Last week a majority of the world learned that 95% of non-fungible tokens are worthless. Know who already knew this? Everyone still following NFTs.

Over time you get a feel for the market and develop a sixth sense for how it moves, what moves it, and what has value. Years of experience taught us that the NFT market runs in cycles, with the hot side of the market lasting usually just a few weeks, though the start of the calendar year’s run usually lasts for a few months.

Between these runs, most NFTs become completely illiquid and fade into oblivion. When the next cycle comes around they’re replaced by an entirely new crop of NFTs. If I were a betting man I’d say that probably 95% of NFTs become worthless between these cycles. That number only grows as more and more supply is created.

There’s a much more important story to tell about the NFT ecosystem than the “95% worthless” narrative that has everyone distracted. It’s that 94% of the market’s value has disappeared. Let me pose a couple of questions to demonstrate why this matters.

Would you measure the stock market by the number of stocks worth one cent or less and would you use bankrupt and failed businesses to represent the overall market value? If I told you that the value of IBM, Microsoft, Apple, and NVIDIA were down 95% wouldn’t that be more noteworthy?

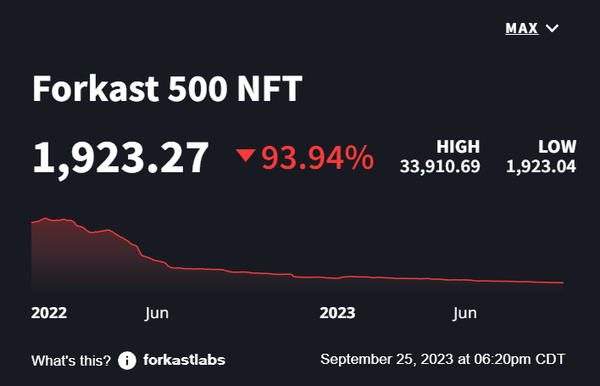

That is the real story in NFTs and it’s exactly the story that the Forkast 500 NFT Index has been telling us throughout the year. The top 500 NFT collections across blockchains represent a majority of the value of the NFT market so measuring them as a proxy of the market, like the S&P 500 is a proxy of the stock market, is the best way to measure the health of the NFT economy. This index reflects that the NFT market has lost nearly 94% of its value since its peak in 2022.

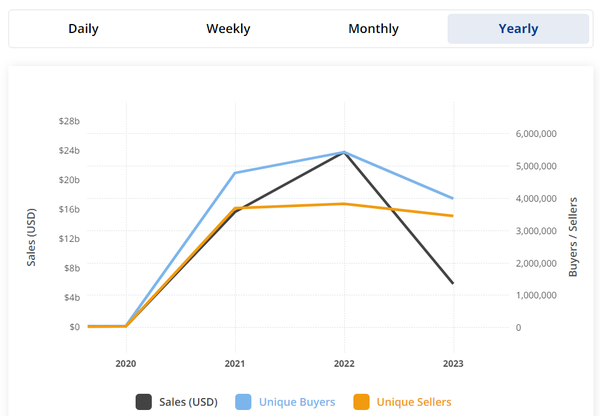

Most of us do not consider this bad news, especially if you were of the mind that NFTs were already overvalued. But, if we’re measuring the value of NFTs from their peak value to today, let’s also measure from the beginning when NFTs were also worth almost nothing. When you compare 2020’s data to the still incomplete 2023 we find some pretty enlightening facts.

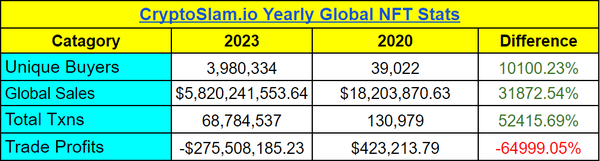

2020 compared to 2023

Already in 2023, unique buyers are up 10,100%, sales are up 31,837%, and total transactions are up 52,304%, all while trade profits are down 64,999%. Maybe most important is that for the most part, collectors and traders haven’t left the NFT economy, even with trade profits nowhere to be found. People believe in the tech, and they believe in the future that NFTs will power.

The conversation has now significantly changed, so let’s reset the room.

Is the value of the NFT ecosystem down from its peak? Yes.

Are NFTs still a world-changing technology? Yes.

Peep the charts

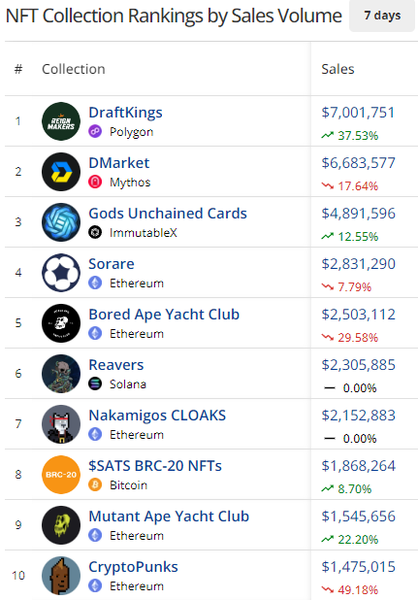

Source: CryptoSlam

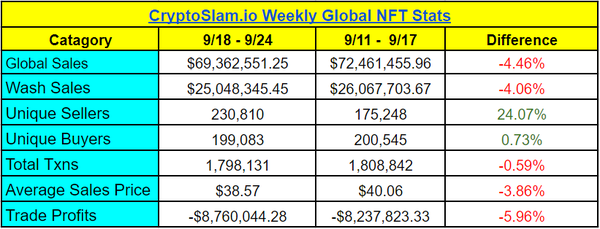

Last week was the fifth week in declining NFT sales but like last week, overall there seems to be some stabilization. The week’s numbers still mostly keep us on par with the action we saw in May and June 2021, and the next milestone would be falling to the US$30 million to US$55 million range that we saw in early 2021.

- DraftKings, DMarket, Gods Unchained, Sorare. “The Four” locked down the top four this week, combining to represent roughly 30% of last week’s total NFT sales volume.

- Reavers’ new mint gives Solana its first top ten collection since Tensorians made the elite list exactly 1 month ago.

- Nakamigos delivered their Cloaks mint as a free claim for holders, and the remaining unclaimed NFTs were sold for 0.05 ETH. The secondary market caught fire, with NFTs selling for an average of US$276 on Sept. 24.

- Bored Ape Yacht Club boasts the top collectible NFT sale of the week with BAYC #3149 selling for US$221,000.

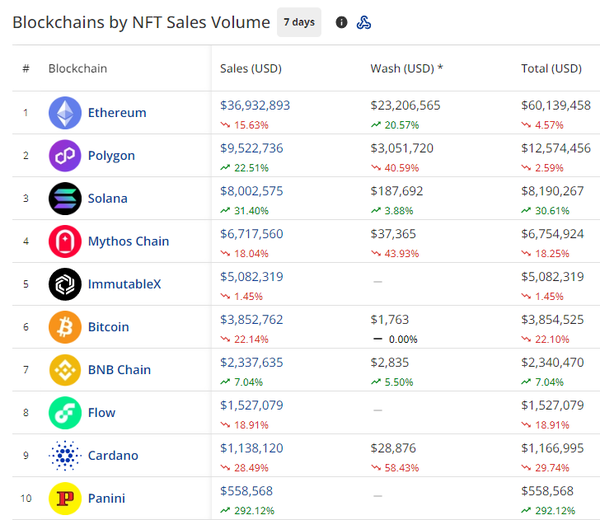

- Ethereum is the true king of NFTs, (sorry DraftKings), almost outselling the other top ten collections, which combined for just over US$38 million in sales.

- Polygon’s DraftKings has kept the blockchain front and center, with 73% of Polygon’s sales coming from the sports collectibles.

- Solana had a few new collections, Reavers and Clear Collectibles, that brought eyes and trading action last week.

- Bitcoin Ordinals creator is proposing a change to the Ordinals numbering system along with a replacement for BRC20s called Runes. This is causing significant debate in the community as the implications can impact the value of the existing collectibles.