Multiple on-chain metrics are looking good for Bitcoin (BTC) despite the top digital asset’s sideways price movement this week, according to crypto analytics firm Glassnode.

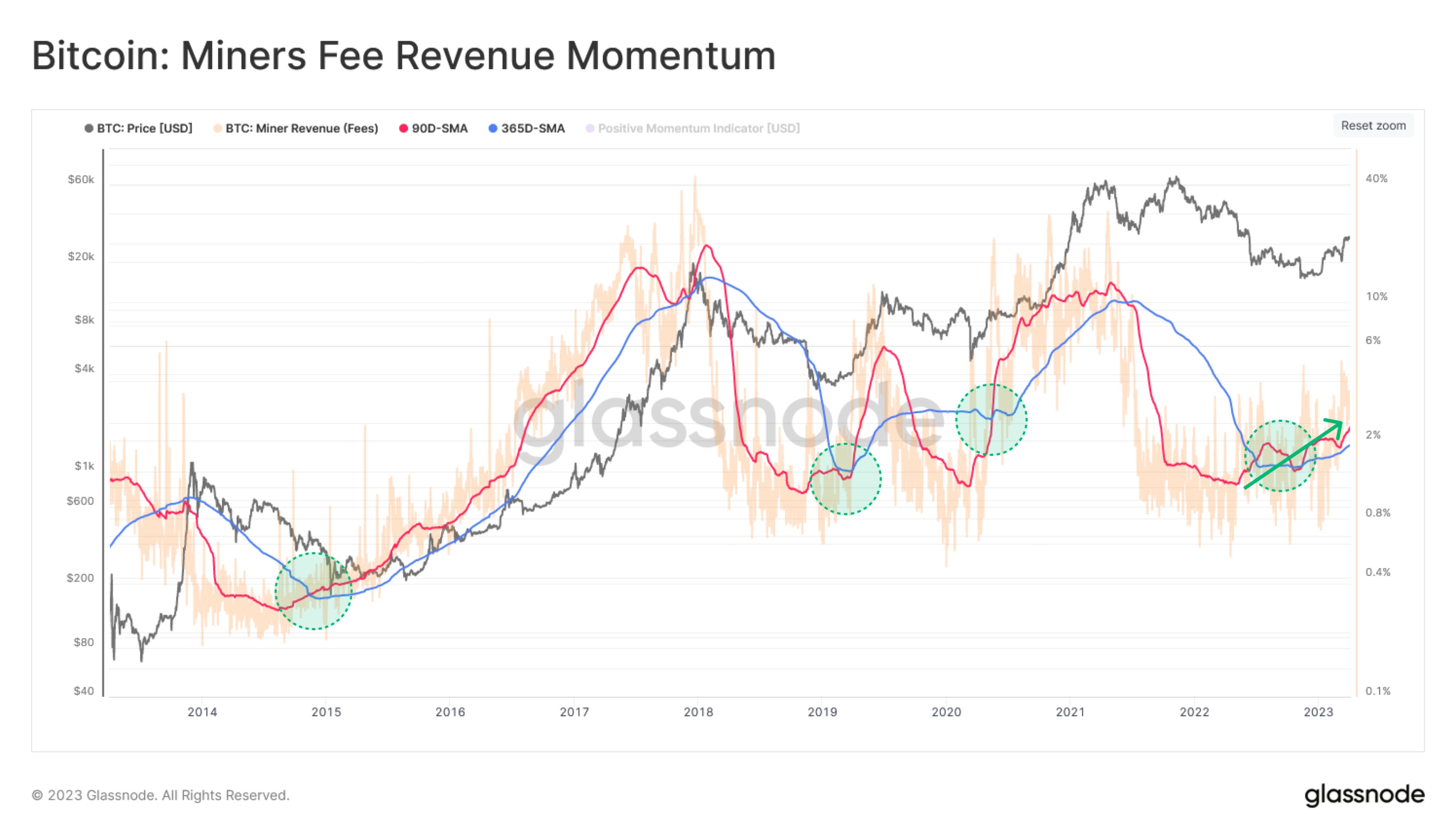

Glassnode says it is keeping an eye on the miners fee revenue momentum metric, which gauges rising demand in the BTC market.

According to the analytics firm, the metric is currently flashing signs that demand is growing for Bitcoin.

“Currently, the 90-day [simple moving average] for fees is outpacing its yearly average, suggesting new demand is entering the market.”

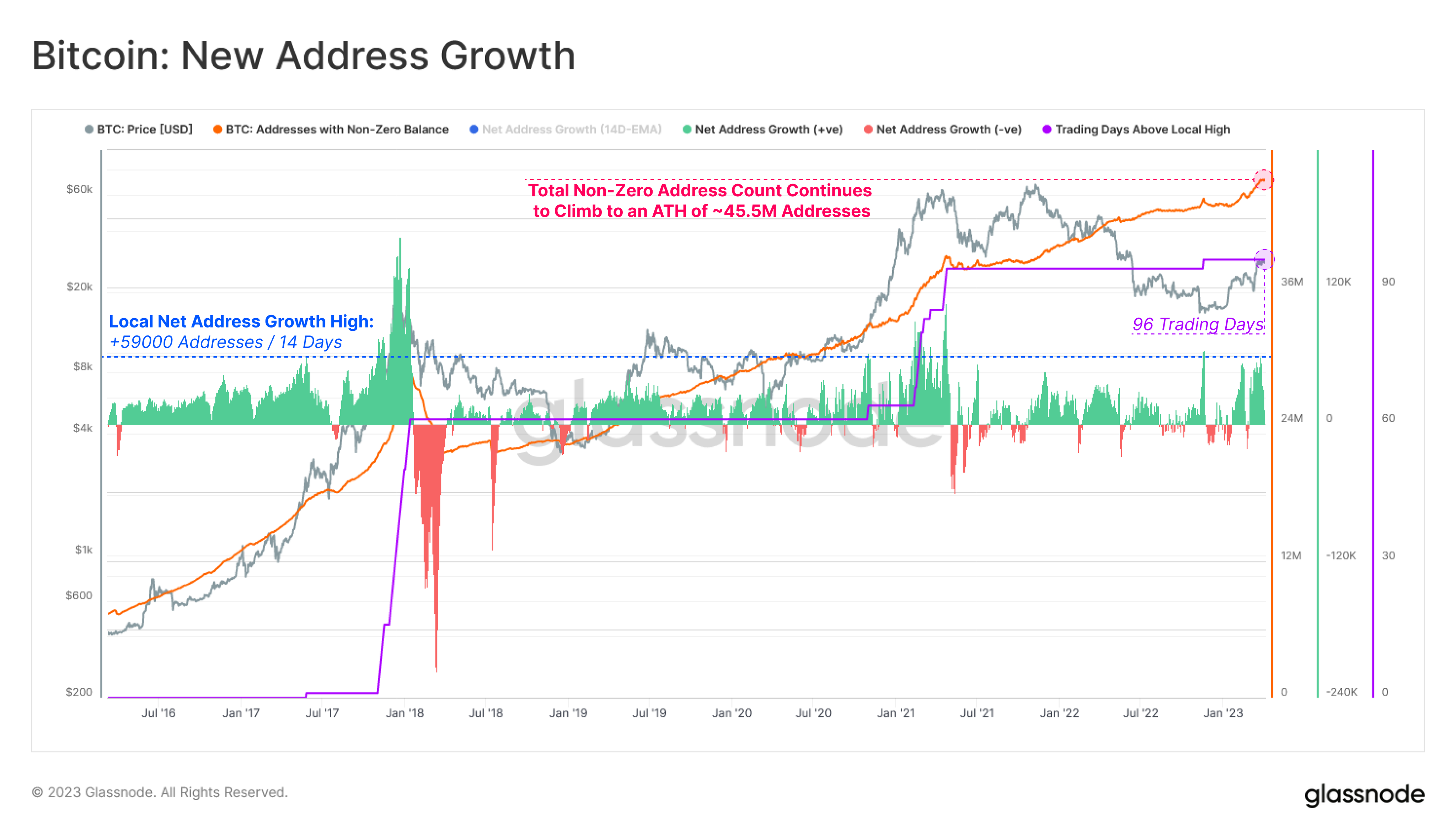

Glassnode also notes that the number of non-zero Bitcoin addresses has jumped to an all-time high of about 45.5 million.

“This suggests the degree of on-chain activity is currently improving.”

Additionally, fellow crypto analytics firm Santiment says that Bitcoin traders are currently transacting at a loss at twice the rate of profit, which it says is actually a bullish development.

“This is the first time this ratio has been negative in five weeks, and is actually a good sign that the FOMO’ers [fear of missing out] are giving up on the rally.”

Bitcoin is trading at $27,935 at time of writing. The top-ranked crypto asset by market cap is down 0.46% in the past 24 hours and nearly 2% in the past week. BTC remains more than 68% up since the start of 2023.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Unleashed Design