- Maker’s recent exceptional hike was not sufficient to provide its long-term holders with significant gains.

- Technical indicators suggested an uptick in sustenance for the token.

MakerDAO [MKR] may have had one of its best-performing months in February, but that 40% 30-day surge only had a minimal impact on the token’s long-term holders.

During the previous month, most cryptocurrencies only traded sideways. But MKR’s standout growth was one not to disregard.

Read MakerDAO’s [MKR] Price Prediction 2023-2024

Is faith in MKR the evidence of things not seen?

Despite the hike, many addresses that held MKR for the past 365 days could only rise to gain regions for the first time since they accumulated. The price increase brought MKR’s 2023 performance to a 75% hike, implying that a lot of holders bought the top.

It was a more discouraging phase for believers in the Maker project who have owned the token for far greater years. According to Santiment’s insight, this group has continued to bear losses.

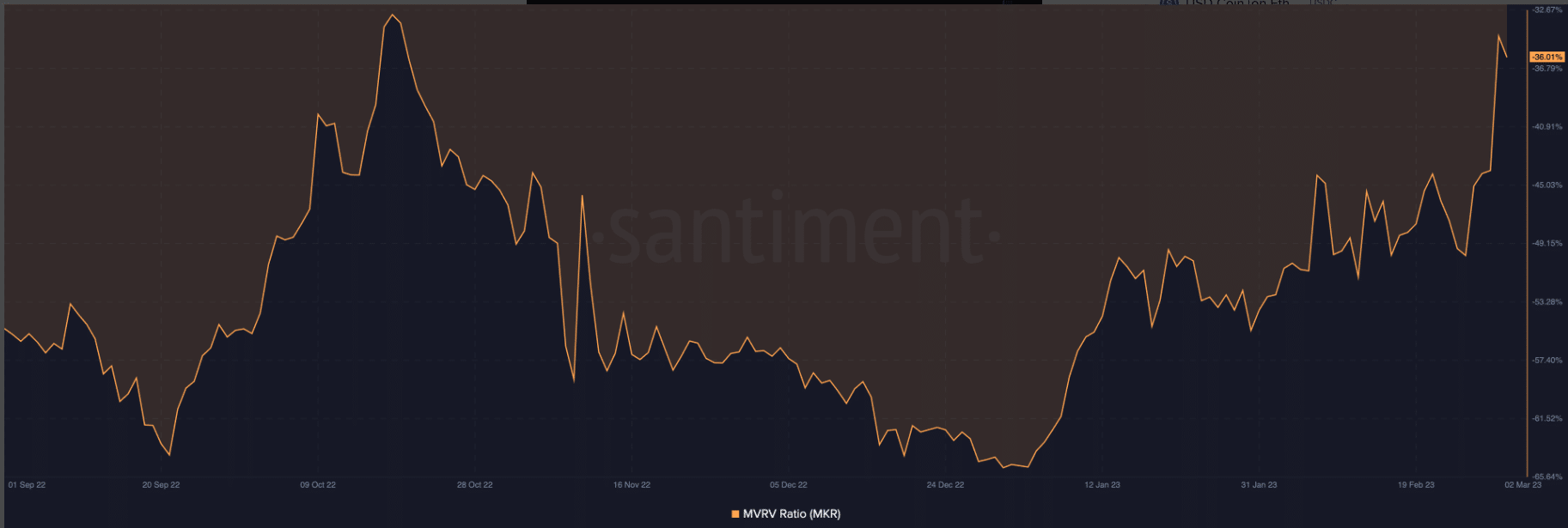

Source: Santiment

The chart above showing the Market Value to Realized Value (MRVR) ratio proved this inference. The metric highlights how much profits holders of an asset have made over a particular period concerning its valuation depending on the market condition.

At press time, the MVRV ratio was -36.01%. Being in the negative region and pegged below one implied that MKR holders of the last five years were currently not in profit. In addition, MKR was down 85.97% down from its All-Time High (ATH).

Withal, Maker still had the biggest decentralized stablecoin in DAI. And, it has also been able to steer clear of the regulatory scrutiny of several stablecoins connected to centralized entities.

Recently, the Ethereum [ETH]-based decentralized currency reserve disclosed that the DAI on the Curve Finance [CRV] liquidity pool hit a new ATH.

On the charts:

• 82.4 million DAI from @CurveFinance stETH-ETH LP—new all-time high.

• 190 million DAI from wstETH (WSTETH-A)—just beat its previous all-time high.

• Total 375 million outstanding DAI from $1.4 billion worth of stETH collateral.

→ https://t.co/Lp9pPEK9df pic.twitter.com/2dmkwpkS3Z

— Maker (@MakerDAO) March 2, 2023

Following the milestone, Maker utilized more of its debt ceiling while its annual fees increased. This also contributed to the supply of staked Ether [stETH] as the validator withdrawal season nears. But subsequently, what’s in store for MKR?

Is your portfolio green? Check out the Maker Profit Calculator

Hope for the common “Maker”

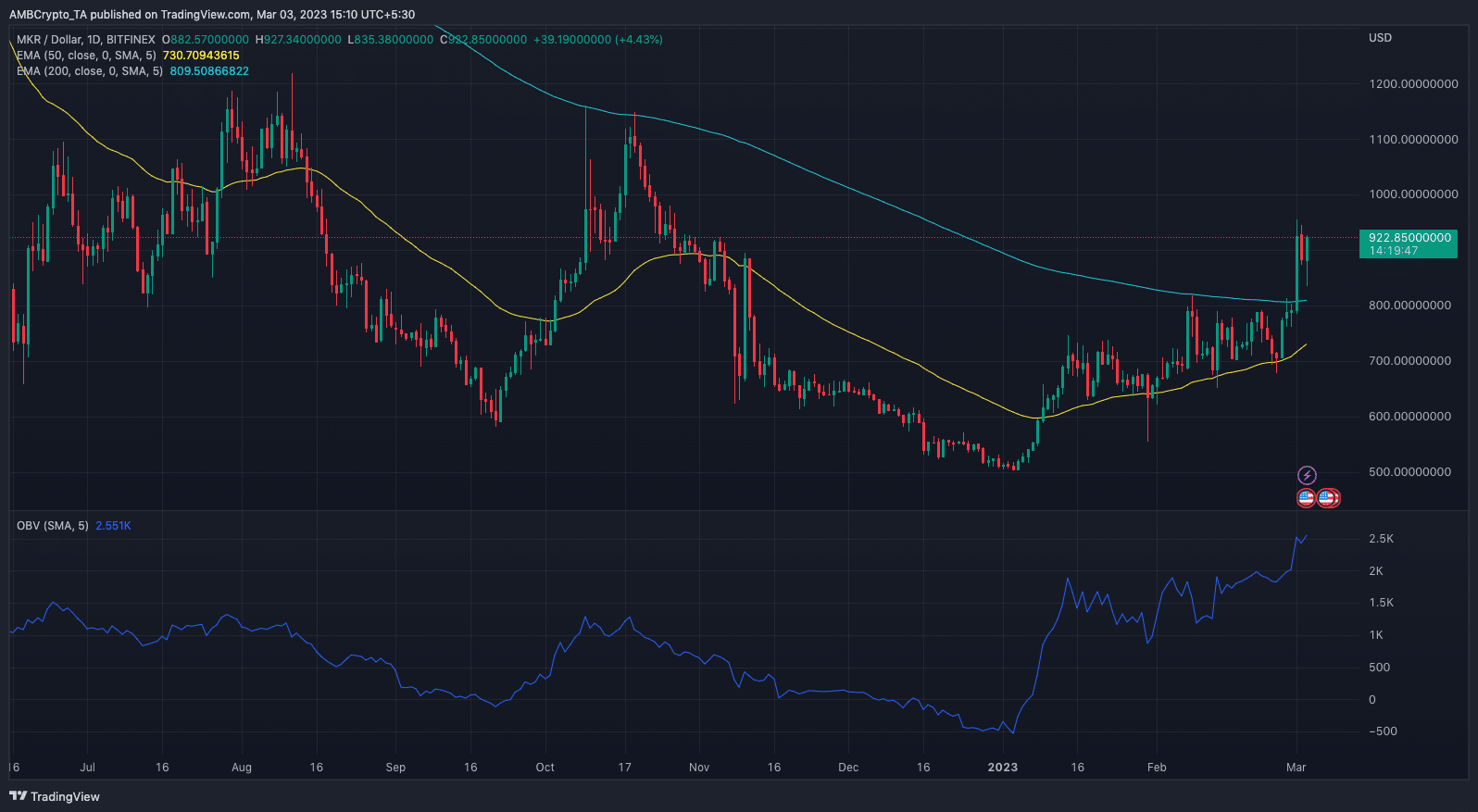

Based on indications from the Exponential Moving Average (EMA), the technical outlook suggested respite for MKR in the mid to long term.

This was because the 50 EMA (yellow) failed to cross the 200 EMA (cyan), thus offering a buy bias and the possibility of an uptrend.

Source: TradingView

Meanwhile, market players’ intent was for MKR to price higher as revealed by the On-Balance-Volume (OBV).

At the time of writing, the OBV hit higher peaks on the daily chart while the price also followed the same direction. Therefore, MKR’s 2.60% 24-hour increase had the tendency to stick to the greens.