NFT

Non-fungible tokens, or NFTs, present a new and exciting investment opportunity. But it’s essential to approach them with caution and do your research before investing.

Non-fungible tokens (NFTs) have become a hot topic in art and digital assets in recent years. NFTs are unique digital assets stored on a blockchain, making them immutable and impossible to duplicate. They are often used to represent digital art, music, videos, and other types of creative content, and they are bought and sold using cryptocurrencies like Bitcoin or Ethereum.

One of the biggest draws of NFTs is their potential as a financial asset. Many people see NFTs as a new type of investment, similar to buying stocks or real estate. Some NFTs have sold for millions of dollars, and investors hope to profit by buying and selling NFTs at the right time.

However, investing in NFTs is not without risk. The market for NFTs is still relatively new, and much volatility and speculation are involved. Prices can rise and fall rapidly, and predicting which NFTs will hold their value over time can be challenging.

Deep-Dive Into NFTs

One way to mitigate the risk of investing in NFTs is to do research and invest only in projects and artists with a proven track record. Look for NFTs backed by reputable galleries or auction houses or created by established artists with a loyal following. One can also look at the underlying technology and the blockchain that the NFT is stored on to assess its authenticity and long-term viability.

Another factor to consider when investing in NFTs is the market’s liquidity. NFTs are less liquid than other assets like stocks or bonds, so it can be challenging to sell NFTs if one needs to access funds quickly. The holder may need to hold onto the NFT for a long time before he or she can sell it for a profit, and there is always the risk that the market will crash before you have a chance to sell.

Despite these risks, many people are still excited about the potential of NFTs as a new type of investment. NFTs can disrupt traditional markets and provide new opportunities for artists and creators to monetize their work. They also offer a new way for investors to diversify their portfolios and potentially make a profit.

For instance, following the success of the first iteration, former US President Donald Trump announced on his social media platform Truth Social the launch of the second set of NFT collection cards. Each is priced at $99, issued on Polygon, with a total of 47,000 pieces.

Trump Digital Trading Card Series 2 NFT Source: OpenSea

Real-Life Opportunities

One area where NFTs are particularly promising is in gaming and virtual worlds. NFTs can represent in-game items or virtual real estate, and players can buy, sell, and trade these items on a blockchain. This can create new economies within virtual worlds, where players can earn real money by participating in the game.

NFTs also have the potential to democratize the art world by allowing artists to sell their work directly to collectors without the need for intermediaries like galleries or auction houses. This could help level the playing field for emerging artists who have traditionally struggled to get their work in front of a wider audience.

Overall, in the long term, NFTs can be beneficial for several reasons.

Firstly, NFTs are unique digital assets verified on a blockchain, making them rare and valuable. Holding onto an NFT for an extended period can increase the asset’s value as demand grows, just like traditional art or collectibles. This can result in a potential profit for the owner if they choose to sell the NFT later.

Secondly, NFTs can have sentimental or emotional value to the owner, such as owning a piece of artwork or a memorable moment in a video game. By holding onto the NFT, the owner can continue to enjoy and appreciate the asset. Thirdly, some NFTs can also provide ongoing benefits or rewards to the owner, such as access to exclusive content or events. By holding onto the NFT, the owner can continue to reap these benefits.

Long-Term Effect as a Financial Investment

NFTs’ popularity and interest as potential financial assets have surged. Many people are investing in NFTs, not only for unique digital assets but also for their potential long-term profit.

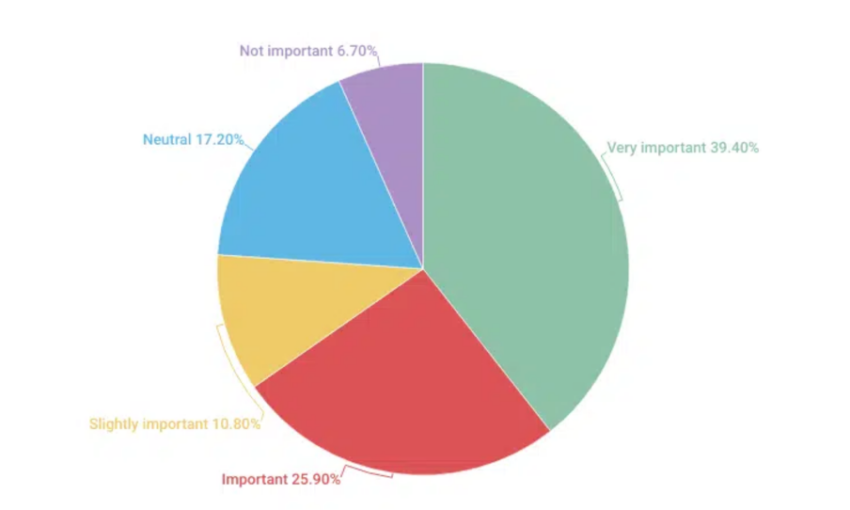

In a report shared with BeInCrypto, BitcoinCasinos.com noted that 39% of NFT buyers are motivated by the long-term profit factor.

How people view NFT profit in the long-term Source: BitcoinCasinos.com

The analysis also found that three out of four NFT holders consider how much utility a collection offers before buying. In addition, 68.80% of buyers said they purchase an NFT because they want to join the community, indicating that people are using their investments to support projects and ideas they believe in.

Lastly, personal enthusiasm for a collection’s business model and artwork was cited as a reason to purchase.

Speaking to BeInCrypto, BitcoinCasinos betting expert Edith Reads opined:

“It appears that NFT buyers are quite savvy when it comes to their investments, carefully factoring in not only the utility of a given collection but also its potential resale value. As such, many NFT holders have been able to take advantage of this emerging market and turn a profit over time.”

Possible Concerns

Despite the promising narratives, the NFT market value did recently take a massive hit. Various factors have acted as an obstacle to further innovation and adoption. One of the factors is security risks.

NFTs are often stored on blockchain networks susceptible to hacks and cyber-attacks. If a hacker gains access to a user’s private key, they could steal or transfer the NFT to another account. Of late, NFT whale Franklin deleted his Twitter account. Earlier, he said that due to personal gambling and a hack, he lost more than 2600 ETH.