beginner

With Bitcoin soaring in popularity and value since the 2010s, many investors are asking themselves whether they have missed their chance to get a piece of this digital pie or not yet. Now is definitely an exciting time for those interested in buying Bitcoin as its price continues to shed on a monthly basis. And here’s the good news: no, it’s not too late to invest in Bitcoin! But this loud statement needs to be clarified.

To decide whether or not it is a good idea for you personally to invest in Bitcoin right now, we suggest you read this article, where we’ll take into account the history of Bitcoin’s performance, analyze its current market condition and assess its future potential.

Bitcoin Explanation in Short

Bitcoin is a revolutionary and innovative cryptocurrency that utilizes blockchain technology.

It was created in 2009 by an anonymous individual or a group. Bitcoin represents a decentralized digital currency that does not require the oversight of any government or financial institution. Secure and anonymous transactions are done via peer-to-peer networks, providing new opportunities for individuals to control their finances and to invest their money without traditional banking structures.

The Bitcoin network is attractive because it can be used anywhere across the globe, has low transaction fees, and provides near-instant transactions. All in all, Bitcoin offers users a unique form of financial independence.

Bitcoin Price History

People frequently wonder: Is Bitcoin still worth investing in? But they ignore the coin’s price history, which can provide insight into potential price movements in the future.

Bitcoin Price – 2009 to 2017

The only places where Bitcoin saw widespread use in its early years were shady online marketplaces like Silk Road.

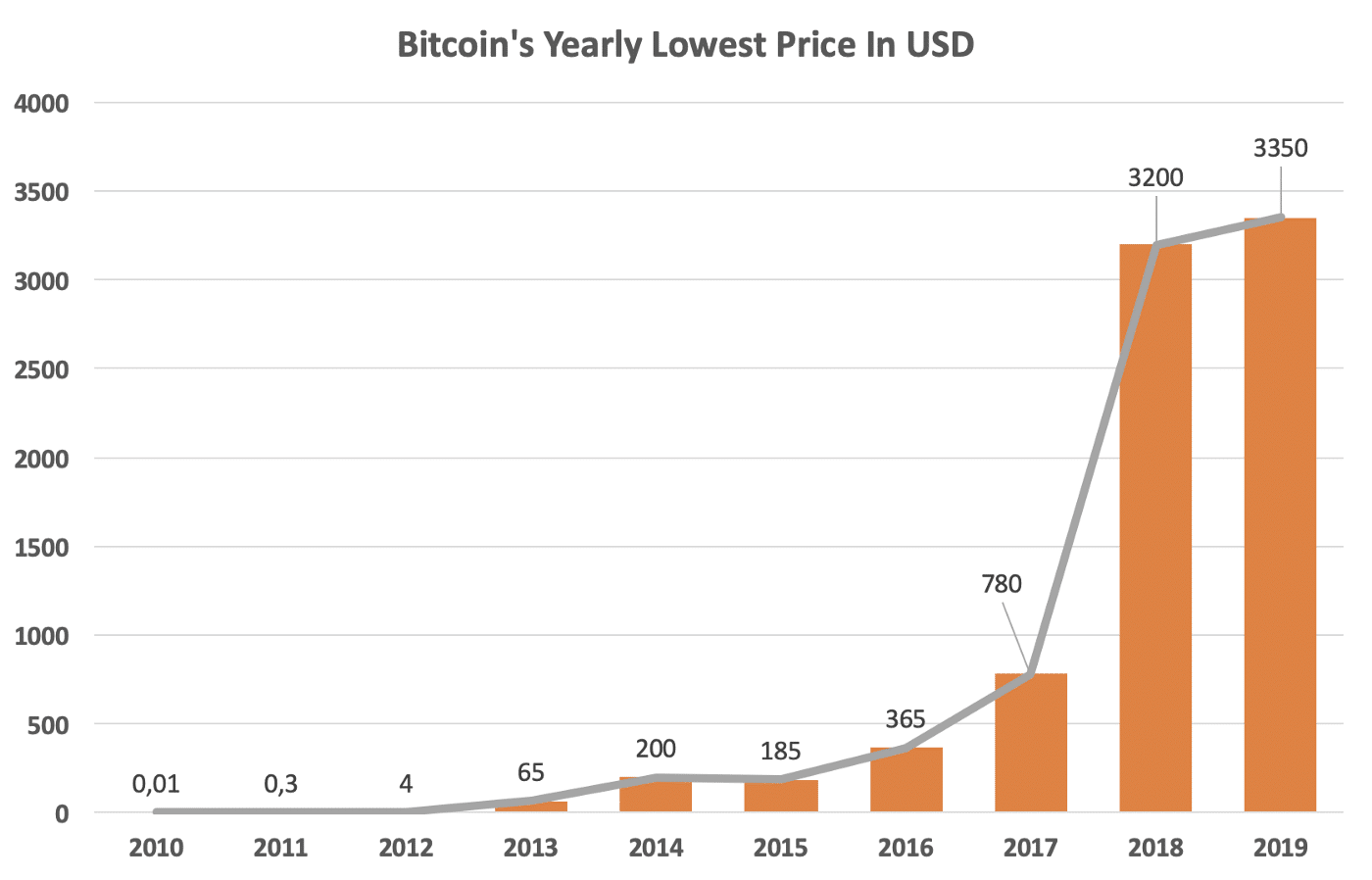

The price of BTC started to rise in the early 2010s, and between 2013 and 2014, it increased by more than 5,600%. The development of many of the top cryptocurrency exchanges we see today was prompted by the investing community beginning to take notice at that point.

The price of the cryptocurrency was around the $1,000 mark at the start of 2017. Bitcoin saw a stunning rise from $975.70 on March 25 to $20,000 on December 17 after a small drop in the first two months.

Bitcoin Price – 2018 to 2021

The BTC price ceased its rise in 2018. Instead, Bitcoin had returned to the $4,000 mark by the start of 2019. In the first half of 2019, the value of the cryptocurrency increased by around 200%, reaching $12,000 by August. The price of Bitcoin stayed between $8,000 and $12,000 for the following six months.

Midway through March 2020, the Covid-19 pandemic struck, sending the entire crypto market into a tailspin. Bitcoin experienced a relatively quick bear market, just like other financial assets, shedding over 50% of its value in less than 48 hours to trade below $5,000.

This decline, nevertheless, proved to be a brief setback. Bitcoin experienced explosive growth after March 2020, reaching about $30,000 by year’s end — and this was only the beginning. In January 2021, Bitcoin reached $40,000, and by March of that same year, its value had risen to $60,000.

After several tumultuous months, Bitcoin eventually reached an all-time high of almost $69,000 in November 2021.

Enjoying this article? Subscribe to our weekly newsletter to stay updated on the latest crypto news!

Bitcoin Highs and Lows

The highs and lows of BTC from its conception to the present are summarized below:

- 2009 saw the first Bitcoin transaction, with the price per coin being $0.0009 back then.

- The price of Bitcoin first began to rise in 2013, when it went from about $100 to $1,150 in a single year.

- The BTC price fell in 2014 and fluctuated in 2015 and 2016.

- December 2017 had a high of $19,735, representing a 933% rise in five months.

- December 2018 had a low of $3,270.

- June 2019 saw a high of $13,910.

- March 2020 set a low of $3,881.

- The all-time high of $68,789 took place in November 2021, surpassing the lows of March 2020 by 1,644%.

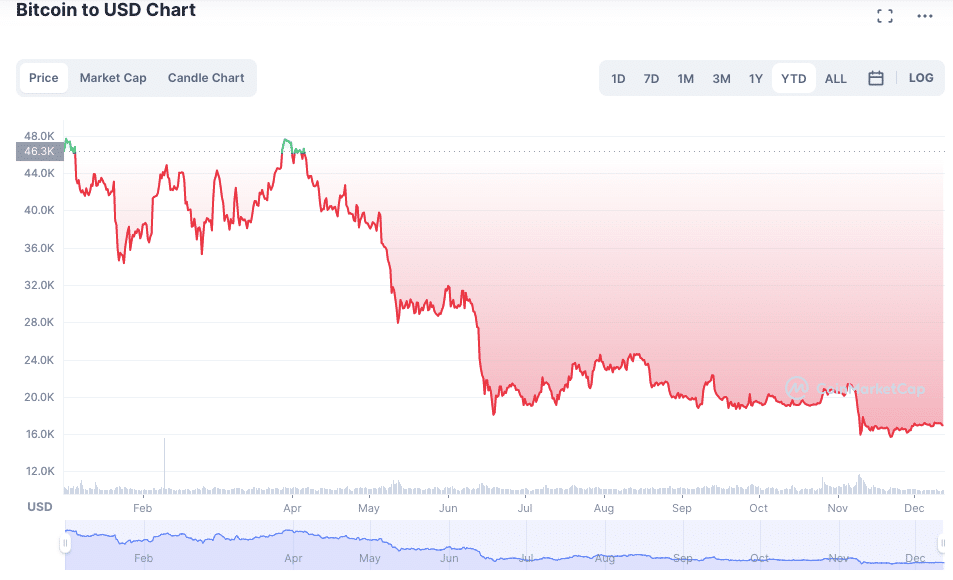

- November 2022 saw a low of $15,757.

Bitcoin Performance in 2022

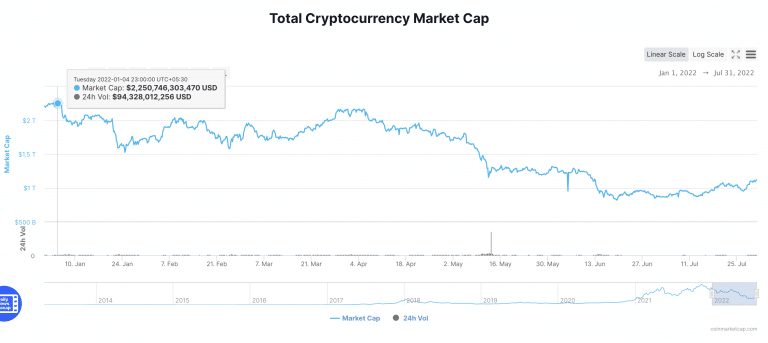

The year 2022 has proven to be difficult for the world markets: high levels of inflation are currently affecting the global economy, and investors are worried about a potential recession.

Additionally, rising interest rates have brought a general decline in investments. These factors have caused the crypto market, including Bitcoin, to enter the bearish stage.

Bitcoin’s bearish momentum gained force as those seeking the cryptocurrency with the greatest potential for growth started concentrating on other initiatives. Large institutional investors like Tesla chose to sell off sizable chunks of their Bitcoin holdings. All these things combined created an unfavorable atmosphere for Bitcoin and its proponents.

The FTX scandal served as the icing on the cake for BTC. Although this crisis had nothing to do with Bitcoin specifically, it impacted the entire cryptocurrency market. This sparked a widespread sell-off, which drove the price of BTC down.

Even if it has dropped by almost 75% from its peak, Bitcoin remains one of the finest investments of the decade. Bitcoin proponents are hopeful that this “crypto winter” is just a brief drop and that, as history has often demonstrated, the value of BTC will rise once more.

Bitcoin Price Prediction 2023 – 2030

According to some analysts, Bitcoin’s days of exponential growth are long gone, so investors seeking quick profits might be better off elsewhere.

We think that Bitcoin will still be able to generate profits in the future, just not at the same rate as it did between 2020 and 2021. So, the next section provides BTC price forecasts for the upcoming years, based on both technical and fundamental analysis.

We estimate that BTC will have been worth $23,000 by the end of 2023. The crypto market should recover in the coming years, creating a better environment for Bitcoin’s price to rise. If this happens, we assume Bitcoin will have been worth $35,000 by the end of 2024. If financial institutions adopt Bitcoin more widely and there are more use cases, Bitcoin will likely be the best long-term cryptocurrency. If this is the case, BTC will have been worth $60,000 by the end of 2025 and 90,000 by the end of 2030.

There are currently 18.5 million Bitcoins in existence, and this number includes lost Bitcoins. There are now less than three million BTC left for distribution. Although you can still mine Bitcoin, only 21 million coins can be mined. In periods of rising costs and diminished purchasing power, scarcity can aid in maintaining value.

For a more detailed BTC price prediction, we suggest you read this article.

How Could Bitcoin Be Used in the Future?

Bitcoin has undoubtedly taken the world by storm since its launch in 2009. As a result, numerous investors have scrambled to get their hands on this digital currency due to its potential to skyrocket in value. While Bitcoin is still volatile and lacks government regulations, experts have identified multiple catalysts that could drive the value of Bitcoin in the coming years. All these key catalysts not only excite investors but also signify that Bitcoin could still reach unimaginable heights in the near future.

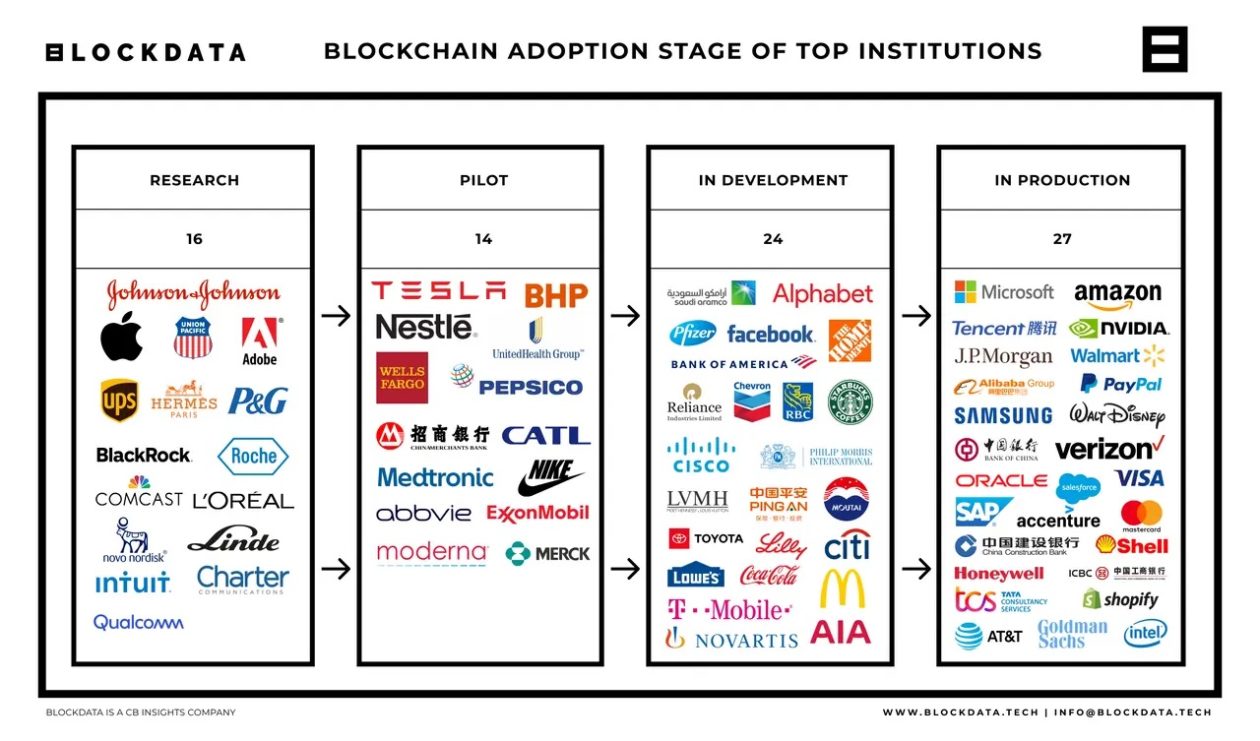

Growing Institutional Adoption

Bitcoin’s low correlation to other financial assets is one of its most alluring features.

With regard to market diversification, this independent stance gives Bitcoin an advantage. For instance, a lot of investors choose to purchase Bitcoin aiming to protect their portfolio from a possible market slump. Financial institutions have created numerous Bitcoin-focused securities in response to the demand for this digital currency. As an illustration, a number of cryptocurrency ETFs provide derivatives like futures in addition to direct and indirect exposure to Bitcoin.

You may also like: Can Bitcoin Become a Reserve Currency?

Real World Transactions

Investors expect that cryptocurrencies will become more widely accepted as a medium of exchange both on national and global levels. Additionally, given the current financial environment, organizations recognize the potential of blockchain technology more and more, which can help bring much-needed efficiency, transparency, and trust into many industries, from finance to healthcare.

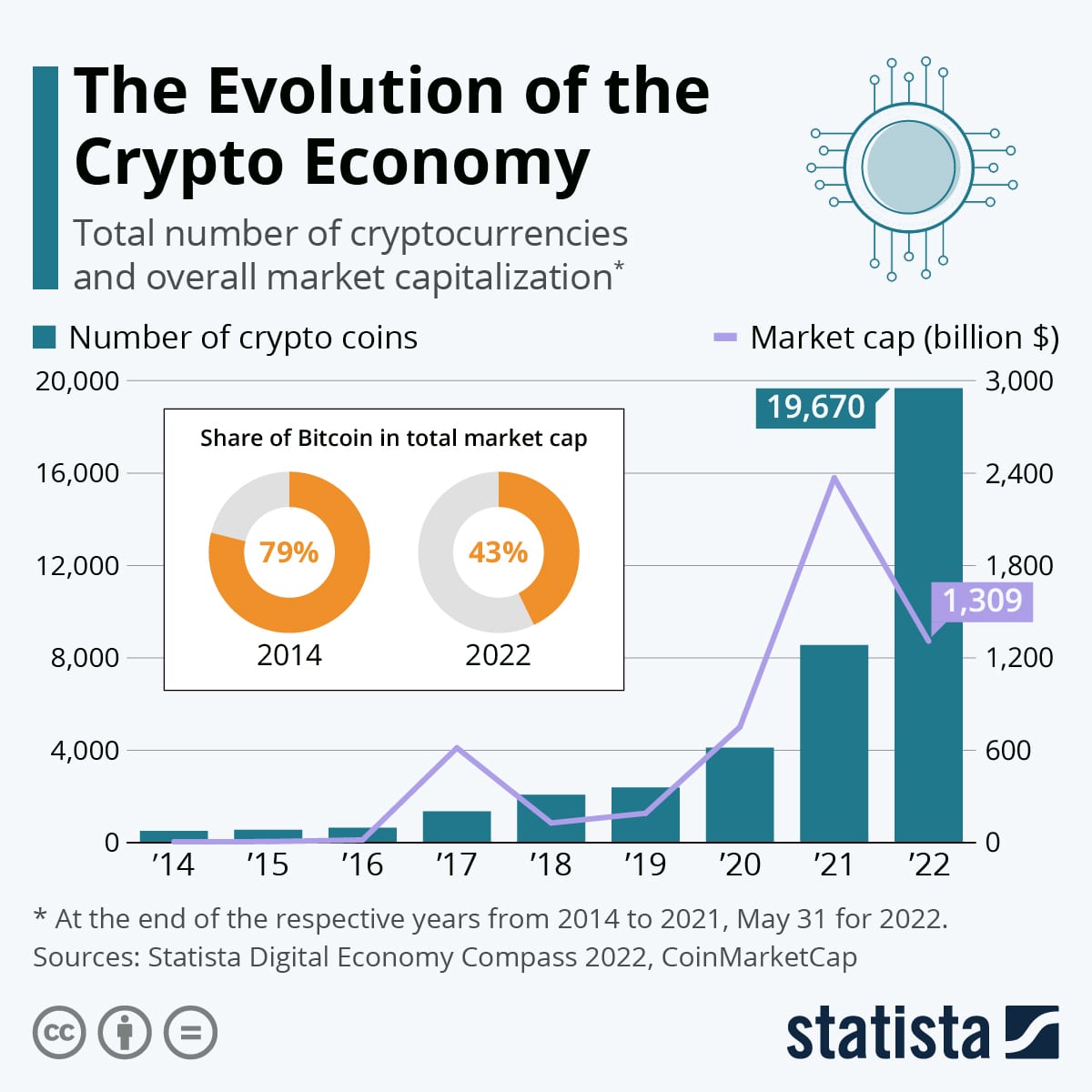

Growing Crypto Infrastructure

Another result of Bitcoin’s popularity is the rise of a completely new industry of infrastructure businesses. A new crypto-based economy is emerging, and it’s led by Bitcoin. For instance, businesses like Block, Robinhood, and PayPal have developed tools to make purchasing and selling Bitcoin simple. The data indicates that there is still a lot of opportunity for Bitcoin to grow, which is good news for investors searching for real-world applications.

Expert Opinions: Is It Too Late to Buy Bitcoin?

The debate on whether it is too late to buy Bitcoin continues to spark strong opinions among financial and cryptocurrency experts. The majority of analysts agree that given its immense gains in recent years, buying Bitcoin now might not be the best investment decision: the spotlight is on new cryptocurrencies, and Bitcoin is progressively losing market share. However, many experts are still intrigued by the potential of this currency.

Michael Novogratz

One of the biggest investors in the field, Novogratz, stated that it is “doubtful” that Bitcoin will reach a price of $30,000 any time soon in his recent Bloomberg interview. Additionally, Novogratz pointed out that Bitcoin’s development is being hampered by a lack of institutional capital entering the market.

Cathie Wood

Cathie Wood, one of the well-known fund managers at Ark Invest, continues to believe that Bitcoin will reach the $500,000 mark. Wood has publicly acknowledged buying $100,000 worth of Bitcoin, underscoring her upbeat outlook. Earlier this year, an analyst at Ark Invest stated their opinion that BTC might be worth more than $1 million by 2030.

Jack Dorsey

Jack Dorsey, the co-founder of Twitter and Block, Inc., is a fervent proponent of cryptocurrencies and has frequently expressed his faith in Bitcoin.

According to Dorsey, “Bitcoin changes everything,” and “The world will eventually have a single currency, and I believe it will be Bitcoin.” Block, Inc. also allows for BTC trade, underscoring Dorsey’s support for cryptocurrencies.

You may also like: Who Owns the Most Bitcoin in the World?

Where to Buy Bitcoin

Looking for a platform to buy Bitcoin online? Changelly is the best place to buy and sell Bitcoin! We are glad to offer you the best exchange rates in the industry, low fees, 24/7 customer support, the highest security standards, and more!

Is It Too Late to Buy Bitcoin? Our Conclusion

So, is it too late to buy Bitcoin? Yes and no. There are solid arguments on both sides. So, before we deliver a verdict, let’s take a closer look at what people coming from these two positions say.

Crypto Is Way Down From Its Recent Highs

If you believe that the cryptocurrency market is just another form of the stock market, there may not be a better time to buy cryptos like Bitcoin because they are currently on sale. As Bitcoin’s history demonstrates, big dips like this are not uncommon at all, yet the cryptocurrency has consistently managed to reach new highs.

Crypto Is Going to $500,000 and Beyond

As we mentioned earlier, the well-known financial planner Cathie Wood predicts that Bitcoin will actually reach $500,000. According to Greg Cipolaro and Dr. Ross Stevens, researchers at New York Digital Investment Group, who also support this assertion, “Increasing fundamental demand combined with a fixed supply and automatically declining supply growth make a compelling case for Bitcoin as an alternative investment for institutional investors.

Governments Are Toughening Up

One of the concerns about investing in the cryptocurrency market has always been that governments will ban the very creation and even acceptance of the coins. The moment may have already arrived. Around the end of May 2021, China started to crack down severely on Bitcoin mining and trade, which caused the price of cryptocurrencies to spiral precipitously.

More lately, far-flung nations like Singapore, Estonia, and Iran have started their own crackdowns. Demand and support for Bitcoin and other cryptocurrencies could collapse if other governments follow suit.

In addition, there are constant headlines in the media about the need to regulate the crypto market. The XRP vs SEC case illustrates this point.

Crypto Market Is Going to Zero

Skeptics think that cryptocurrencies are a class of assets without a store of value, an entry barrier, or any value as a medium of exchange. Because of this, detractors see cryptocurrencies as merely speculative investments that won’t last as legitimate asset classes in the long run. Jeff Schumacher, the founder of BCG Digital Ventures, stated this about Bitcoin in 2019: “I do believe it will go to zero. Although I think it’s a brilliant technology, I don’t think it should be used as money.”

Summing Up

In summary, investors continue to favor Bitcoin as one of their top investments. Over the course of 13 years, Bitcoin has evolved from a niche fad to a widely used investment vehicle and will likely remain the largest digital asset by market capitalization.

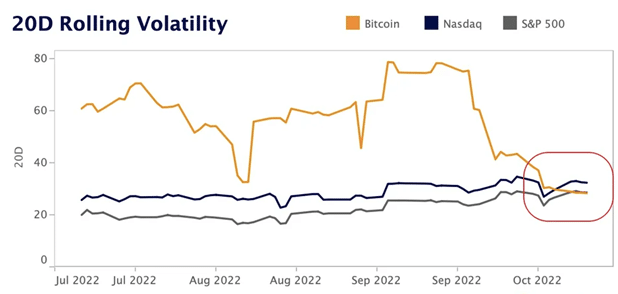

Bitcoin was less volatile than the S&P 500 and Nasdaq for the first time since 2020. Source: Kaiko

Without a doubt, Bitcoin is no longer a new cryptocurrency and is now even regarded as “old” or “mature” in the context of the cryptocurrency market. This makes the coin’s price less unpredictable on average, but this also makes episodes of exponential growth unlikely. This is due to a variety of factors, including the outdated, energy-intensive mining process, lack of practicality, and, as surprising as it may sound, popularity. Although the acceptance by financial institutions has some advantages, it also raises the possibility that Bitcoin’s four-digit growth is no longer possible.

Given its mainstream popularity and promising future, Bitcoin may be a good choice for retail investors who are looking to enter the world of cryptocurrencies. Many analysts contend that Bitcoin is one of the most undervalued cryptocurrencies accessible at the moment, with a price of around $17,000 as of this writing. However, there are undoubtedly better choices if investors seek cryptocurrencies with greater upside potential.

Coins to Consider Buying Alongside Bitcoin

Despite its tremendous success as an alternative asset, Bitcoin is not without its risks, the most notable of which being its volatile price and slow processing times. Fortunately, there are a number of other digital or “alt” coins that offer potentially higher returns and faster transactions:

While these options may be attractive to those interested in investing in digital currencies, it is important to remember that cryptocurrency markets can change quickly, and investors should conduct thorough research before making any decisions.

Cryptos to Consider Buying Instead of Bitcoin

If you’re looking to invest in cryptocurrency, Bitcoin is not your only option. Before purchasing Bitcoin, investors should consider other cryptocurrencies that have the potential to generate higher returns. Here are the best altcoins with the most upside potential:

The volatility of these coins can cause crypto prices to fluctuate drastically in a single day, so it’s crucial to do your research before investing any significant amount of money. With the right approach and knowledge, alternative cryptocurrencies could be the key to higher returns for savvy investors.

The information on Changelly should not be regarded as investment advice, nor are we qualified to offer it.

FAQ

Is it too late now to invest in Bitcoin?

It depends on what you expect from this type of investment.

Is it ever too late to get into crypto?

As the crypto market becomes more and more mainstream, the likelihood of incredible upsurges in price decreases. Among a few reasons why some day it might be too late to invest in crypto, this is the main one.

Is it the right time to buy Bitcoin?

If you believe in technical analysis — yes, it is. BTC has been at its lows in recent months.

Is it too late to invest in Bitcoin in 2022?

Some may argue that it’s never too late to invest in BTC. We’ve discussed what to expect from BTC investments above.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Bitcoin Daily: Treasuries

Bitcoin Daily: Treasuries  Rising & ETF Flows Analyzed!

Rising & ETF Flows Analyzed!