Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Holders could book a profit and send MATIC into a pullback.

- The sentiment and structure behind the asset remained bullish.

Over the past five days, Bitcoin oscillated between $25.2k and $23.5k. A breakout past $25.2k resistance was not yet seen. A consolidation under resistance before a move upward was a likely course forward for BTC.

Is your portfolio green? Check the MATIC Profit Calculator

In turn, this could boost the bullish sentiment behind the native token of Polygon. MATIC has performed remarkably well in recent weeks. The evidence at hand showed further gains were likely, although a pullback could offer better rewards for buyers.

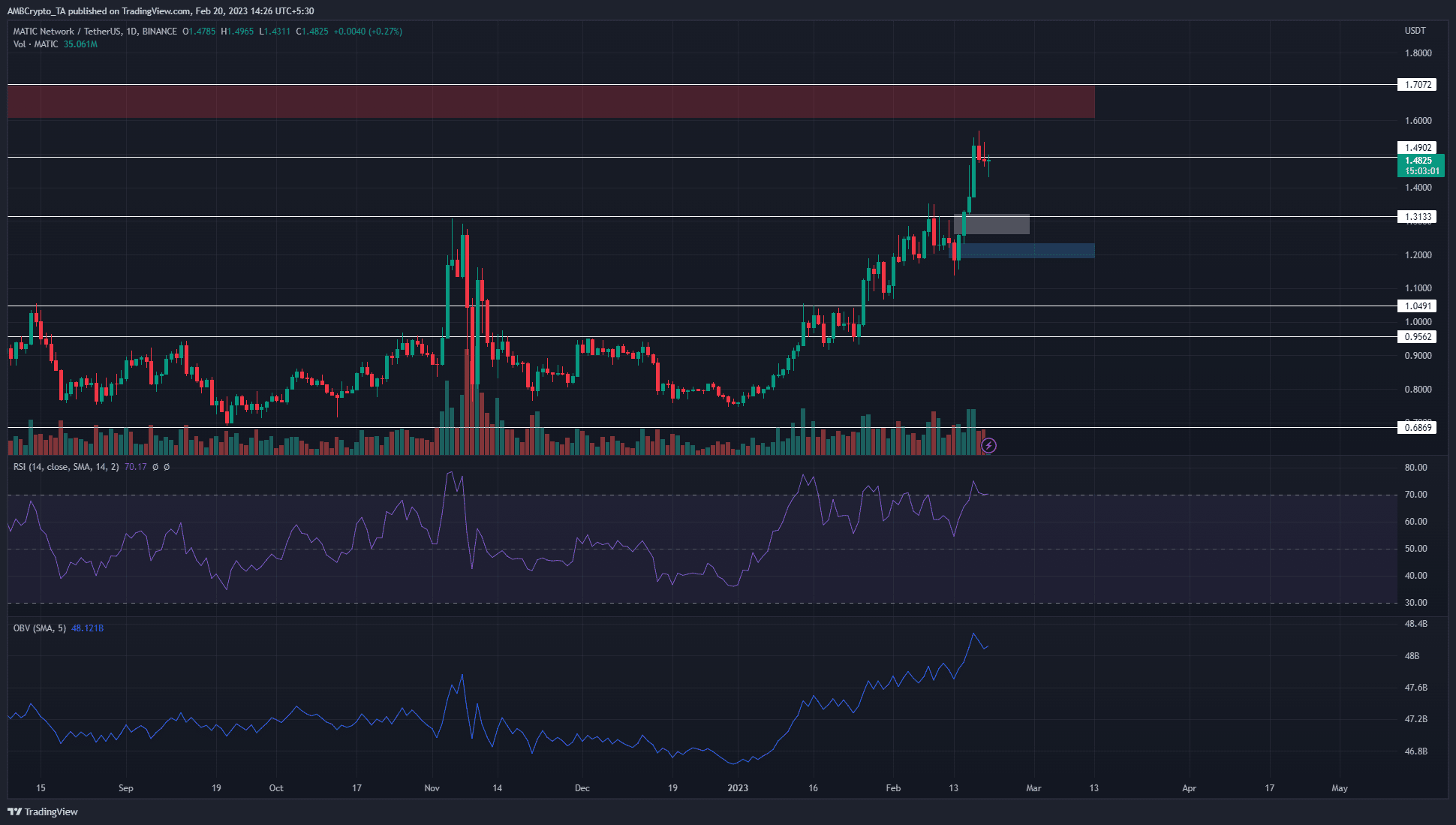

The FVG near the $1.3 key level could be filled

Source: MATIC/USDT on TradingView

As things stand, MATIC might not see a retracement back to $1.3. The RSI showed strong bullish momentum and the OBV was also making a series of higher lows.

This meant that genuine demand was behind the rally. Furthermore, Bitcoin sat beneath a significant resistance level. If it broke out upward, MATIC would be likely to follow.

On the other hand, a pullback to the $1.3 area would be certain to interest longer-term MATIC buyers. This was because of the presence of an imbalance on the charts on the daily chart, highlighted in white.

The $1.3 area has been significant in the past. In early November, $1.3 offered stern resistance, and the FTX implosion meant heavy selling pressure originated at $1.3.

How much are 1, 10, and 100 MATIC worth?

In the coming weeks, if this area was retested as support, it would offer a good risk-to-reward buying opportunity targeting $1.6, where a bearish order block lay.

The bullish order block at $1.18-$1.23 would be a more precise location to await lower timeframe bullish market structure breaks before buying MATIC.

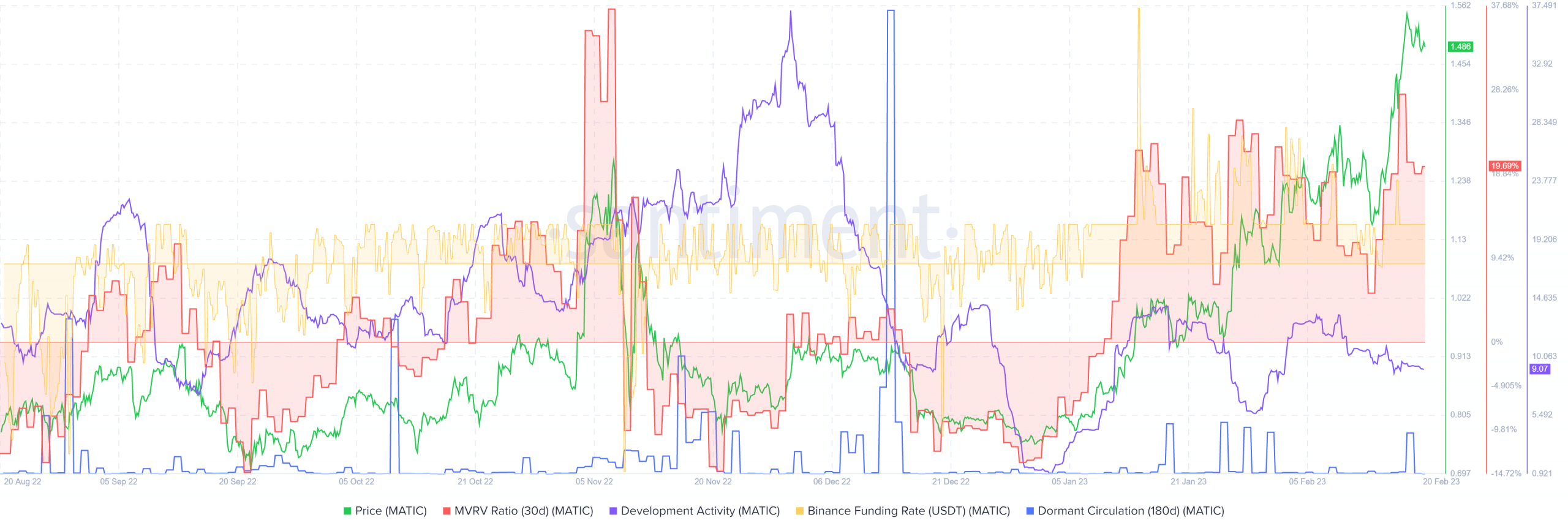

Rising MVRV ratio showed the possibility of profit-taking by holders

Source: Santiment

In early November, the rally to $1.3 was followed by a sharp rise in the 30-day MVRV ratio. This showed short-term holders sat atop a large profit. At the time of writing as well, the rising MVRV indicated much the same.

The funding rate remained positive to highlight the bullish market sentiment. If the MVRV reverted back toward the zero mark, buyers could look for opportunities that lined up with price analysis.

The 180-day dormant circulation saw a spike a few days ago and signaled a small wave of selling pressure could commence soon. The development activity has been falling throughout February.