DeFi

Several on-chain positions are at risk of being liquidated following ether’s plunge to a two-month low of $1,373.

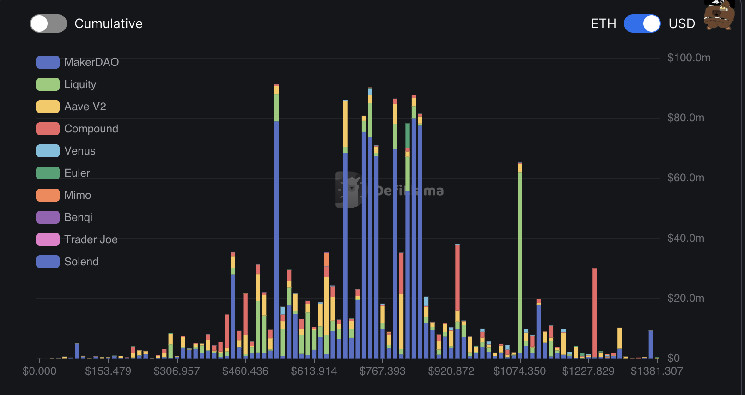

A $9.2 million position on MakerDAO will get liquidated at $1,367, while a $29.6 million position on decentralized finance (DeFi) lender Compound will get liquidated by the protocol’s smart contract at $1,241, according to DeFiLlama data.

On-chain liquidations occur when the value of collateral added by a user borrowing an asset slumps, and the user is then required to add more margin to avoid it being liquidated. Conversely, the user will also risk liquidation if the value of the borrowed asset rises beyond borrowing capacity.

CoinDesk reported yesterday that $300 million in derivatives positions on centralized exchanges had been liquidated, and that number has now increased to $400 million according to CoinGlass.

On decentralized exchanges and lending protocols, meanwhile, a total of $119.3 million is at risk of liquidation if the price of ether slumps by a further 20%.

Ether is trading 18.34% lower than its February high of $1,745 and 71.1% lower than its record high of $4,876.

A slide in equities coupled with a regulatory clamp down on crypto has sent the price of crypto assets spiraling. Bitcoin is currently down by 7.35% in the past 24 hours, trading at $20,050 per CoinDesk data, as fears of a bear market continuation intensify.