- Optimism Goerli nodes halted temporarily, business went on as usual for Optimism

- Spike in daily transactions observed while fees collected declined on the charts

The implementation of the long-anticipated Shapella hard fork took place on Ethereum’s Goerli network on March 15. This resulted in a brief pause in Optimism‘s Goerli nodes. Goerli is a network utilized by Ethereum developers for testing purposes. Nevertheless, the Optimism protocol persevered, with its ecosystem flourishing despite the disruption to the Goerli nodes.

Critical update for node operators on Optimism Goerli: Goerli’s Shapella fork caused a halt for Optimism Goerli nodes in the default configuration.

Node providers will need to add a flag to resume syncing. Full details can be found on our status page: https://t.co/LwPl4ASs38

— Optimism (✨🔴_🔴✨) (@optimismFND) March 14, 2023

Read Optimism’s Price Prediction 2023-2024

Glass half full

The growth of Optimism’s ecosystem is evident in the neck-to-neck competition for its 10th grant cycle. This cycle received a high number of applications, with many developers and applications competing for a grant to build on the network. The incentives to build on Optimism could help the protocol in attracting more developers and users to the network.

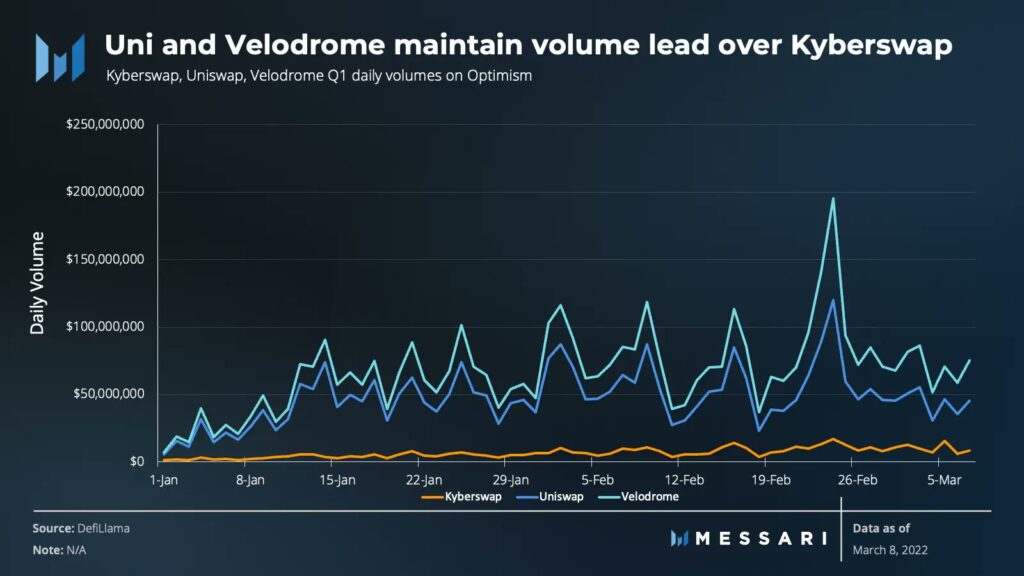

One of the applicants is a dApp called KyberSwap, which has seen its Optimism-based volumes grow by 9 times over the past year. While Uniswap and Velodrome still hold a lead over KyberSwap in terms of volume, the incentives to build on Optimism are attracting more developers and users to the network.

Source: Messari

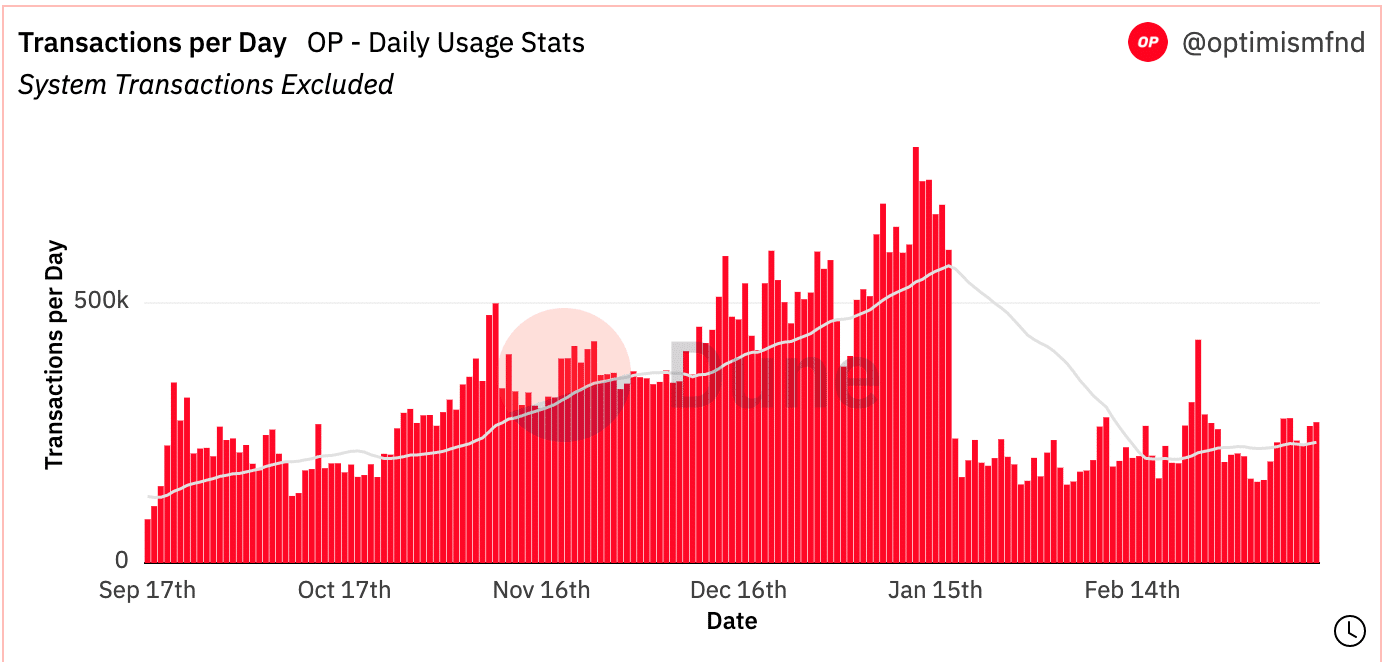

Another sign of the network’s expansion is the rise in its transaction volume. The same has increased from 159,600 transactions to 269,700 transactions over the last few months.

However, despite this hike, the fees generated by the protocol have declined. This, likely due to greater competition among layer-2 solutions, something that has driven down fees generated by the network.

Source: Dune Analytics

And the state of OP is…

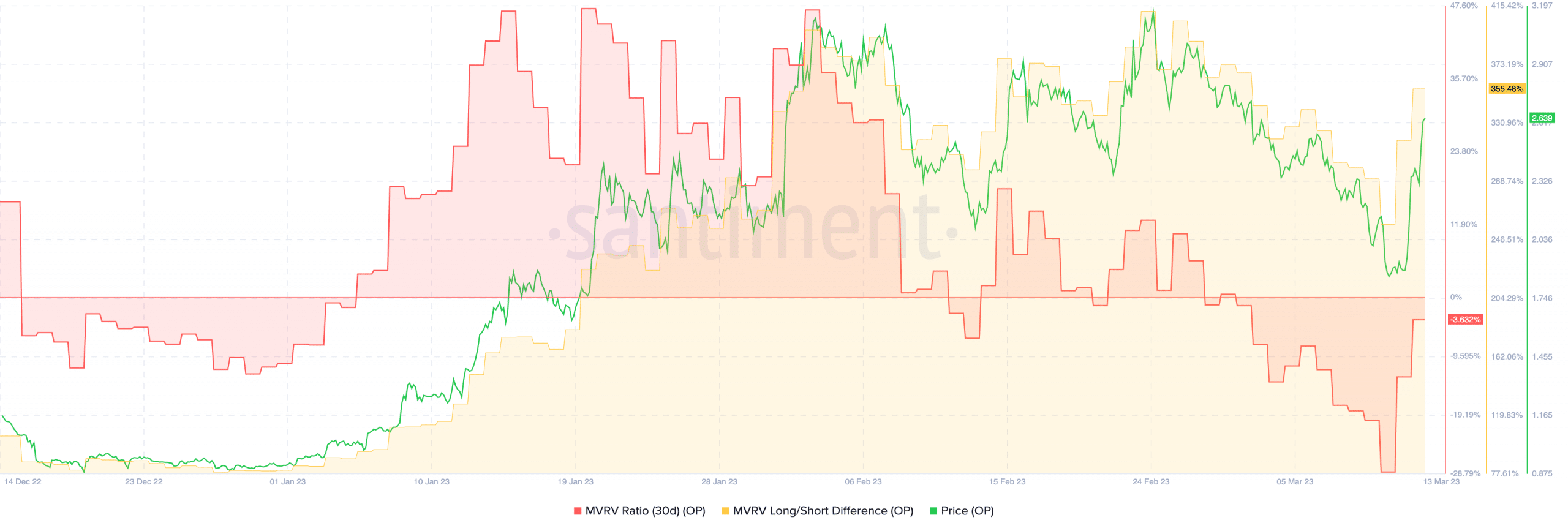

Despite the decline in fees, the price of the OP token has continued to rise. This is a sign that investors have faith in the long-term potential of the Optimism network. Coupled with that, the MVRV ratio for OP declined, indicating that most holders would not profit if they sold their holdings. This is a sign that there is low selling pressure on OP at this point.

Realistic or not, here’s OPs market cap in BTC’s terms

Additionally, the long/short difference for the OP token has been highly positive too. This is evidence that many holders are long-term investors who are unlikely to sell their holdings.

Source: Santiment