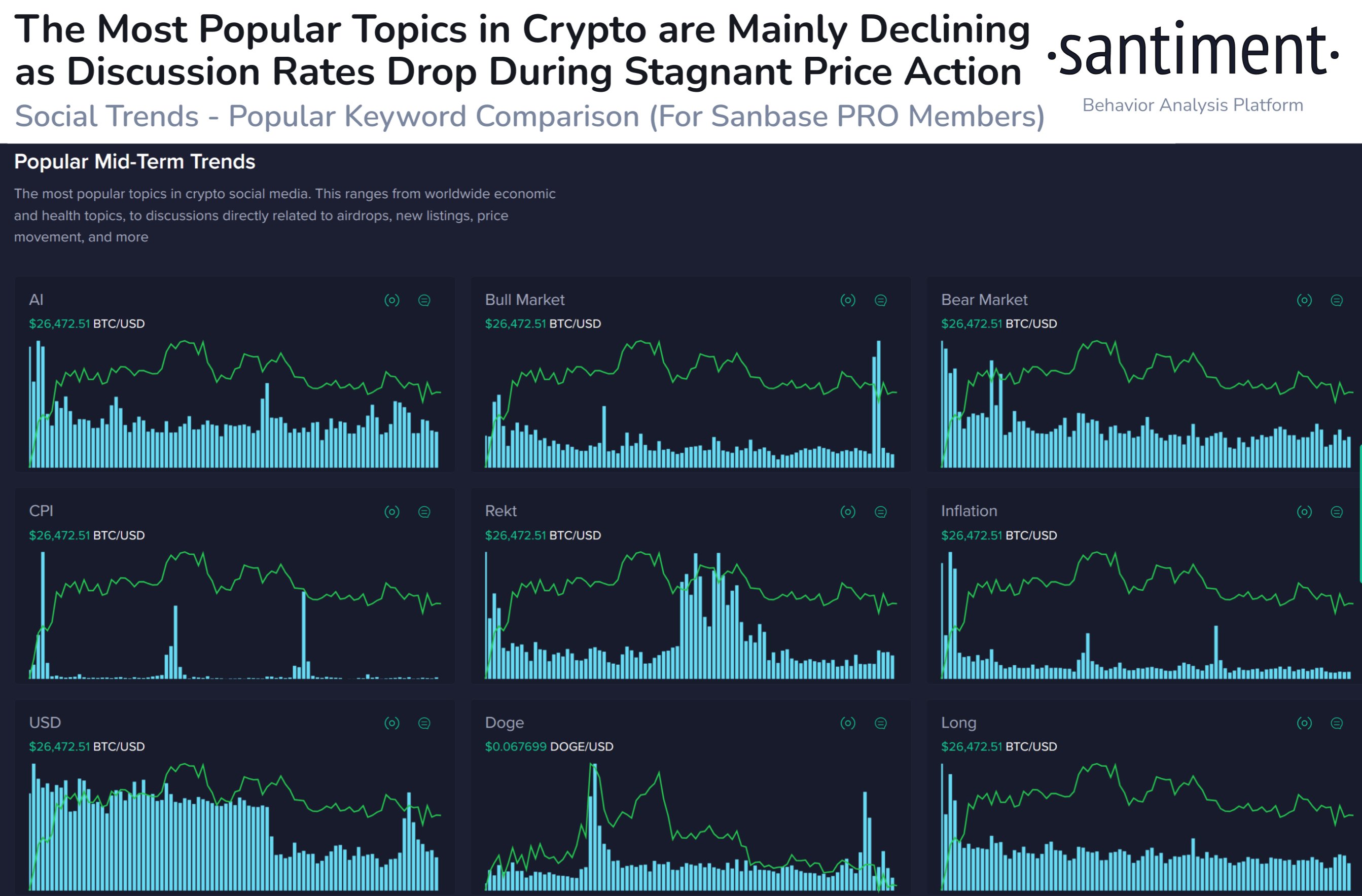

Santiment says that discussions using certain crypto terms on social media platforms are rapidly cooling off, indicating that the latest market dip may be close to reaching a bottom.

“Crypto discussion rates across Twitter, Telegram, Discord, Reddit, and 4Chan are dropping as traders show signs of disinterest. Look at these drop-offs as a sign that markets are getting closer to capitulation, which is traditionally bullish.”

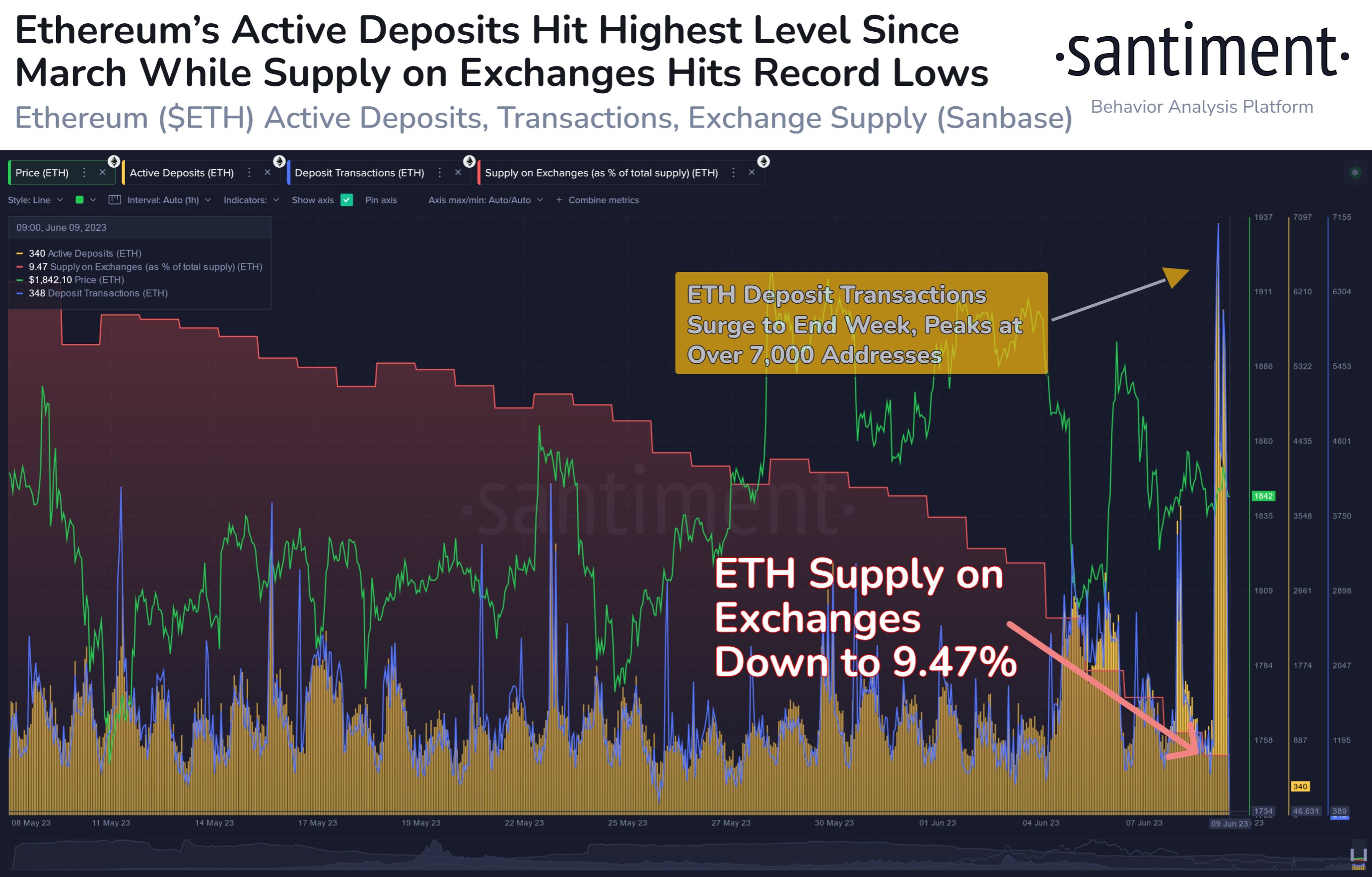

Next, Santiment notes that Ethereum’s (ETH) supply on crypto exchanges is approaching record lows, suggesting that the potential of future sell-offs may be limited for the leading altcoin.

However, the analytics firm warns that the next few days could be rocky for Ethereum as ETH’s deposit transactions skyrocketed to close out the week.

“Ethereum’s supply on exchanges continues falling to record lows, now at just 9.47%, which implies lower risk of a future sell-off. However, active deposit addresses just hit their highest level since March, implying this weekend could be volatile.”

Ethereum is worth $1,836 at time of writing, down 0.9% during the past 24 hours.

The blockchain analytics platform is also keeping an eye on the activities of Tether (USDT) whales and sharks. According to Santiment, USDT whales and sharks have accumulated the largest amount of Tether in history and have moved most of the stablecoin off of exchanges.

“There is an interesting correlation between Tether’s key shark and whale addresses and the amount of coins on exchanges. Wallets with $100,000 to $10 million in USDT now hold over $16 billion, and most of these coins are moving away from exchanges and into self-custody.”

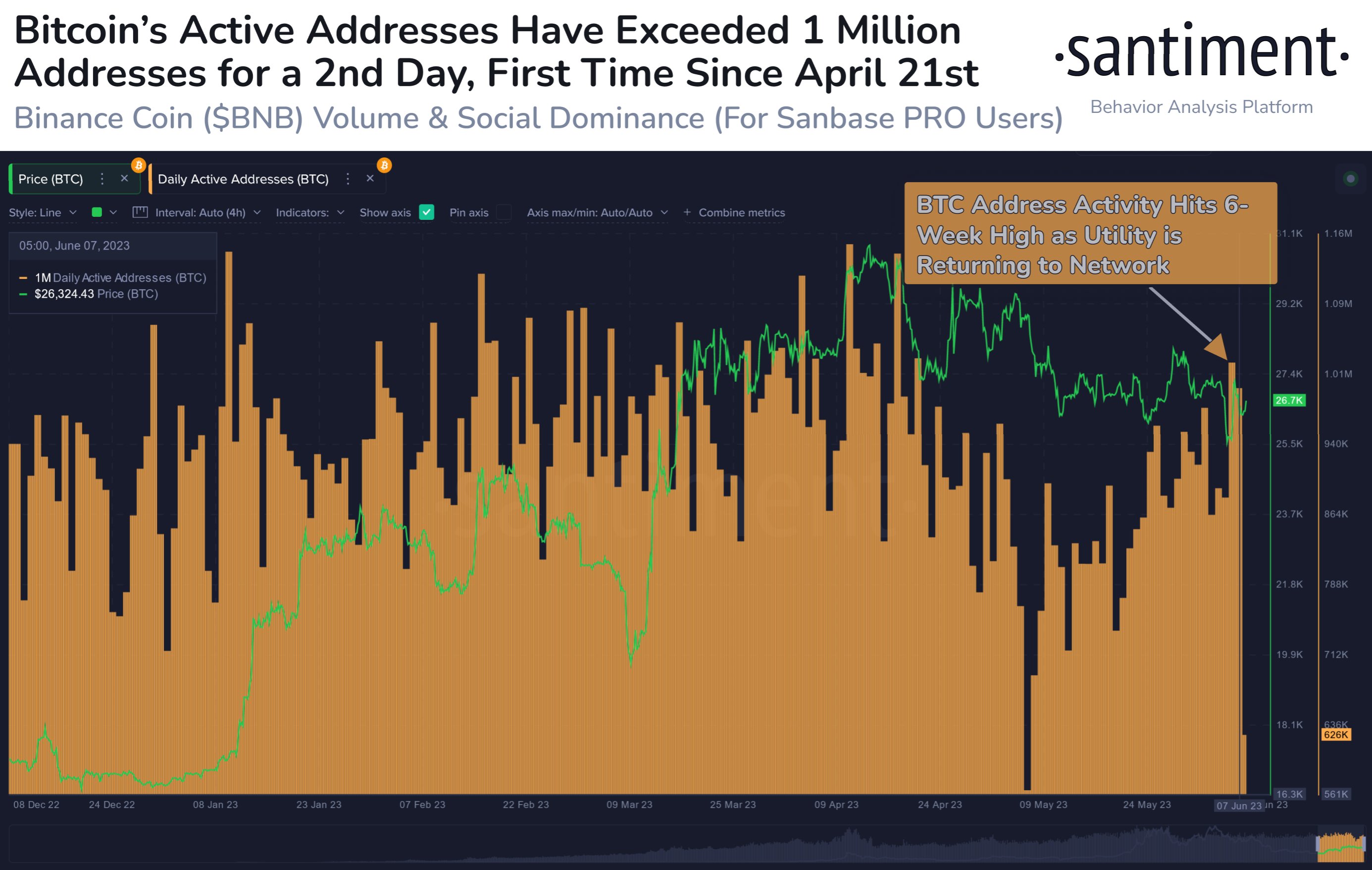

Lastly, Santiment says that the Bitcoin (BTC) network is seeing more active addresses. Active addresses show the number of distinct addresses that participated in transferring BTC on any given day.

According to Santiment, increasing active addresses could be seen as a bullish signal, especially if it is coupled with declining exchange deposits as it indicates growing coin utility without the risk of a potential sell-off.

“With volatility increasing market-wide, Bitcoin’s level of utility has picked up quite drastically. The amount of unique addresses interacting on the BTC network has exceeded one million in each of the past two days, the first time since April 21st.”

Bitcoin is trading for $26,450 at time of writing, down 0.6% during the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney