- NEAR’s TVL fell as Alameda withdrew liquidity.

- Accounts on NEAR Social increased while NFT activity fell.

The U.S SEC’s decision to classify the Near Protocol [NEAR] token among others as a security was the major public highlight of the second quarter (Q2). But beyond that, a number of things have happened with the project— some impressive, others? Not so much.

Realistic it not, here’s NEAR’s market cap in ETH terms

Fortunately, crypto transparency platform Messari took it upon itself to evaluate the situation with the project. Messari, in its Q2 report, mentioned that the SEC announcement had a significant effect on NEAR’s market capitalization and revenue. The report noted that,

“NEAR experienced a decline in both circulating market capitalization and revenue during Q2 2023. The circulating market cap at the end of the quarter stood at $1.25 billion, reflecting a 25% decrease QoQ.”

Unlocking the revenue and supply

However, the increase in the overall market cap, led by Bitcoin [BTC] and Ethereum [ETH], ensured that NEAR’s own did not shrink lower than mentioned.

In terms of revenue, the project’s “fee-burning mechanism”, and “demand for security model”, ensured that it raked in $98,000. For context, NEAR’s fee-burning mechanism occurs when validators get a small part of every transaction fee by burning a part of the token supply.

On the other hand, the function of the demand security model is to allow continuous network scalability even as demand increases. Moreso, NEAR took another step towards unlocking all of its tokens by 2025.

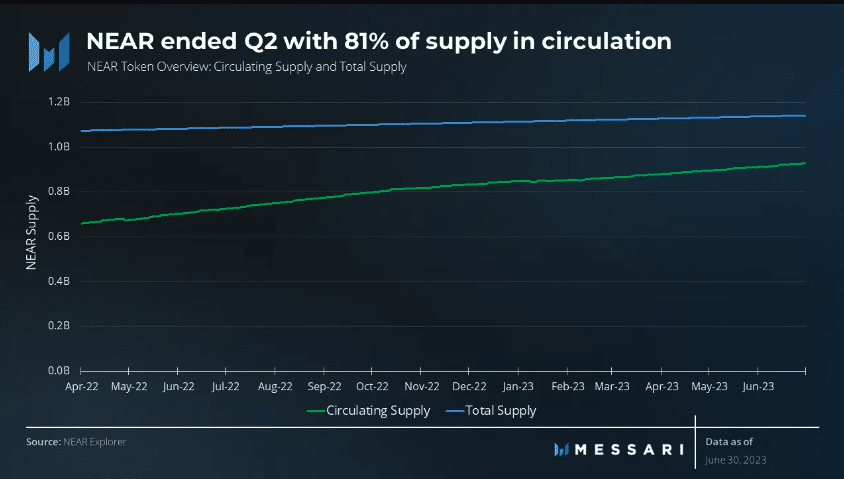

In Q2, 81% of the total NEAR supply was now in circulation. This was because it has no fixed supply, but the annual staking yield enjoyed by stakers ensured that more of the tokens were distributed.

Source: Messari

While there were other positive outcomes from the project’s strides in the quarter, some previous declines were as stubborn as a mule. One of them was NEAR’s Total Value Locked (TVL).

Bye, liquidity

The TVL measures the level of liquidity flowing into a protocol. When it increases, it implies that participants trust the protocol enough to deposit into the decentralized Applications (dApps) operating under it.

But NEAR’s TVL decreased by 39%. And this was a fall for the fifth consecutive quarter. Therefore, this means that the protocol’s health was at risk since it wasn’t performing at its highest capacity.

Beyond doubt, one reason the TVL shrunk was Alameda’s decision to withdraw liquidity. As highlighted by Proximity Labs, the trading firm led by former FTX CEO Sam Bankman-Fried, withdrew $16 million from the USN/USDT pool.

Source: Messari

Although NEAR had not fully recovered from the slump, protocols including Burrow and Orderly Network attracted substantial interest in Q2 to ensure that the TVL does not drop more than it had. Messari’s report explained,

“Among these, Ref Finance and Bastion were the most impacted by Alameda’s withdrawal, experiencing decreases in TVL of $22 million and $15 million, respectively. Conversely, Burrow and Orderly Network emerged as the quarter’s most significant gainers, with TVL increases of $2 million and $2 million, respectively.”

Meanwhile, the adoption of NEAR soared within the same period, thanks to its Blockchain Operating System (BOS) launched in March.

Hello to the new traction

NEAR created the BOS as an open-source platform. This was to enable developers to build on any blockchain irrespective of whether they use web2 or web3 networks.

Furthermore, the BOS widgets, which serve as the building block for developing applications on the NEAR Social increased.

This increase suggests that the BOS use case was widely adopted. As a result, accounts on NEAR Social, the social base layer of the BOS, grew to 15,000 within four months. The report pointed out,

“Since its launch four months ago, NEAR Social has gained significant traction, attracting over 15,000 user accounts. Notably, NEAR experienced heightened engagement in late May.”

Source: Messari

Consequently, the rise in social accounts also impacted activity on NEAR’s network. According to Messari, the project maintained an average of 58,000 active accounts daily.

This was a significant hike from the number in Q1. However, the new addresses did not follow suit, falling by 19% from the previous quarter.

Not the best NFT season

Also, NEAR, known for its input in the NFT and gaming sector, maintained a downtrend in this regard.

Just like the TVL, NEAR’s NFT activity continued to fall as it has done since January. The decrease reflects a similar one to the lack of interest in NFT collections connected to other blockchains like Ethereum.

Source: Messari

Despite the drawdown and upticks, NEAR has been able to maintain a safe level of financial health. At the end of Q2, the project’s treasury was close to $1 billion, even though it had a slight fall.

How much are 1,10,100 NEARs worth today?

And one reason why it didn’t worsen was NEAR Foundation’s action to hand over decision-making to its Decentralized Autonomous Organization (DAO).

Going forward, the Marketing DAO, Developer Hub, and Ceatives DAO would be responsible for reviewing proposals and effecting governance on the network.